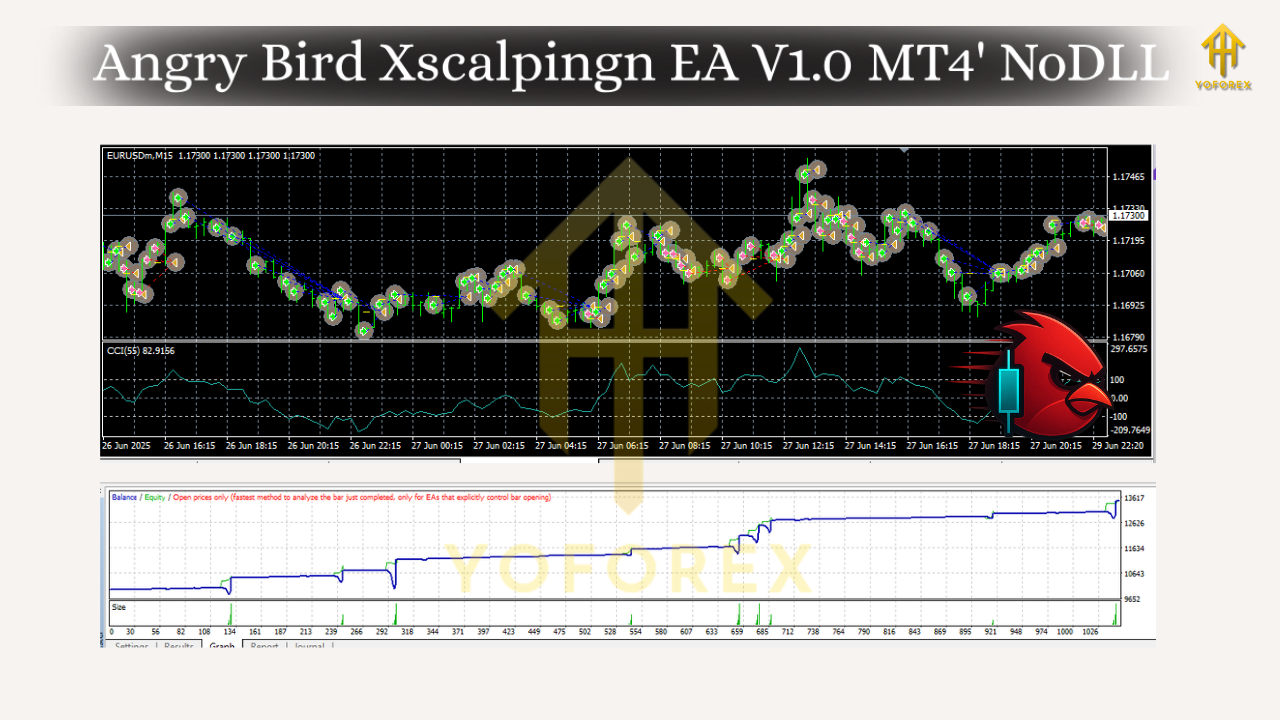

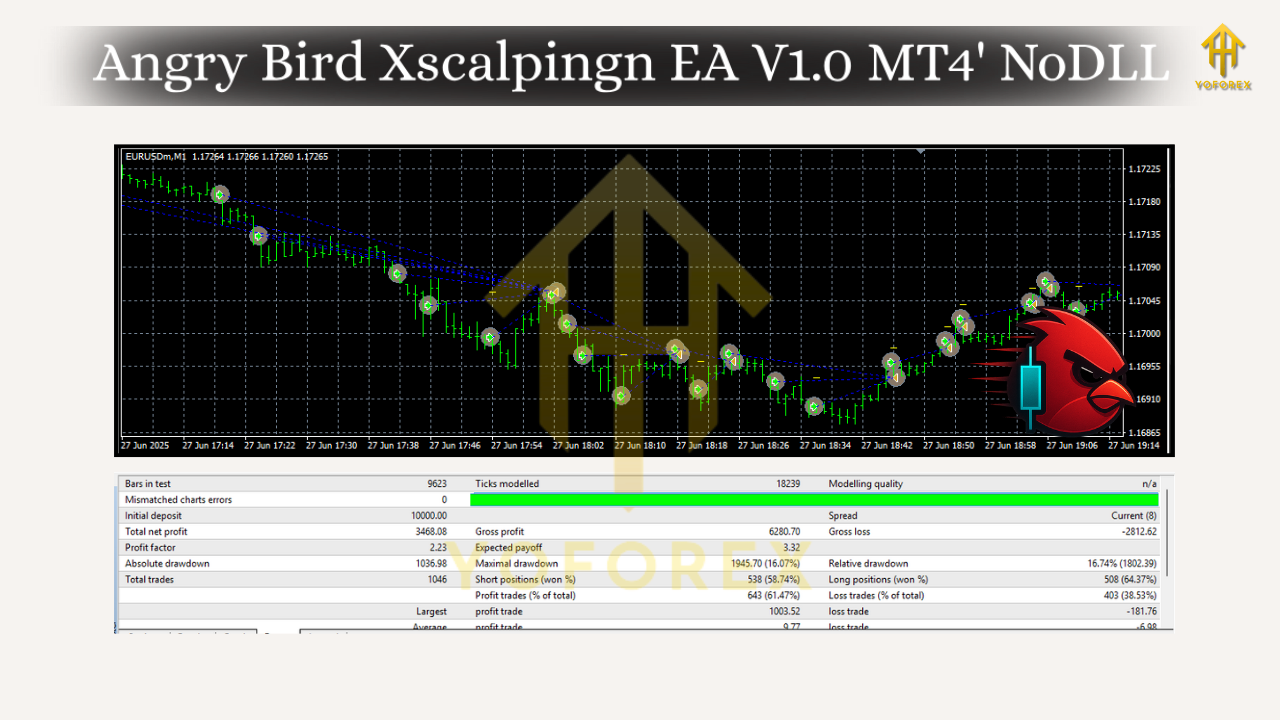

Angry Bird Xscalping EA V1.0 MT4 — Built for lightning-fast entries on M1/M5

If you’re hunting for a no-nonsense scalping robot that just gets in, gets out, and keeps risk sane, Angry Bird Xscalping EA V1.0 for MT4 is your jam. It’s designed for short, high-probability bursts—think M1/M5 scalps during liquid sessions—without resorting to dangerous tricks like martingale or recovery grids. Plug it on a fast VPS, point it to a low-spread broker, and let it seek those tiny, repeatable edges all day long. Minimum deposit is just $200, so you don’t need deep pockets to try it out; you’ll just want to keep position sizing realistic and spreads tight.

Below you’ll find the complete rundown: pairs and timeframes, strategy logic, risk control, setup steps, and a few pro tips for consistent usage.

What is Angry Bird Xscalping EA?

Angry Bird Xscalping EA V1.0 MT4 is a lightweight, event-aware scalper for MetaTrader 4 that focuses on micro-moves within intraday ranges and early breakouts. Its core is built around momentum ignition and mean-reversion filters: it hunts for small bursts of volatility, checks whether price is stretching away from its very short-term baseline, and times entries to “snap back” or “push through” depending on market context.

Supported pairs: all majors and gold; our recommended instruments are XAUUSD (Gold), EURUSD, GBPUSD, and USDJPY due to their tight spreads and deep liquidity.

Timeframes: M1 and M5 are the primary modes; M5 is the sweet spot for stability, while M1 is available for higher frequency (use a VPS + ECN spreads).

Account type & deposit: any standard or ECN account is fine; minimum deposit $200 is sufficient for the default micro-lot profile.

You don’t need to be a pro to run it. Attach to your chart, choose the recommended set file (or start with defaults), and let it do the repetitive heavy lifting that human scalpers find tiring. It’s intentionally resource-light so it won’t bog down your terminal even if you add it to multiple charts.

How the strategy works (in plain English)

Angry Bird Xscalping EA blends short-term momentum and micro mean-reversion checks. When price accelerates away from a fast moving baseline (think a very short EMA ribbon) and the spread/volatility filters pass, the EA opens a position aiming to capture the “burst” or the “fade”—the choice depends on a confluence of signal quality, session timing, and distance from recent micro-levels.

A few safeguards run under the hood:

- Spread guard: prevents entries when spreads widen beyond your threshold (common during news spikes or rollover).

- Session filter: optional timing bias toward London and New York overlap when liquidity is best.

- News pause (optional): you can set a pre-/post-event buffer to avoid unpredictable spikes.

- Dynamic TP/SL: take-profit and stop-loss adapt to recent micro-volatility, so it isn’t a rigid “one-size-fits-all” pip target.

Bottom line: it’s built to catch quick moves on liquid symbols, close positions fast, and keep the equity curve from swinging wildly.

Recommended symbols, timeframes, and risk

Pairs (best to start):

- XAUUSD (Gold): tight broker spreads + constant intraday motion = frequent signals.

- EURUSD / GBPUSD / USDJPY: classic majors with predictable flows.

Timeframes:

- M5 (recommended): a balance of frequency and stability.

- M1 (advanced users): more signals, but be strict about spreads/latency.

Lot sizing & deposit:

- With $200 minimum deposit, begin with 0.01 lots and scale only after you’ve seen at least 2–4 weeks of consistent behavior on your broker.

- Keep max simultaneous positions conservative (1–3) until you learn the EA’s rhythm on your feed.

When to run it:

- Best during London session and London–NY overlap when spreads are generally tight and moves are cleaner.

- Consider pausing 10–15 minutes before/after high-impact news.

Key features you’ll actually use

- True scalping logic for M1/M5: optimized for liquid sessions, quick in–out trades.

- No martingale / no dangerous grid: drawdown kept sane by fixed-risk entries.

- Spread & slippage control: trades only when broker conditions are favorable.

- Adaptive TP/SL: reacts to micro-volatility so profits aren’t capped in fast tape.

- Session & news filters: trade only when markets are worth trading.

- Multi-pair capable: run on XAUUSD and major FX pairs simultaneously.

- Minimal footprint: light on CPU/RAM; safe to attach on multiple charts.

- Beginner-friendly defaults: sensible out-of-the-box settings for a $200–$500 account.

- Manual override ready: close button and safety options for full control.

- Prop-firm friendly mode: optional daily loss cap and one-trade-at-a-time behavior.

Setup & installation (MT4)

- Download & copy files: place the EA .ex4 (or .mq4) into

MQL4/Experts/in your MT4 data folder. - Restart MT4: or right-click Expert Advisors in the Navigator panel and hit Refresh.

- Attach to chart(s): open XAUUSD and/or EURUSD charts on M5 (start here), drag the EA on the chart.

- Enable algo trading: allow Algo Trading globally and “Allow live trading” inside the EA’s Common tab.

- Load the set file (optional): import the recommended

.setfile for your broker/timeframe, or keep defaults. - Broker conditions: choose ECN/Raw type with commissions + tight spreads; lower slippage is a big plus.

- VPS (recommended): for M1/M5 scalping, run on a VPS close to your broker’s servers to cut latency.

- First week: observe. Start with 0.01 lots, monitor spread at entries, and confirm execution quality.

Risk management & pro tips

- Daily loss limit: set a max daily loss or equity stop; when hit, the EA stops trading till the next day.

- One chart per symbol: don’t stack multiple instances of the same EA on the same pair/timeframe.

- Don’t chase news: unless you’re explicitly testing a news strategy, pause around red-flag events.

- Scale slowly: consider increasing the lot size only after consistent, verified broker execution.

- Broker matters: two brokers can show different outcomes with scalpers. Tight spreads + low slippage win.

Who is it for?

- Newcomers who want an approachable scalper that doesn’t rely on risky recovery tactics.

- Busy intraday traders who prefer automation for the repetitive edges of the day.

- Prop-firm challengers who need tighter risk controls and one-trade-at-a-time behavior.

- Veterans who want an additional, low-footprint system to diversify their intraday lineup.

Final word

Angry Bird Xscalping EA V1.0 MT4 keeps things refreshingly simple: identify short-term momentum/mean-reversion edges, enter with discipline, exit fast, and protect the downside. If you’re after flashy settings or risky pyramids, this isn’t it. But if you want a focused scalper that respects risk and thrives in liquid sessions, you’ll feel right at home. Start on M5, keep risk tiny, and let the stats build; consistency beats impulse, every time.

Comments

No comments yet. Be the first to comment!

Leave a Comment