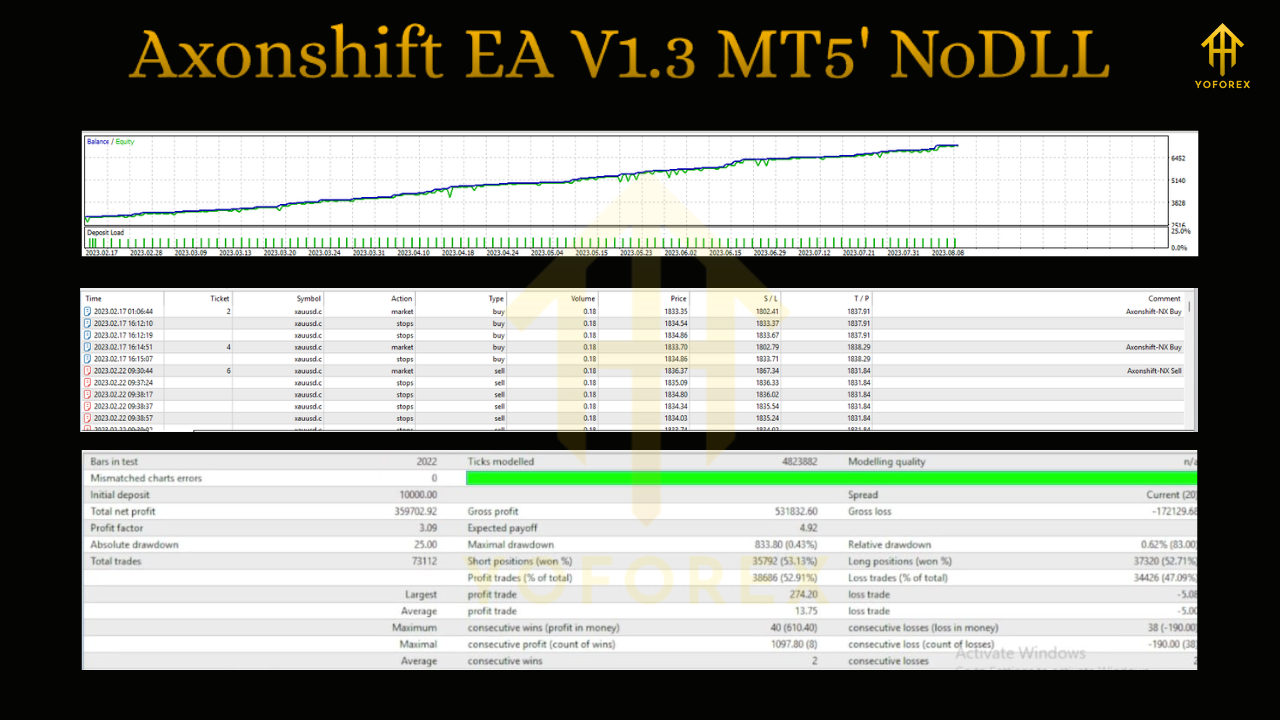

Algorithmic trading continues to evolve as traders demand more accurate, disciplined, and reliable systems. Among the latest Expert Advisors that has captured attention is Axonshift EA V1.3 MT5, a trading robot designed exclusively for gold (XAUUSD) on the H1 timeframe. While many EAs promise extraordinary results, this one takes a different path by focusing on strict risk management and structured entry logic. Let’s explore its features, advantages, limitations, and how it can fit into your trading journey.

What Makes Axonshift EA V1.3 Different?

Unlike many robots that try to cover multiple currency pairs and timeframes, Axonshift EA is developed with a clear specialization: gold on the one-hour chart. This narrow focus allows the developer to fine-tune the logic for gold’s unique behavior—its volatility spikes, liquidity cycles, and directional impulses. The version 1.3 release builds on earlier editions, improving risk controls and offering smoother trade execution.

The EA avoids dangerous tactics such as martingale, grid trading, or doubling positions in an attempt to recover losses. Instead, it relies on fixed Stop Loss and Take Profit levels for every trade. This transparency gives traders a clear picture of potential risk before each position is opened. By removing unpredictability, Axonshift EA appeals to those who prioritize stability over reckless profits.

Key Features of Axonshift EA V1.3

- Focused Trading Approach

The system is optimized specifically for XAUUSD on H1, making it more accurate for gold traders. Its design leverages the natural momentum and volatility patterns of gold. - Strong Risk Management

Every trade includes fixed SL and TP levels. No martingale or grid logic means traders avoid unlimited exposure that can wipe out accounts. - Structured Entry Logic

The EA combines volatility analysis with trend filters. It only enters trades when predefined structural conditions are met, reducing unnecessary trades. - Consistent Updates

The release of version 1.3 demonstrates ongoing development. Continuous refinement is critical for adapting to changing market conditions.

Benefits for Gold Traders

Gold has always been a favorite instrument for retail traders due to its volatility and global importance. However, the same volatility that brings opportunity also introduces risk. Axonshift EA addresses this by providing:

- Clear predictability with predefined risk on each trade.

- Reduced emotional stress since traders no longer need to decide manually when to enter or exit.

- Adaptability through logic that avoids overtrading, waiting patiently for high-probability setups.

- Suitability for prop firm challenges since it respects strict drawdown rules, which are crucial for evaluation accounts.

Risks and Drawbacks

Despite its strengths, there are factors traders must consider before using Axonshift EA V1.3 MT5:

- Broker Dependency: Gold spreads and slippage vary widely between brokers. Without a broker offering tight spreads and fast execution, results may differ significantly.

- Limited Scope: The EA is optimized only for gold on H1. It should not be expected to perform on other assets or timeframes.

- Cost: The price is on the higher end compared to many EAs. Traders must evaluate whether the investment is justified by potential returns.

- Market Conditions: No EA is perfect. During extreme volatility or unexpected global events, even structured strategies can experience losses.

Best Practices for Using Axonshift EA

If you are considering this Expert Advisor, approach it strategically:

- Test on Demo First: Run it on a demo account for several weeks to understand its style and verify execution under your broker’s conditions.

- Start Small: Transition to a live account with low risk and small lot sizes before committing larger capital.

- Use a VPS: Keep your MT5 platform running without interruption to avoid missed trades and execution delays.

- Stick to Default Parameters: Since the EA is optimized for XAUUSD H1, changing its settings drastically may reduce effectiveness.

- Monitor Performance: Keep track of equity, drawdown, and profit factor regularly to ensure the system behaves as expected.

Why Traders Should Consider Axonshift EA V1.3

Axonshift EA stands out in a crowded market because it combines specialization, discipline, and long-term thinking. It doesn’t chase unrealistic profits with risky tactics. Instead, it builds on risk transparency and structured logic—qualities that many traders overlook when searching for shortcuts.

For those who trade gold regularly and prefer a steady approach, this EA could be a valuable addition. However, success depends on realistic expectations, proper testing, and disciplined risk management. Traders who view it as a supportive tool rather than a guaranteed money-maker are more likely to benefit from its strengths.

Final Thoughts

The release of Axonshift EA V1.3 MT5 highlights a shift in the algorithmic trading space—moving away from aggressive recovery methods toward safer, structured trading. By focusing exclusively on XAUUSD and maintaining fixed risk per trade, it offers a level of control that many other EAs lack.

That said, no trading system can remove risk completely. The best way to use Axonshift EA is within a balanced strategy, where it provides automation and discipline, but the trader remains in control of overall risk. With careful testing and responsible use, Axonshift EA V1.3 can become a dependable partner for gold traders looking to strengthen their edge in the market.

Comments

No comments yet. Be the first to comment!

Leave a Comment