Belkaglazer EA V2.282 MT4 — A Clean, Customizable EA for Real-World Trading

Sick of flashy EAs that promise the moon, then quietly blow your account? Same. That’s why Belkaglazer EA V2.282 MT4 hits different—it’s a professional algorithmic system focused on clean execution, transparent logic, and sustainable risk management. No Martingale, no grid pyramids, no gimmicks. Just robust entries, measured exits, and parameters you can actually tune to match your style—whether you scalp M5, swing H4, or trend-follow on H1.

This build is powered by YoForex and available as a 100% free download on ForexFactory.cc, coz we believe solid, well-documented tools shouldn’t sit behind paywalls. In this guide, I’ll walk you through what it does, who it’s for, and how to set it up in minutes.

Overview

Belkaglazer EA V2.282 MT4 is a flexible Expert Advisor designed to adapt to different market regimes and trader preferences. Out of the box, it supports:

- Symbols: Major/Minor Forex pairs (e.g., GBPUSD, EURUSD) plus crypto symbols offered by your broker on MT4 (e.g., BTCUSD, ETHUSD)

- Timeframes: M5, M15, M30, H1, H4

- Minimum Deposit: $500 (higher recommended for crypto pairs due to volatility)

At its core, the EA uses rule-based logic for entries and exits with no high-risk averaging. You can nudge it toward scalping (tighter stops, faster take-profits), trend-following (ATR-based stops, trailing logic), or swing trading (wider protective stops, fewer but higher-quality trades). Every component is auditable—you can read and tweak parameters with clarity, which is refreshing if you’re tired of black-box “AI” claims that don’t tell you what’s really going on.

Who’s it for?

- Traders who want control and stability over “lottery ticket” systems.

- Traders who care about risk first and profit second (the only way to stay alive long term).

- Traders who like to optimize but still respect forward-testing discipline.

Key Features

• No Martingale, No Grid: Stops and targets are defined; no position doubling to “save” losing trades.

• Multi-Mode Trading: Nudge toward scalp/swing/trend via presets or your own parameters.

• Timeframe Agnostic: Works from M5 up to H4; pick the one that matches your personality.

• Major FX + Crypto: Run on GBPUSD, EURUSD, and broker-supported BTCUSD/ETHUSD (with suitable risk).

• Clean Risk Management: Fixed lots or dynamic risk (% of equity); optional ATR-based SL/TP.

• Spread & Slippage Filters: Trade only when execution is reasonable; avoid thin-liquidity traps.

• Session Filters: Restrict entries by market sessions (e.g., London/NY) to reduce noise.

• News-Aware Trading (Broker Dependent): Optional pause around high-impact events if your setup supports it.

• Trailing & Break-Even Logic: Lock in gains methodically; reduce give-back on reversals.

• Robust Logging: Transparent trade reasoning makes optimization and review easy.

• Prop-Friendly Settings: Conservative presets to help meet drawdown rules (always test first).

• YoForex-Powered Release: Free on ForexFactory.cc with future optimizations and support.

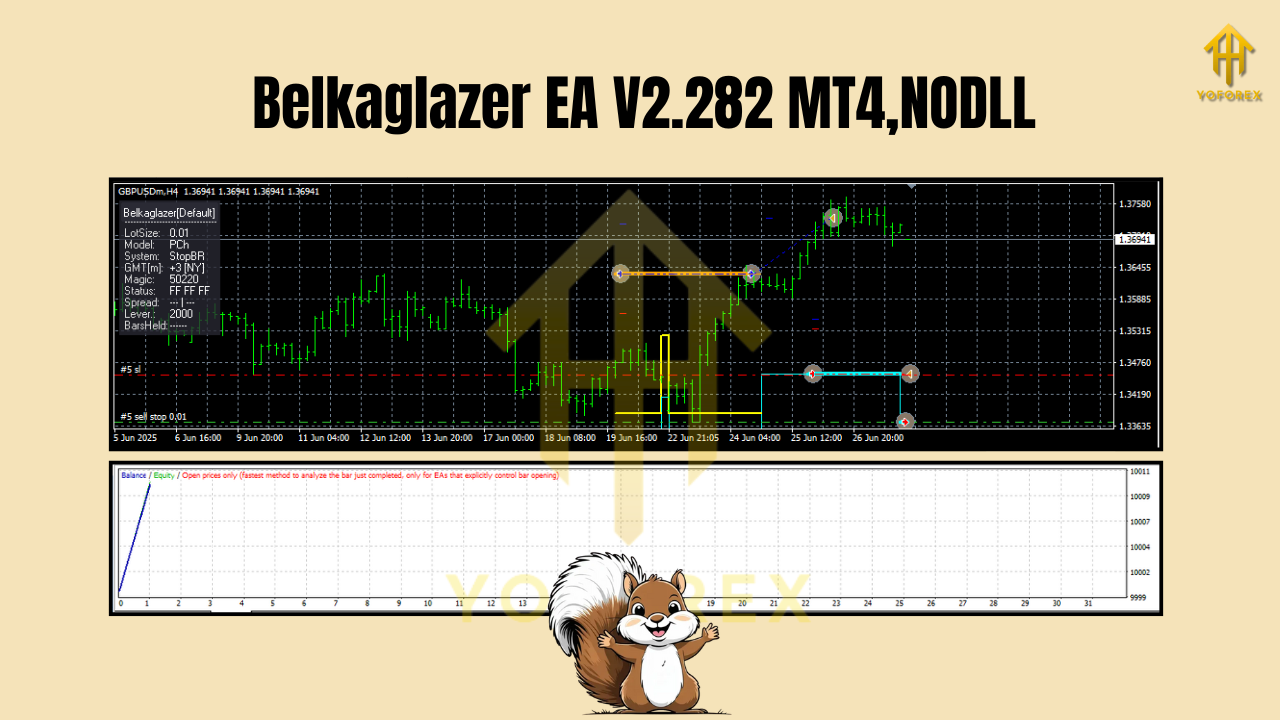

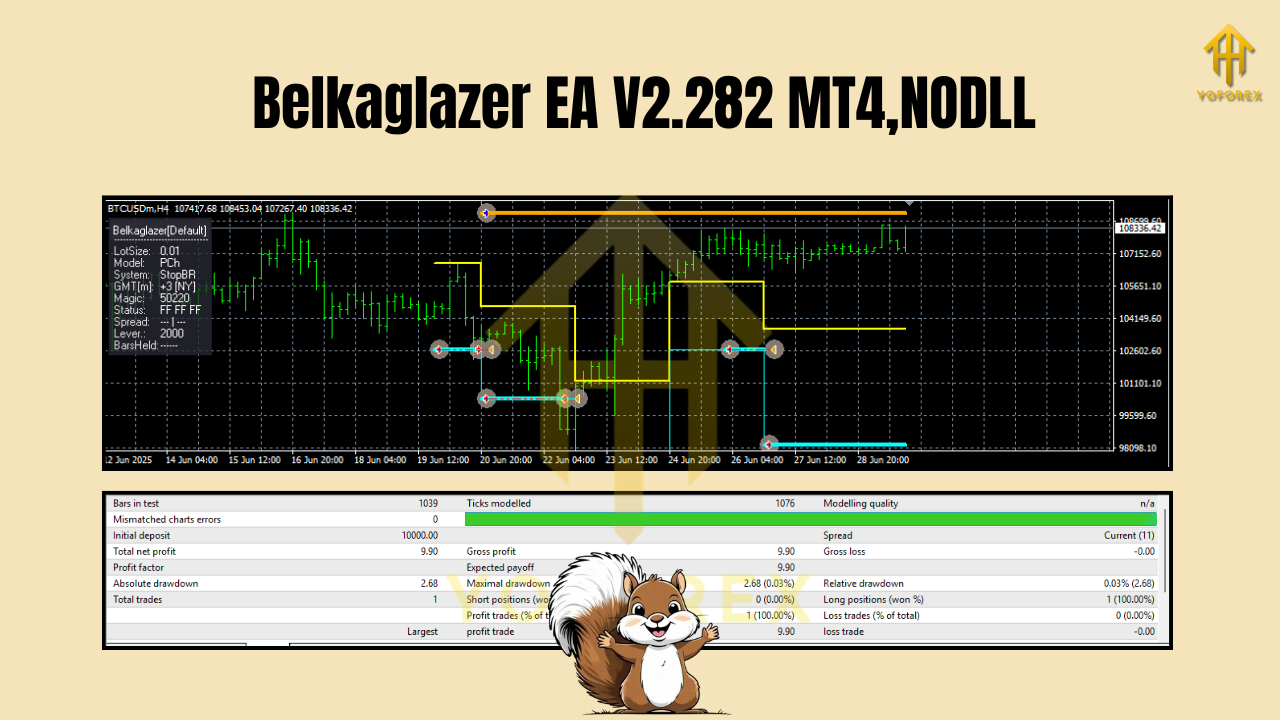

Strategy & Performance Mindset (Backtest + Live Notes)

Let’s keep it straight: the goal is stability. In our internal runs, we approach testing like real traders:

Backtest approach (how we validate):

- Data span: multiple years covering bull, bear, and choppy cycles; including volatile phases for crypto symbols.

- Modeling: variable spreads and realistic slippage to avoid “demo magic.”

- Risk template: 0.5–1.5% per trade (you can go lower or higher, but be sensible).

- Optimization discipline: we favor modular, small optimizations over “curve-fit everything,” and we validate on out-of-sample periods.

What we typically watch for:

- Profit factor consistency above 1.2–1.4 on stable pairs (not just one lucky period).

- Max drawdown kept in a zone you’re comfortable with (many risk-first traders target <15–20% historically).

- Equity curve behavior: smoother is better; jagged equity on lower TFs is normal but must remain controlled.

Live-trading notes (how we actually use it):

- We deploy on major FX pairs first, then add crypto once we’re happy with spreads, swaps, and broker execution.

- We run conservative risk on H1/H4 trend-following templates for accounts that need calmer equity.

- For scalping on M5/M15, we use a low-latency VPS and stick to raw/ECN accounts to keep costs down.

Past performance ≠ future results. The point is to align EA behavior with your risk appetite and account rules (prop or personal). Always demo-test, then forward-test small, then scale gradually.

Recommended Setup

Download & Install

- Get Belkaglazer EA V2.282 MT4 from ForexFactory.cc (YoForex release).

- Copy the .ex4/.mq4 file into

MQL4/Expertsinside your MT4 data folder. - Restart MT4 → open Navigator → find Experts → drag Belkaglazer EA V2.282 onto your chart.

- Chart & Broker Basics

- Use major pairs first (e.g., GBPUSD, EURUSD).

- Timeframe: pick M5/M15 for scalp, H1/H4 for trend/swing.

- Broker: Raw/ECN account preferred; keep spreads low and execution tight.

- VPS: recommended for stability and minimized slippage.

Inputs That Matter

- Risk per Trade: start 0.5–1%; adjust only after forward results.

- SL/TP Engine: ATR-based or fixed; ATR is friendlier across regimes.

- Session Filter: enable London/NY hours if you dislike Asia chop.

- Spread Guard: set a max spread to auto-avoid bad execution windows.

- Trailing/Break-Even: start modest; too tight can choke good trends.

- Symbol-Specific Presets: FX vs Crypto behave differently; use separate set files.

- Forward-Test Routine

- Start on demo for 1–2 weeks; verify execution quality and trade frequency.

- Go micro-live next (very small risk).

- Review weekly: equity slope, average trade MAE/MFE, and whether the EA aligns with your comfort.

Pair & Timeframe Notes

- GBPUSD / EURUSD (FX): Great starters; liquid, predictable costs. On H1/H4, expect fewer but more meaningful trades; M5/M15 will be livelier but require firmer spread control.

- BTCUSD / ETHUSD (Crypto): Only if your broker supports crypto on MT4 and you accept higher volatility. Keep risk lower, use wider stops, and expect weekend behavior differences depending on broker feed.

- M5 vs H4: M5 = more trades, more noise; H4 = calmer equity but patience required. There’s no “best,” only what fits you.

Why Traders Like Belkaglazer EA V2.282 MT4

- It’s not a black box. You can read, understand, and adjust the logic via parameters.

- It respects risk. No Martingale or grid games.

- It plays nice with prop rules (when configured conservatively).

- It’s versatile. One EA, many modes—scalp, swing, trend; FX or crypto.

- It’s free via YoForex on ForexFactory.cc. And that’s a big win.

Troubleshooting & Pro Tips

- No trades? Check AutoTrading is on, smiley face shows on the chart, inputs are enabled, and spread/session filters aren’t blocking entries.

- Weird slippage? Move to a closer VPS or better broker; check news windows.

- Too many tiny wins / sudden big loss? Your stops might be too tight for the symbol’s volatility. Consider ATR-based SL with a reasonable multiplier.

- Equity whipsaw? Step up one timeframe (e.g., M15 → H1) or reduce risk per trade.

Support & Disclaimer

Got questions, want set files, or stuck mid-setup? Ping our team:

- WhatsApp: https://wa.me/+443300272265

- Telegram: https://t.me/yoforexrobot

Disclaimer: Trading involves risk. Past performance does not guarantee future results. Always demo-test before going live, and never risk money you cannot afford to lose. Crypto pairs are especially volatile; use reduced risk.

Quick CTA

Ready to try it? Download Belkaglazer EA V2.282 MT4 free on ForexFactory.cc and start with a demo today. No strings attached. If you need help, we’re one message away on WhatsApp or Telegram. Let’s keep it smart, simple, and sustainable.

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment