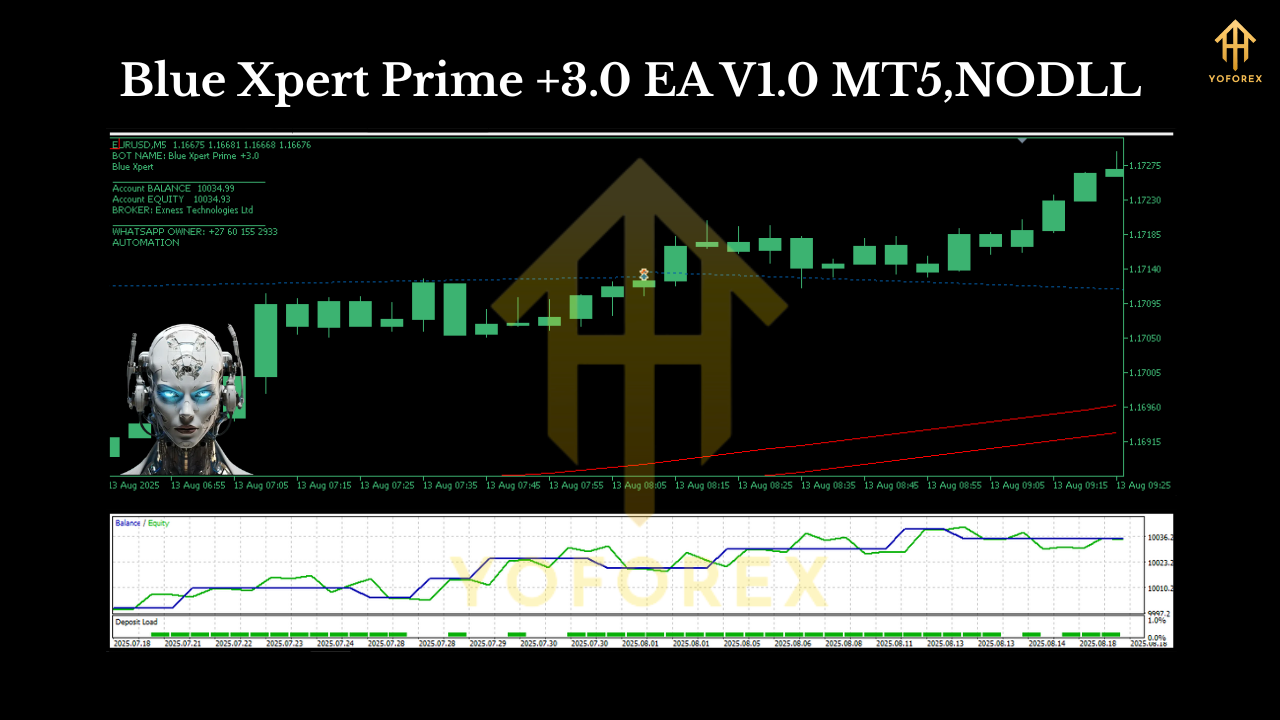

Blue Xpert Prime +3.0 EA V1.0 MT5 – a calm, steady EURUSD worker

If you’re tired of EAs that promise the moon and then blow up your account the first time NFP hits, you’ll like this one. Blue Xpert Prime +3.0 EA V1.0 MT5 is built for what most traders actually want: stable, controlled account growth on EURUSD with a conservative risk-to-reward framework. It’s deliberately simple to use, light on resources, and happy grinding away on the M5 timeframe with a $100 minimum deposit. No drama, just disciplined entries, risk controls, and a focus on preservation first, profits second… coz longevity matters if you want to last in this game.

Below, I’ll walk you through how it works, what makes it different, and the quick steps to get it running right on MetaTrader 5. By the end, you’ll know exactly whether Blue Xpert Prime +3.0 EA V1.0 MT5 fits your style.

What is Blue Xpert Prime?

Blue Xpert Prime +3.0 EA V1.0 MT5 is a EURUSD-only automated trading system for MetaTrader 5. It’s designed around three core principles:

- Conservative risk – smaller exposure per trade, capped drawdowns, and fewer “all-in” moments.

- Repeatable logic – consistent, rules-based entries that don’t rely on curve-fitting.

- M5 clarity – the 5-minute chart offers enough signals to compound steadily without getting noisy.

You won’t find martingale pyramids or reckless grids here. The EA’s logic favors clean pullback entries in trend, filtered by volatility and session timing. It takes fewer but higher-quality setups, aiming to keep equity curves smoother and max drawdown contained. The goal isn’t to double the account overnight; it’s to keep your account alive long enough to compound over months.

At a glance

- Platform: MetaTrader 5 (MT5)

- Pair: EURUSD only

- Timeframe: M5

- Min/Recommended Deposit: $100+ (start small, scale smart)

- Best Environment: Low-spread ECN account, fast VPS, 1:200–1:500 leverage

Why traders pick it (Key strengths)

- Low-risk posture: Small default lots, strict SL per trade.

- No martingale, no hedge spaghetti: Every position stands on its own logic.

- M5 sweet spot: Enough signals to matter, not enough to stress you out.

- EURUSD focus: Tight spreads, deep liquidity, fewer surprises.

- Session filter: Prioritizes higher-quality liquidity windows.

- Volatility guardrails: When ranges expand, the EA adapts.

- Simple setup: Attach to one chart, load setfile, done.

- Account protection: Optional daily loss halt and max open trades.

- Equity-friendly scaling: Increase lot sizes only after growth, not before.

- Clean reporting: MT5’s built-in stats keep you honest and on track.

How the strategy behaves (plain English)

Think of Blue Xpert Prime +3.0 EA V1.0 MT5 as a trend-aware pullback trader with common-sense filters:

- Detects direction: Uses moving-average structure plus slope/price action to decide bias.

- Waits for a pullback: Avoids chasing breakouts; prefers discounted entries into momentum.

- Confirms volatility: ATR-like filters aim to avoid dead zones and wild spikes.

- Defines risk first: Stop loss goes in at order time; take-profit is modest and realistic.

- Manages the day: Optional daily risk cap means if things go off-script, the EA stands down.

That’s it. Boring? Maybe. Effective for steady growth? That’s the idea. You can run it on a $100 micro account to learn the rhythm, then scale when you’re confident.

Recommended settings (start here)

- Chart: EURUSD, M5

- Lot size: 0.01 per $100–$300 (adjust upward gradually after profits)

- Stop Loss: Fixed per trade in pips; don’t widen during drawdowns

- Take Profit: 1.0R–1.5R style targets; keep it modest to increase hit rate

- Max open trades: 1–3 (start with 1 if you value calmness)

- Daily loss limit: Enable at 2–4% of balance; EA pauses after hit

- Session window: London or London+NY overlap preferred

- VPS: Yes, low-latency if possible

- Broker: Tight spread, fair commissions, no funny business on execution

Risk and money management (where the edge lives)

The logic is solid, but risk management is where you win. Three quick rules:

- Never over-lot. Keep sizing modest until you see multiple weeks of consistency.

- Respect the daily stop. When the market is choppy, sitting out can save your month.

- Scale only after growth. If the account gains 10–20%, consider nudging lot size up. Not before.

One more tip: if you change anything, change one variable at a time and journal the effect. That’s how you learn what truly helps your account.

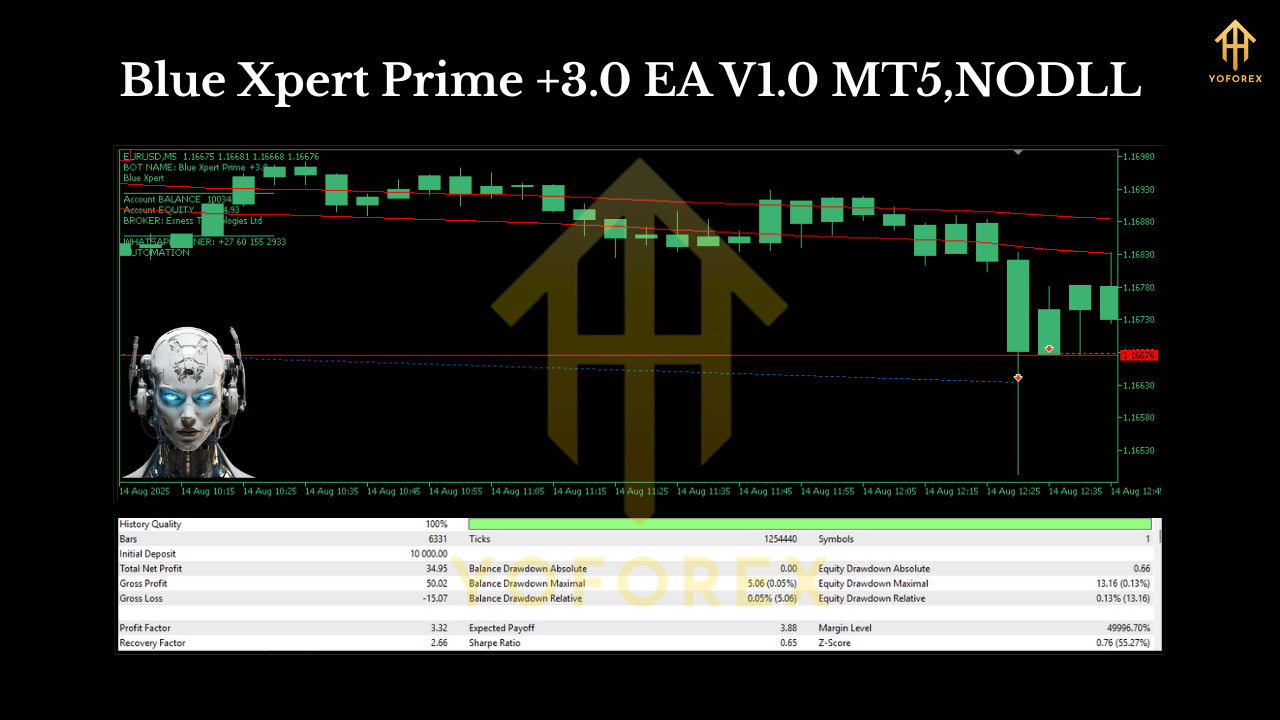

Performance mindset (backtests vs live)

Backtests can be useful to validate logic across multiple months, different volatility regimes, and news cycles. If you run your own:

- Period: At least 12–24 months on EURUSD M5

- Model quality: 1-minute OHLC or, better, tick data if you have it

- Spread: Use a realistic average plus commission

- Metrics to watch: Max drawdown, profit factor, average trade, and stagnation periods

But remember: live equals slippage and spread spikes. That’s why Blue Xpert Prime is built conservatively; it’s meant to survive the messy parts of real trading, not just shine on paper. Start small, gather your live stats, and let the data guide your next steps.

Installation (MT5 quick start)

- Open MT5 → File → Open Data Folder.

- Go to MQL5 → Experts and place the EA file there.

- Restart MT5.

- Open EURUSD (M5) and drag Blue Xpert Prime +3.0 EA V1.0 MT5 onto the chart.

- Allow Algo Trading (top toolbar and in EA properties).

- Load the recommended setfile (if provided) or use defaults.

- Enable the VPS (MT5 built-in or external) for 24/5 uptime.

- Let it run for two weeks on demo to confirm broker conditions and execution.

That’s it—no wizardry. Keep one clean chart, avoid stacking five EAs on the same symbol, and don’t touch trades mid-flight unless your plan says so.

Who is this EA for?

- Beginners who want a low-noise introduction to automated trading.

- Busy traders who prefer calmer equity curves over roller-coasters.

- Risk-conscious users who value daily loss limits and defined stops.

- EURUSD fans who want a single-pair focus without spreading themselves thin.

If you want ultra-aggressive compounding or multi-pair HFT, this isn’t the one. If you want steady and sensible, it’s a match.

Pro tips for best results

- Use a clean ECN account and check live spread during London open.

- Keep drawdown under 10–15% by design; if it creeps up, reduce lots.

- Avoid news spikes if your broker widens spreads heavily (NFP, CPI, rate decisions).

- Audit weekly: wins/losses, average R, slippage, and whether daily stops saved you.

- Stay patient. The edge shows over a basket of trades, not one or two.

Final word

Blue Xpert Prime +3.0 EA V1.0 MT5 won’t make flashy headlines, and that’s its strength. It focuses on risk-first trading on EURUSD M5, uses no martingale, and keeps the process transparent. Start on demo, step into micro live, and scale carefully. Small, consistent edges can do amazing things over time—especially when you protect your downside.

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment