In today’s automated trading environment, Expert Advisors (EAs) must do more than just place trades — they must analyse, adapt, and survive through shifting volatility. Candle Power EA V1.0 MT4 has been engineered to accomplish exactly that. Built for professional traders and institutions who demand reliability, this EA takes a modular approach to mean-reversion strategies while focusing on steady, long-term profitability.

Unlike the typical high-risk martingale or grid-based bots that dominate the retail space, Candle Power EA applies quantitative candle analytics and volatility mapping to detect overextended market movements. It then capitalises on potential reversals — particularly in the S&P 500 index — where price often oscillates back to equilibrium.

This article dives deep into its internal mechanics, strategic value, and performance-driven design that distinguishes it from conventional MT4 Expert Advisors.

A Powerful Fusion of Data and Strategy

The Candle Power EA V1.0 MT4 was developed around one key idea: controlled mean-reversion. Markets frequently deviate from their averages due to emotional or macroeconomic shocks. When prices move too far too quickly, the algorithm identifies the overreaction and places strategic entries to exploit the pullback.

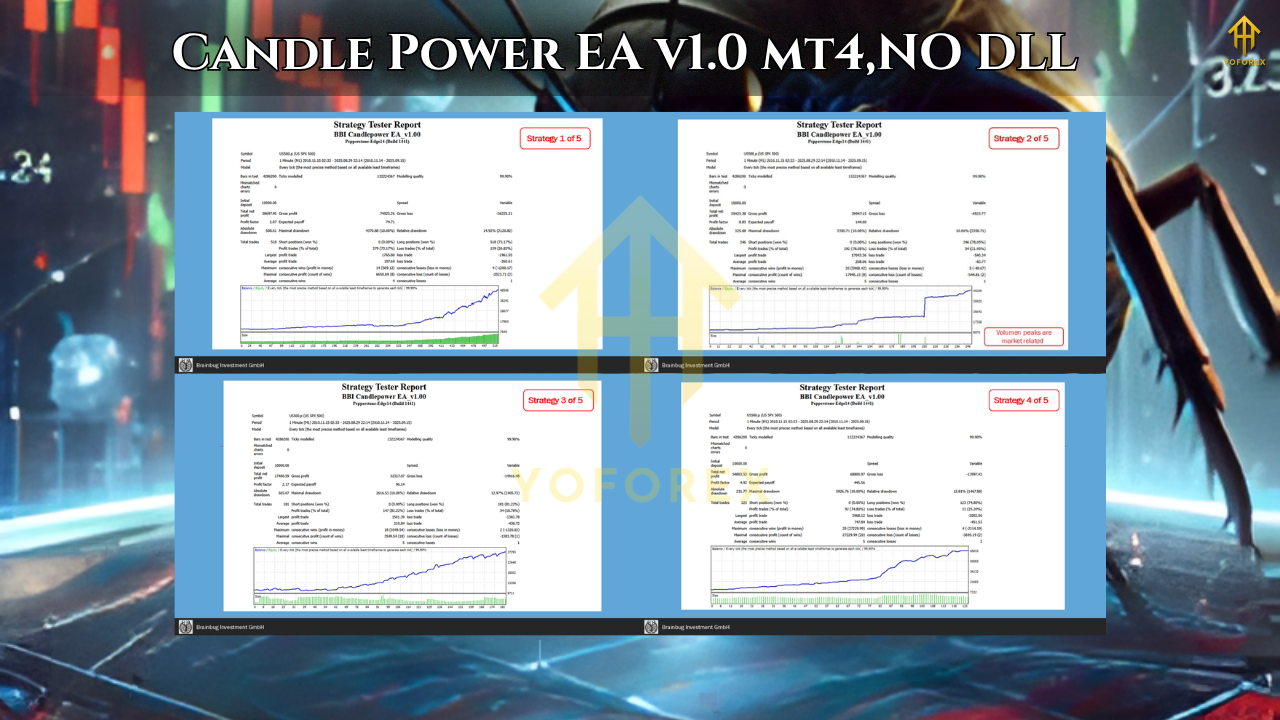

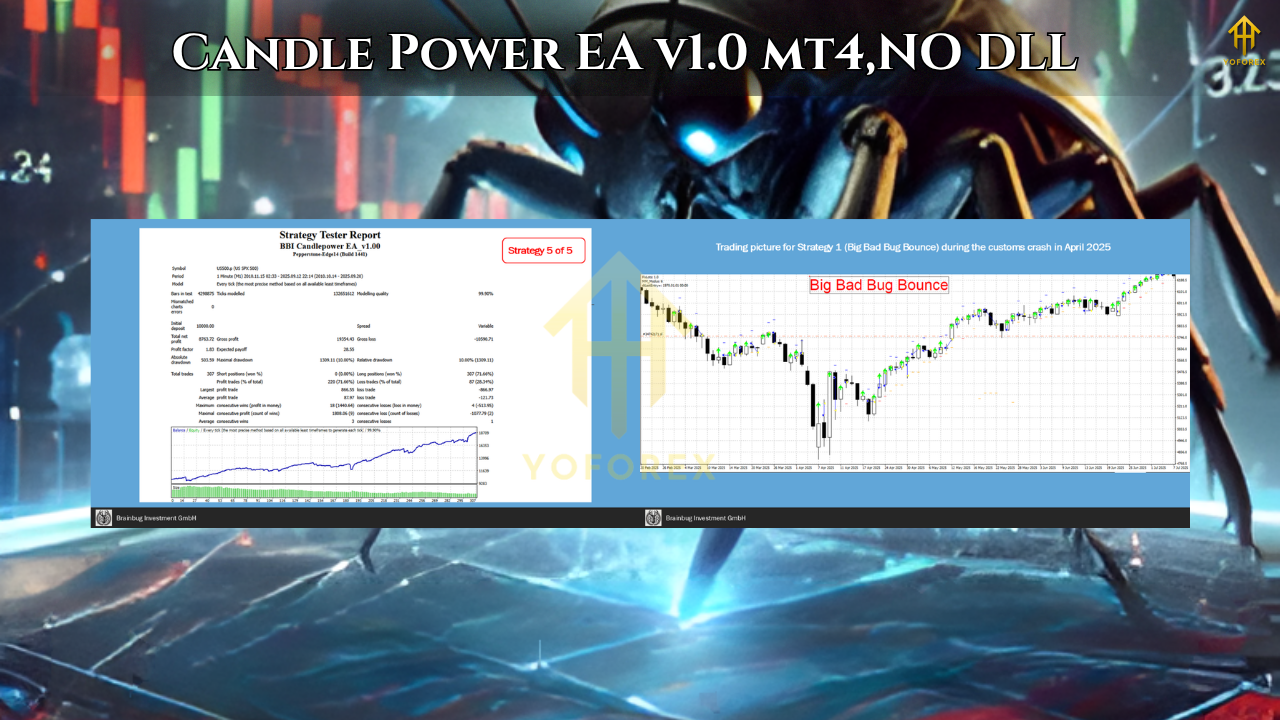

At its core, the EA utilises five distinct trading modules — each built to handle different types of price behaviour, volatility clusters, and market sessions. These modules operate independently with unique identifiers, giving traders flexibility to run them as a complete portfolio or selectively based on their preferences.

This structure makes the system not only adaptive but also stable. While one module might perform better in volatile weeks, another can dominate in calm periods — balancing risk and performance over time.

How Candle Power EA Works

The EA’s architecture combines price-action, volatility filters, and a custom Candle Power Indicator (CPI). Each module interprets market strength and momentum differently, allowing the EA to diversify across internal strategies without correlation issues.

The CPI evaluates candle behaviour — analysing size, wicks, and directional energy — to calculate potential turning zones. When combined with additional layers such as RSI and time-of-day filters, this results in highly accurate reversal signals.

Entries are executed with full automation, while exits follow a hierarchy of dynamic take-profit, trailing-stop, and time-based closure logic. This ensures that no trade is left unprotected or allowed to overstay during unfavourable momentum shifts.

The system’s philosophy centres on consistency, transparency, and simplicity — every decision the EA makes can be traced back to a measurable indicator value or volatility threshold.

Features That Define Candle Power EA V1.0 MT4

- Multi-Strategy Portfolio

- Contains five fully independent trading modules.

- Each has unique filters, triggers, and management systems.

- Provides smoother equity growth through internal diversification.

- No Martingale or Grid Recovery

- Every position stands alone with predefined risk.

- The EA never increases lot sizes after a loss, preventing compounding drawdowns.

- Advanced Risk Management System

- Supports eight money management modes — from fixed lots to percentage-based dynamic sizing.

- Risk is calculated only once per entry to maintain capital discipline.

- Includes built-in stop loss, trailing, and break-even logic for capital protection.

- Stress-Phase Trading Engine

- Specifically designed to capitalise during volatile or “panic” phases of the market.

- Executes trades when other systems avoid participation, turning uncertainty into profit.

- Tick-Level Testing and Transparency

- Verified performance using 15+ years of tick data for the S&P 500.

- Emphasis on realistic backtests without curve fitting.

- Historical robustness ensures adaptability across changing market conditions.

- High Customisation

- Users can enable or disable modules.

- Adjustable volatility filters and CPI thresholds allow different levels of aggression.

- Easy to integrate with prop firm risk parameters or portfolio setups.

Trading Philosophy and Market Focus

Candle Power EA is fundamentally a mean-reversion system — a technique that profits when the market corrects itself after excessive movement. It thrives on emotional extremes, where traders overreact to news or events.

While its default optimization targets the S&P 500 index (US500, SPX500), its flexible logic allows adaptation to other instruments such as NASDAQ, DAX, and even commodities once parameter tuning is complete.

The underlying belief is simple: markets can behave irrationally in the short term, but price tends to normalize. Candle Power EA capitalizes on that return to balance with mathematical precision and controlled exposure.

Setup and Usage Recommendations

To unlock the full potential of Candle Power EA V1.0 MT4, traders should follow a structured deployment approach:

- Platform Compatibility

- Works exclusively on MetaTrader 4.

- Recommended timeframe: H1 for balanced accuracy and trade frequency.

- Broker Requirements

- Low spread and reliable execution for S&P 500 or equivalent CFD.

- A true ECN environment is ideal to minimise slippage.

- Minimum Deposit

- Suggested starting balance: $1000 to $2000 for conservative risk profiles.

- Always allocate margin for volatility expansion phases.

- Testing and Optimisation

- Conduct demo testing for at least 3–4 weeks before live usage.

- Adjust lot sizing and enable/disable modules based on personal drawdown tolerance.

- VPS Hosting

- Continuous uptime is recommended for stability, especially for traders running multiple modules.

- Updates and Maintenance

- The developer periodically provides new presets for alternative instruments like Gold or Oil.

- Traders can import these to further diversify their strategy portfolio.

Who Should Use Candle Power EA?

This EA is suitable for:

- Systematic traders seeking diversified automation.

- Index-focused investors who prefer algorithmic precision over manual trading.

- Prop-firm applicants who require risk-controlled EAs that comply with drawdown limits.

- Beginner algorithmic traders looking to learn professional-grade mean-reversion techniques.

However, it’s not suitable for traders expecting unrealistic daily returns or those unwilling to test parameters. Candle Power EA performs best when combined with patience and proper money management discipline.

Advantages of Choosing Candle Power EA V1.0 MT4

- Modular diversification reduces strategy correlation risk.

- Effective during high volatility and market crashes.

- Transparent and non-aggressive risk architecture.

- Adaptive logic compatible with major index CFDs.

- Comes with preset configurations and documentation.

- Minimal maintenance once deployed properly.

- Tested across different broker feeds for robustness.

This combination of realism and structure gives it a competitive edge over many “plug-and-play” robots that rely on overfitted results.

Long-Term Viability and Future Potential

Candle Power EA is more than a short-lived market gimmick. Its foundation lies in multi-phase market analysis, ensuring that performance isn’t dependent on one regime. In periods of rapid sell-offs, it leverages panic recoveries; in sideways markets, it exploits smaller oscillations.

As financial markets evolve, modular EAs like Candle Power are expected to dominate — offering traders flexibility, lower drawdowns, and the ability to merge statistical methods with real-time execution.

The upcoming versions promise presets for other assets like Gold, Oil, and VIX — giving this EA room to expand its edge beyond the index market.

Conclusion

Candle Power EA V1.0 MT4 represents the future of modular mean-reversion trading. It bridges quantitative logic with simplicity, making it accessible to beginners yet powerful enough for professionals.

Its goal is not instant riches but steady, data-backed growth. By avoiding martingale techniques and adopting risk-defined methods, it promotes responsible algorithmic trading.

For traders who value structure, adaptability, and realism, Candle Power EA V1.0 MT4 can be an integral part of a balanced automated trading portfolio.

Comments

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555

555'"

555????%2527%2522\'\"

@@aLJCG

(select 198766*667891)

(select 198766*667891 from DUAL)

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555ZSC5OTfh')) OR 874=(SELECT 874 FROM PG_SLEEP(15))--

555t73vtHlx') OR 559=(SELECT 559 FROM PG_SLEEP(15))--

555o25eefYb' OR 424=(SELECT 424 FROM PG_SLEEP(15))--

555-1)) OR 193=(SELECT 193 FROM PG_SLEEP(15))--

555-1) OR 278=(SELECT 278 FROM PG_SLEEP(15))--

555-1 OR 429=(SELECT 429 FROM PG_SLEEP(15))--

555Xsnbmbvy'; waitfor delay '0:0:15' --

555-1 waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

555-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

555*if(now()=sysdate(),sleep(15),0)

-1" OR 5*5=25 or "dMOjElpG"="

-1" OR 5*5=25 --

-1' OR 5*5=25 or 'ZVrmuArK'='

555

-1 OR 5*5=25 --

-1 OR 5*5=25

-1' OR 5*5=25 --

555

555

Leave a Comment