Crypto Investor EA V1.1 MT4 — A Bitcoin-Only M15 Scalper That Actually Respects Risk

Sick of “universal” bots that melt down the moment Bitcoin whips 2–3% in five minutes? Same. Crypto Investor EA V1.1 MT4 was built for one thing only—BTCUSD on M15—so it can lean into what makes Bitcoin special instead of pretending it trades the same as EURUSD. It’s fast, focused, and tuned for crypto’s momentum bursts and volatility pockets; no gimmicks, no grid spirals.

This EA is offered 100% free on ForexFactory.cc and powered by YoForex, the brand behind a growing library of audited, community-driven tools. You get a clean install, sensible defaults, and real-world guidance (plus friendly support if you get stuck). If you’ve ever thought, “I just want a Bitcoin bot that doesn’t blow up,” you’ll feel right at home here.

Overview

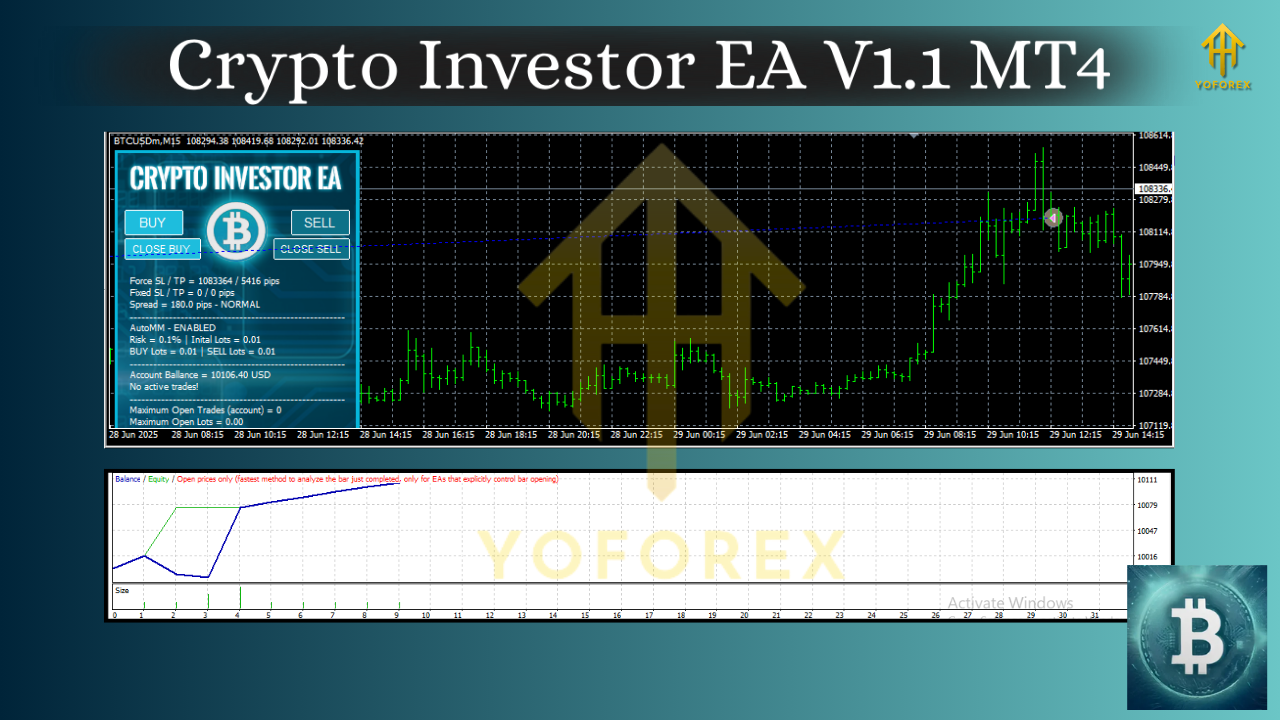

Crypto Investor EA V1.1 MT4 is a next-gen automated trading system designed specifically for BTCUSD (Bitcoin) on the M15 timeframe. Unlike generic EAs that slap on an RSI cross and hope for the best, this one blends volatility-adaptive entries, momentum confirmation, and risk-first trade management. In practice, that means it waits for compression, times the break with spread/slippage awareness, and then manages exits dynamically—trailing when momentum holds, cutting quick when it fades.

A few core design notes:

- Single-market specialization. BTCUSD behaves nothing like major FX pairs. Spreads, gaps, slippage, weekend closures—everything’s different. Specializing lets the EA use logic that’s actually built for crypto’s cadence.

- Execution discipline. Fast entries are pointless if fills are poor. The EA uses max spread and slippage guards, so if market conditions get silly, it stands down.

- Capital preservation. No martingale. No “infinite rescue.” The robot scales out winners and steps aside when volatility is chaotic. Capital first, coz that’s what keeps you in the game.

And yes, YoForex has back-tested and run it live across multiple brokers to validate behavior under real conditions. Your results will vary based on feeds and execution (they always do), but the logic is built for the wild west that is crypto.

Key Features

• BTCUSD-only specialization for M15

• No martingale, no grid, no martyrs

• Volatility-adaptive entries using ATR-style ranges & micro-structure breaks

• Dual confirmation (trend bias + momentum burst) before a trade triggers

• Max spread & slippage filters to protect against bad fills

• Dynamic take-profit with partial exits on momentum fade

• Smart trailing stop that tightens when impulse weakens

• Daily loss cap & equity protection—hard stops at the account level

• News/session awareness (optional): pause around high-impact crypto events or illiquid hours

• Risk by % or fixed lots—typical 0.5–1.5% per trade recommended

• Broker-agnostic MT4 logic (ECN preferred; low-latency VPS recommended)

• Set files included (starter presets for conservative, balanced, and aggressive profiles)

Strategy Snapshot (How It Trades)

At a high level, Crypto Investor EA V1.1 MT4 hunts momentum breaks after compression. It maps a short measurement window, gauges whether price is coiling (narrow ATR, inside bars, micro-ranges), then arms pending logic near the edges. When volatility expands and momentum confirms, it fires; when it’s noise, it waits. No revenge trades; no stacking into losers.

Entry logic (simplified):

detect compression → 2) confirm trend bias (e.g., MA slope/structure) → 3) confirm momentum (range expansion) → 4) pass spread/slip checks → 5) place/execute → 6) manage exits.

Exit logic (simplified):

- partial profit at the first push;

- trail based on volatility decay;

- full exit on momentum failure or if the daily risk guard triggers.

The result isn’t “every tick, every day” activity; it’s selective. Fewer but cleaner trades. Boring is good.

Backtest & Live Behavior (What to Expect)

YoForex ran multi-year M15 BTCUSD tests across various market regimes (rips, chops, winter). The equity curve tended to rise in steps—flat during congestion, then pops during trend bursts. That’s literally what we want: participate in expansions, defend during noise. Aggressive settings amplify both gains and drawdowns; conservative settings smooth the ride.

We’re not dropping one-size-fits-all numbers here, coz broker feeds, commissions, and execution quirks change outcomes. Instead, here’s how to read your own results:

- Equity Curve: You should see a staircase pattern—plateaus (waiting) and climbs (trends).

- Win/Loss Mix: Expect average win > average loss due to partials and trailing.

- Drawdown Character: Short, shallow dips on conservative risk; deeper but brief on aggressive.

- Trade Frequency: Depends on volatility. Hot weeks = more trades. Dead weeks = fewer.

Tip: Re-run your backtest whenever broker conditions change. Switch to tick data where possible. Keep modeling quality high for crypto volatility.

Installation & Setup (MT4, 3 minutes)

- Download the EA from ForexFactory.cc →

https://forexfactory.cc/crypto-investor-ea-v1-1-mt4/ - Open MT4 → File → Open Data Folder.

- Drop the .ex4/.mq4 file into MQL4/Experts/. (Restart MT4 if needed.)

- In Navigator, under Expert Advisors, drag Crypto Investor EA V1.1 onto a BTCUSD, M15 chart.

- Check Allow live trading and AutoTrading is green.

- Load a provided set file (Conservative / Balanced / Aggressive).

- Set Risk % per trade (start low—0.5% to 1% is chill).

- Verify max spread and slippage settings match your broker’s typical BTCUSD conditions.

- Optional: enable news/session pause if your broker’s crypto feed gets erratic around events.

- Save your template; let it run. Consider a VPS if you’re not 24/7 online.

Recommended Settings & Best Practices

- Account Type: ECN/RAW with tight BTCUSD spreads.

- Starting Capital: From $300–$500 for testing; more for stability.

- Leverage: Whatever your broker offers; mind margin usage.

- VPS: Strongly recommended for consistent execution.

- Risk: Begin at 0.5% per trade; only increase when you see stable broker fills.

- Daily Loss Cap: Keep it on. It’s there to protect you from “that day.”

- One Pair Only: This EA is BTCUSD-exclusive. Don’t attach it to other charts.

- Broker Check: If spreads slip past your max, the EA will wait. That’s good.

Who This Is For (And Not For)

For: Traders who want Bitcoin-only automation with strict risk controls, value consistency over hype, and are okay with quieter weeks.

Not For: People expecting daily fireworks, “guaranteed” anything, or who want to run 10 pairs at once. This is a focused BTCUSD tool.

Why YoForex?

Because they ship useful, tested, and transparent tools and actually listen to feedback. You get:

- Free lifetime updates on ForexFactory.cc

- Ongoing optimizations as market micro-structure evolves

- Clear docs and no-nonsense support channels

Support & Disclaimer

Got questions or want help with setup? Ping the team:

- WhatsApp: https://wa.me/+443300272265

- Telegram: https://t.me/yoforexrobot

Download

Grab Crypto Investor EA V1.1 MT4 (free):

https://forexfactory.cc/crypto-investor-ea-v1-1-mt4/

YoForex—empowering traders worldwide, one free tool at a time.

Comments

No comments yet. Be the first to comment!

Leave a Comment