Gold Straddle EA V1.0 MQ4 – Precision Breakout Entries for XAUUSD

Sick of missing those fast gold breakouts that happen right after a key headline or when the market squeezes into a tight range… then boom? The Gold Straddle EA V1.0 MQ4 is specifically designed for that moment. It places a balanced “straddle” of pending orders around price before volatility hits, so whichever way XAUUSD bursts, you’re already in the move. No over-optimization, no random guessing—just a clean, mechanical approach to capturing that initial impulse. If you’ve been searching for an MT4 expert advisor that prioritizes quick execution, disciplined risk management, and no martingale strategies, this EA is for you.

Below, I’ll walk you through how it works, the core features, recommended settings, and some practical best practices from live usage. Keep it simple, keep it disciplined, and let the math do the heavy lifting.

Overview

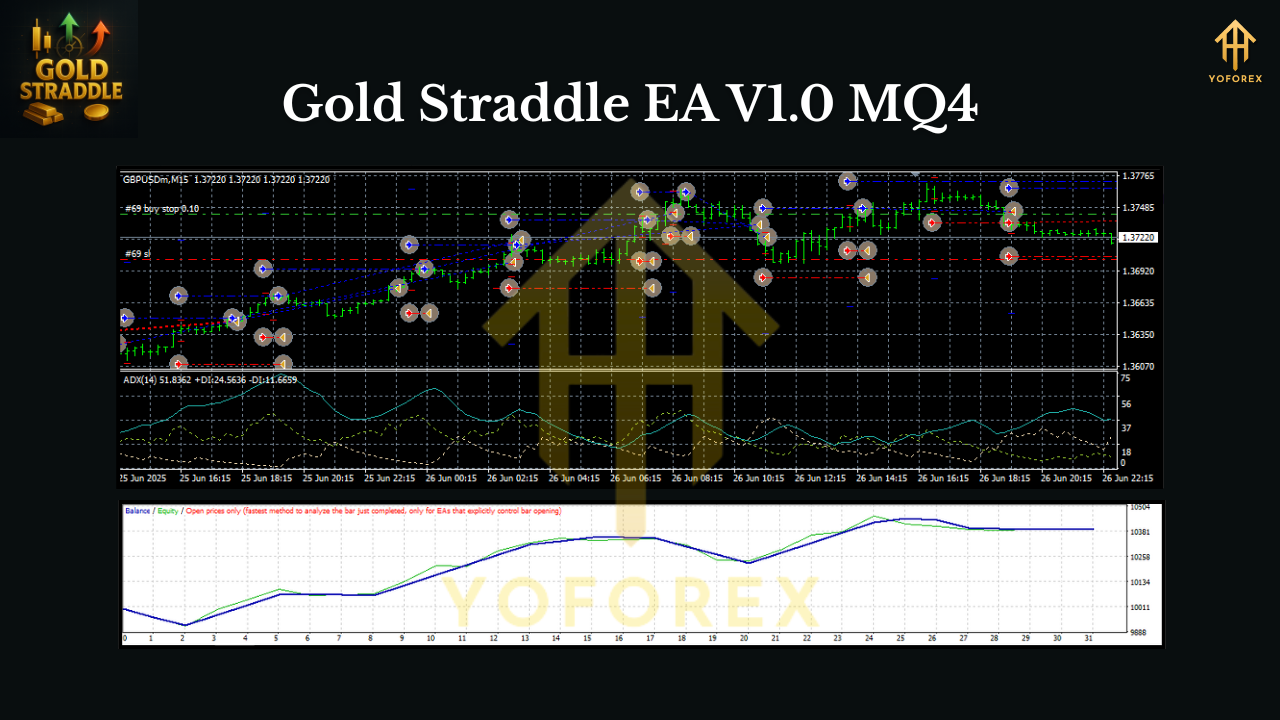

Gold Straddle EA V1.0 MQ4 is a MetaTrader 4 expert advisor designed primarily for XAUUSD during periods of expected volatility—think major economic data releases, central bank speeches, or even London/New York session transitions. The idea is straightforward: place a buy stop above the price and a sell stop below the price at a defined distance, just before the event or anticipated breakout. When the price breaks the range, one side triggers; the other is canceled to avoid hedging and unnecessary exposure.

Because the strategy relies on pending orders, the chart timeframe isn’t critical. That said, M1 or M5 charts are recommended for lower lag and easier visual monitoring. The EA comes with spread and slippage checks, time-window control (so it can arm itself only during chosen intervals), and clear risk parameters. It won’t multiply lots after losses (no martingale), and it offers optional break-even and trailing features once the price moves in your favor.

In short: it’s built for speed, control, and consistency—especially around news or range breakouts on gold.

How the Gold Straddle Strategy Works

- Identify a quiet range or scheduled event window (e.g., 2–3 minutes before high-impact news or just ahead of the London open).

- The EA places two pending orders: a Buy Stop a fixed/ATR-based distance above price and a Sell Stop the same distance below.

- When the breakout happens, one order triggers, the opposite is canceled instantly.

- Protective Stop Loss is placed; Take Profit, break-even, and trailing rules manage the trade automatically.

- If no breakout occurs by the end of the window, the EA can auto-cancel unfilled orders to avoid stale entries.

That’s it—clean and rules-based, perfect for gold’s jumpy personality.

Key Features

- Purpose-Built for XAUUSD: Tuned defaults for gold’s volatility profile.

- M1–M5 Execution: Timeframe-agnostic logic; lower timeframes recommended for responsiveness.

- Balanced Straddle Orders: Symmetrical Buy Stop/Sell Stop entry with single-side continuation.

- Auto Cancel on Trigger: Immediately removes the opposite pending as soon as one fills.

- Distance by Points or ATR: Choose fixed points/pips or dynamic ATR-based distance.

- Hard SL/TP with RR Control: Set precise Stop Loss and Take Profit to keep risk in check.

- Break-Even + Trailing: Lock gains after a defined move, then trail for runners.

- Spread & Slippage Filters: Skip entries during toxic conditions or sudden spread spikes.

- Time Window Control: Arm/disarm around exact minutes for news/session plays.

- No Martingale, No Grid: Risk is fixed, transparent, and easy to model.

- Broker-Agnostic: Works with any MT4 broker; ECN/raw spread preferred.

- VPS-Friendly: Designed to run 24/5 on a low-latency VPS.

Recommended Settings (Starting Point)

These are starter values—you should forward test on demo and adjust to your broker’s execution, typical spread, and your risk appetite.

- Lot Size: 0.01 per $500 (scale proportionally; risk-managed).

- Order Distance: 200–350 points (20–35 pips on a 1-digit gold broker; adjust for your broker’s digits).

- Stop Loss: 250–400 points (25–40 pips equivalent; keep SL inside your acceptable risk per trade).

- Take Profit: 400–800 points (40–80 pips); or use RR 1:1.5 to 1:2 as a baseline.

- Break-Even Trigger: +150 to +250 points; Break-Even Offset: 30–60 points.

- Trailing Start: +300 points; Trail Step: 100 points.

- Max Spread: 25–35 points (2.5–3.5 pips equivalent—tune to your broker).

- Trade Window: Enable only 2–5 minutes before your targeted event/session.

- Expiration: 5–10 minutes for pending orders if not triggered.

Minimum Deposit: $200 (recommended $500+).

Leverage: 1:200–1:500, typical for gold (confirm with broker).

VPS: Strongly recommended; aim for <20–30 ms latency to broker.

Risk Management & Best Practices

- One Event, One Chance: Don’t re-arm immediately after a whipsaw; let the market settle.

- Avoid Illiquid Minutes: Minutes where your broker widens spreads aggressively can ruin RR—respect your Max Spread filter.

- Size for Worst Case: Assume a slippage-impacted fill on news; keep lot size small until you have data.

- Stick to the Plan: Pre-define the event/time window and let the EA execute; don’t toggle settings mid-spike.

- Weekly Review: Log results by event type (CPI/NFP/Fed/London open) and refine distances/filters accordingly.

Example Scenario

You’re targeting the New York session open on XAUUSD. Five minutes before the bell, spreads are normal. The EA arms itself and places a Buy Stop 300 points above and Sell Stop 300 points below the current price. The open hits, liquidity surges, and price bursts upward: the buy-stop gets filled, the sell-stop is auto-canceled. Price rips +550 points quickly, your break-even kicks in, then trailing follows the move. You either take full TP or trail out on a pullback with a meaningful chunk of the move in your pocket. Clean and controlled.

Installation & Setup (MT4)

- Download the

Gold Straddle EA V1.0.ex4(or.mq4). - In MT4, go to File → Open Data Folder → MQL4 → Experts and paste the file there.

- Restart MT4 (or right-click “Expert Advisors” → Refresh).

- Drag Gold Straddle EA V1.0 onto an XAUUSD chart (M1 or M5 recommended).

- Allow live trading and DLLs if prompted (per your broker’s requirements).

- Load the input settings: distance, SL/TP, break-even/trailing, time window, spread/slippage filters.

- Confirm the smiley face in the top-right corner (EA is active).

- Forward test on demo first; then go live with conservative sizing.

Final Thoughts

Gold Straddle EA V1.0 MQ4 gives you a disciplined way to engage XAUUSD when it matters most—right as momentum ignites. Instead of guessing direction, you prepare for either outcome, control risk, and let the market decide which side to pay. Start with demo, collect data, tweak distances and filters, then scale responsibly. Trading gold will never be 100% smooth (coz nothing is), but a rules-driven straddle approach can make those jumpy minutes feel a whole lot more manageable.

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment