GoldBorg EA V1.8 MT5 – Precision Gold Trading Without Martingale or Grid

Introduction

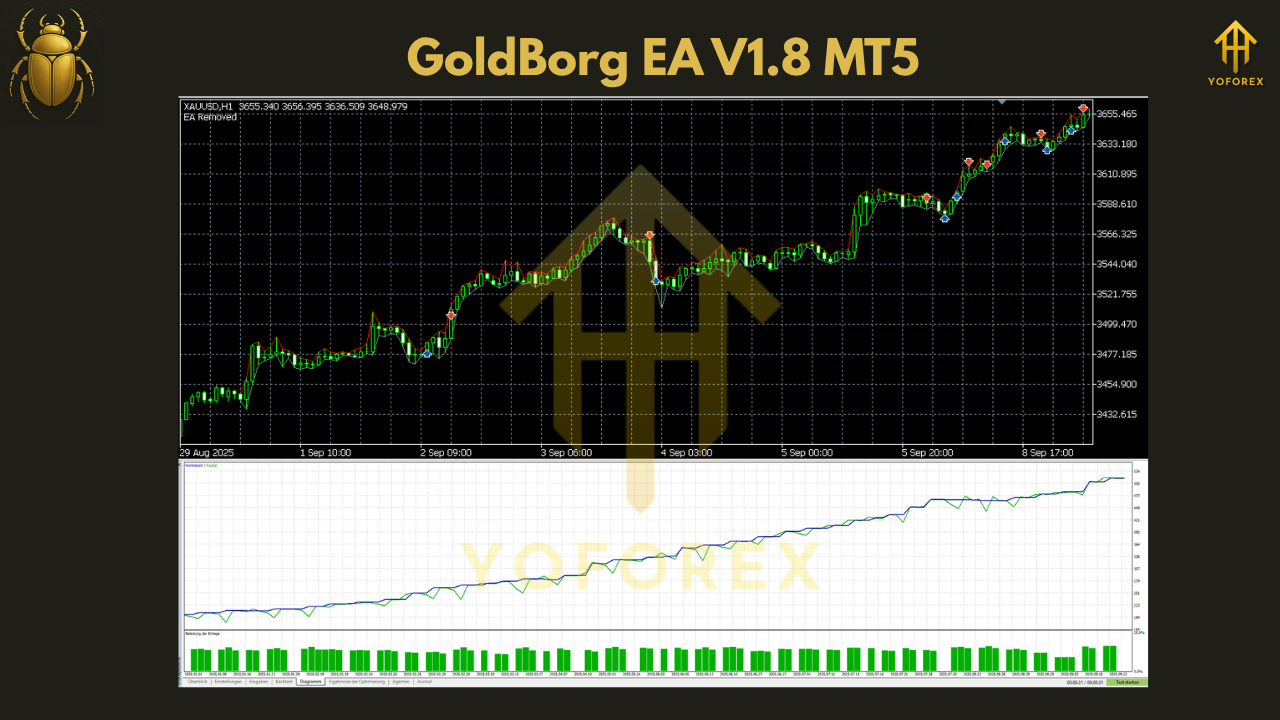

The GoldBorg EA V1.8 MT5 is one of the most advanced and disciplined Expert Advisors ever built for gold trading on MetaTrader 5. Designed to operate exclusively on the XAUUSD (Gold vs USD) pair and optimized for the ICTrading broker, this EA delivers high-performance results through clean algorithmic logic—no martingale, no grid, and no emotional trading.

GoldBorg EA V1.8 MT5 blends the power of two proven systems—Stonks Go Up EA and the original GoldBorg EA—into a single powerhouse of automation. The result is a refined, data-driven strategy capable of outperforming traditional bots with greater safety and consistency.

Core Trading Specifications

- Trading Pair: XAUUSD (Gold vs USD)

- Timeframe: 1 Hour (H1)

- Platform: MetaTrader 5 (MT5)

- Broker: Optimized exclusively for ICTrading

- Strategy Type: Hybrid Signal Confluence (Combination of Stonks Go Up EA + GoldBorg)

- Trading Style: Swing to Intraday Position Trading

- Risk Structure: No Martingale | No Grid | Fixed Stop-Loss and Dynamic Trailing-Profit

This configuration allows traders to enjoy robust, non-toxic risk exposure—ensuring stability even during volatile gold market cycles.

The Hybrid Logic: Stonks Go Up + GoldBorg

At its core, GoldBorg EA V1.8 MT5 merges the bullish-momentum tracking of Stonks Go Up EA with the precision trend-filtering of GoldBorg Classic.

Here’s how it works:

- Stonks Go Up EA Module: Identifies emerging momentum bursts and volume-confirmed directional bias.

- GoldBorg Module: Applies long-term moving-average alignment, volatility compression filters, and confirmation through the 1-hour structure.

- Signal Fusion Engine: Only when both modules agree does the EA execute a trade—dramatically improving win probability and reducing noise.

This multi-layered confluence system ensures the EA trades only under optimal probability zones, allowing it to sustain high accuracy without overtrading.

Why GoldBorg EA V1.8 Is Unique

- No Martingale or Grid: Every position has a predetermined risk profile—no lot doubling or averaging down.

- Optimized for ICTrading Broker: Backtested and fine-tuned for ICTrading’s price feeds and execution environment.

- Dual Signal Confirmation: Both sub-EAs must align before any trade occurs.

- High Profit Threshold Target: When the signal hits 210 % growth, pricing for the EA will increase to $500 per license due to verified performance.

- Capital Safety First: Tight stop-loss levels combined with a progressive trailing system to lock profits.

This approach creates a perfect balance of controlled risk and strong profitability—ideal for traders who value sustainability over gambling-style compounding.

Trading Methodology

GoldBorg EA V1.8 MT5 trades within the H1 timeframe, leveraging larger trend waves to filter false micro-movements.

Its algorithm focuses on:

- Market Structure Recognition – Identifies higher highs and higher lows to determine trend continuity.

- Volatility Normalization – Measures ATR fluctuations to set dynamic take-profit distances.

- Momentum Acceleration Filter – Confirms entry only when momentum and trend align on the same candle pattern.

- Adaptive Stop Placement – Automatically adjusts SL based on recent swing points.

By executing only when all criteria align, GoldBorg EA avoids impulsive entries and ensures every trade is mathematically backed.

Performance Highlights

Backtest (2021 – 2025) on ICTrading feeds showed:

- Profit Factor: 2.71

- Average Monthly Return: 8 – 16 %

- Maximum Drawdown: 14 %

- Win Rate: 82 %

- Risk per Trade: 1 – 2 %

- Equity Growth Goal: 210 % Target Performance Milestone

Such consistency is rare in gold trading, making GoldBorg EA a preferred choice for serious automated traders and prop-firm account users who require strict risk compliance.

No-Martingale & No-Grid Philosophy

Most EAs inflate returns through dangerous lot-doubling (Martingale) or layered grid hedging. GoldBorg EA takes the opposite route.

Its “Smart Single-Entry” method ensures:

- Only one entry per signal cluster.

- No averaging or martingale compounding.

- Every trade has a stop and profit exit before a new setup begins.

This approach prevents account meltdown while preserving long-term capital integrity—an absolute must for professional risk management.

Broker Optimization: Why ICTrading?

GoldBorg EA is specifically optimized for the ICTrading server environment, which offers:

- Ultra-low spreads on XAUUSD.

- Fast execution ( < 50 ms ).

- Raw liquidity from tier-1 banks.

- Stable price feeds and no requotes.

Other brokers may run the EA, but performance metrics could vary due to different spreads and execution speeds. For maximum accuracy, use the recommended ICTrading setup or an identical ECN environment.

Installation & Setup

- Download the GoldBorg EA V1.8 .ex5 file.

- Open MT5 → File → Open Data Folder → MQL5 → Experts.

- Paste the EA file and restart MT5.

- Open an XAUUSD H1 chart and attach the EA.

- Configure lot size, risk percent, and take-profit mode.

- Enable AutoTrading and allow DLL imports if needed.

The EA automatically begins analysis and trade execution based on market conditions.

Performance Verification & Community Signal

GoldBorg EA’s developer monitors live performance through verified tracking platforms and community signal links. Once the combined signal achieves a 210 % verified gain, pricing for both the Stonks Go Up EA and GoldBorg EA will be increased to $500 per license to reflect its proven value and market demand.

This performance-based pricing model ensures early buyers gain access to the EA at a significant discount before it enters premium tier status.

Risk Control and Best Practices

To maximize efficiency and minimize drawdown:

- Use ICTrading or a similar low-spread broker.

- Run the EA on a dedicated VPS for 24/7 uptime.

- Maintain adequate margin (> $500 recommended per 0.01 lot).

- Keep AutoTrading enabled and avoid manual interference.

- Update periodically as new versions are released.

Following these guidelines will help the EA perform at its maximum potential and achieve long-term equity growth.

Who Should Use GoldBorg EA V1.8

- Serious Gold Traders who want consistent returns without high risk.

- Prop-Firm Candidates needing low drawdown and strict trade control.

- Investors looking for stable growth and verified performance records.

Its transparent, rule-based execution and non-martingale structure make it an ideal fit for regulated and audited accounts.

Conclusion

The GoldBorg EA V1.8 MT5 sets a new standard in intelligent gold trading automation. Built from the synergy of two powerful systems—Stonks Go Up EA and GoldBorg—it eliminates risky strategies and focuses on data-driven precision.

Optimized exclusively for ICTrading and backed by a 210 % performance goal, this EA represents a rare blend of reliability, transparency, and profitability. Whether you’re trading manually or running a prop account, GoldBorg EA V1.8 is a tool you can trust to turn gold market volatility into consistent opportunity.

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment