Golden Leopard Brushing EA V1.0 MT4: Unleashing Profitability on XAUUSD, USDJPY Across H1, H4, M1, M5 Timeframes

In the dynamic world of Forex trading, having the right tools can make all the difference. The Golden Leopard Brushing EA V1.0 MT4 is one such tool that has been gaining attention for its potential to enhance trading profitability. In this comprehensive blog post, we will delve into the intricacies of this Expert Advisor (EA), exploring its compatibility with XAUUSD and USDJPY pairs and its performance across various timeframes, including H1, H4, M1, and M5. Whether you're a seasoned trader or just starting your Forex journey, this EA might just be the game-changer you've been looking for.

What is the Golden Leopard Brushing EA V1.0 MT4?

Before we dive into the specifics, let's understand what an Expert Advisor (EA) is and why the Golden Leopard Brushing EA V1.0 MT4 is generating buzz in the trading community.

Expert Advisors (EAs): Your Automated Trading Partner

An Expert Advisor, often referred to as an EA, is a computer program designed to automate trading activities within the MetaTrader 4 (MT4) platform. These programs are essentially trading robots that execute trades based on predefined algorithms and strategies. EAs can analyze market conditions, identify trading opportunities, and execute trades without human intervention.

The primary goal of an EA is to remove the emotional aspect of trading, which can often lead to costly mistakes. By following a set of rules and strategies, EAs aim to provide a disciplined and consistent approach to trading.

The Golden Leopard Brushing EA V1.0 MT4: A Closer Look

The Golden Leopard Brushing EA V1.0 MT4 is a specific EA designed for use on the MT4 platform. What sets it apart is its focus on the XAUUSD (Gold vs. US Dollar) and USDJPY (US Dollar vs. Japanese Yen) currency pairs. These pairs are known for their volatility and potential trading opportunities, making them attractive choices for automated trading systems.

Now, let's explore why these currency pairs are of particular interest to traders and how the Golden Leopard EA aims to capitalize on their movements.

Why XAUUSD and USDJPY?

XAUUSD: The Precious Metal's Dance with the Dollar

XAUUSD represents the exchange rate between gold (XAU) and the US Dollar (USD). Gold has long been considered a safe-haven asset, often sought after during times of economic uncertainty. Its price movements are influenced by a wide range of factors, including inflation, interest rates, geopolitical events, and market sentiment.

Traders are drawn to XAUUSD for several reasons:

- Volatility: Gold prices can experience significant fluctuations, providing ample opportunities for profit.

- Diversification: Including gold in a trading portfolio can help diversify risk.

- Safe-Haven Status: Gold is often seen as a store of value during turbulent times.

The Golden Leopard Brushing EA V1.0 MT4 is designed to navigate the complexities of XAUUSD trading, identifying trends and entry/exit points to maximize profitability.

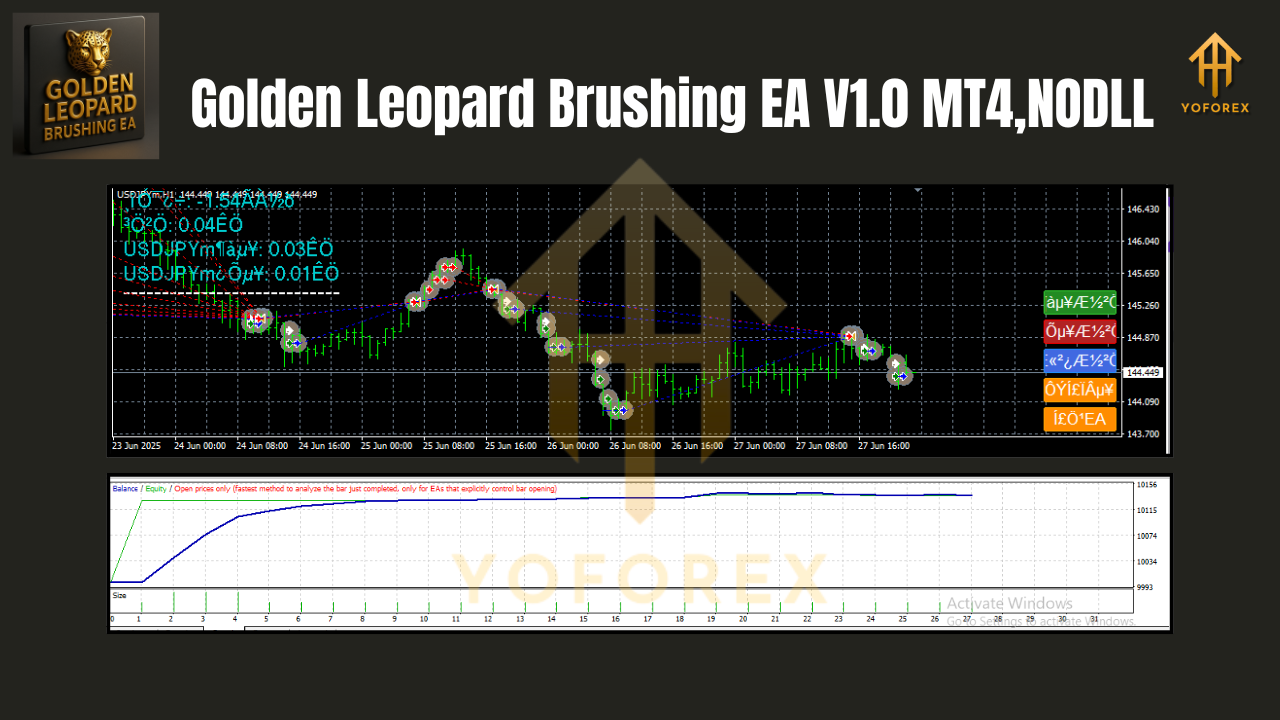

USDJPY: The Yen's Journey with the Greenback

USDJPY represents the exchange rate between the US Dollar (USD) and the Japanese Yen (JPY). The Japanese Yen is known for its status as a safe-haven currency, similar to gold. It tends to strengthen during times of global uncertainty.

Key factors influencing USDJPY include:

- Interest Rates: Monetary policies of the Federal Reserve and the Bank of Japan play a significant role.

- Economic Data: Economic indicators from both the United States and Japan impact the pair.

- Global Events: Geopolitical developments and market sentiment can cause rapid shifts.

The Golden Leopard EA's algorithm is tailored to analyze these factors and make informed trading decisions on the USDJPY pair.

Timeframes: H1, H4, M1, M5 - The Golden Leopard's Playground

One of the standout features of the Golden Leopard Brushing EA V1.0 MT4 is its adaptability across multiple timeframes. Traders can deploy this EA on the following timeframes:

H1 (Hourly) Timeframe

The H1 timeframe provides a balanced view of market trends. It captures daily fluctuations while smoothing out short-term noise. Traders who prefer a more relaxed pace often favor the H1 timeframe.

H4 (4-Hour) Timeframe

The H4 timeframe offers a broader perspective, allowing traders to identify medium-term trends. It's particularly useful for swing traders who aim to capture significant price movements.

M1 (1-Minute) Timeframe

The M1 timeframe is for traders who thrive on speed and precision. It's ideal for scalpers and day traders who seek to capitalize on rapid price changes.

M5 (5-Minute) Timeframe

The M5 timeframe strikes a balance between the M1 and H1 timeframes. It's suitable for traders who want to capture short-term trends without getting overwhelmed by minute-by-minute fluctuations.

The Golden Leopard EA's versatility across these timeframes makes it accessible to a wide range of trading styles and preferences.

How Does the Golden Leopard Brushing EA V1.0 MT4 Work?

Now that we've covered the basics, let's delve into the inner workings of this EA. Understanding its mechanisms can help traders make informed decisions about its implementation.

Algorithmic Trading

At its core, the Golden Leopard EA relies on algorithmic trading. This means it follows a set of predefined rules and calculations to determine when to enter and exit trades. These rules are typically based on technical indicators, price patterns, and market conditions.

The EA continuously monitors the selected currency pairs and timeframes, looking for signals that align with its trading strategy. When conditions are met, it executes trades automatically.

Risk Management

Effective risk management is a cornerstone of successful trading, and the Golden Leopard EA incorporates risk management principles into its design. This includes features like:

- Stop-Loss Orders: The EA can set stop-loss levels to limit potential losses on trades.

- Position Sizing: It calculates the appropriate position size based on account equity and risk tolerance.

- Trailing Stops: Some EAs include trailing stops to secure profits as the market moves in the trader's favor.

These risk management features are crucial for preserving capital and ensuring long-term trading viability.

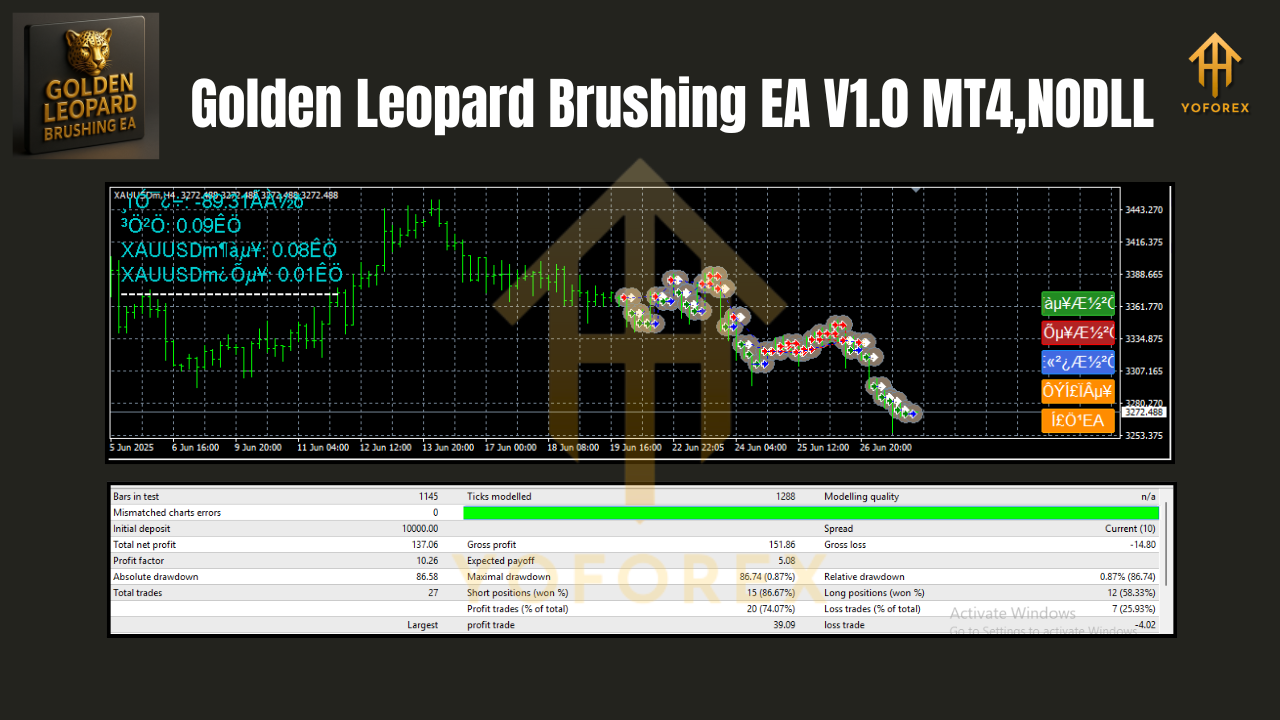

Backtesting and Optimization

Before deploying an EA in a live trading environment, it's essential to conduct thorough backtesting and optimization. This involves testing the EA's performance on historical data to assess its profitability and identify areas for improvement.

Traders can adjust various parameters and settings within the EA to fine-tune its performance. This optimization process helps tailor the EA to specific market conditions and trading preferences.

Benefits of Using the Golden Leopard Brushing EA V1.0 MT4

Now that we've explored how this EA operates, let's highlight some of the key benefits it offers to traders:

1. Automation and Efficiency

One of the primary advantages of using an EA is automation. The Golden Leopard EA can run 24/7, continuously scanning the markets for trading opportunities. This frees up traders from the need to constantly monitor charts and execute trades manually.

2. Emotionless Trading

Emotions like fear and greed can cloud judgment and lead to impulsive trading decisions. EAs eliminate this emotional element, ensuring that trades are executed based on logic and predefined rules.

3. Consistency

Consistency is key to long-term trading success. EAs follow the same rules every time, reducing the likelihood of making costly mistakes due to human error.

4. Diversification

The Golden Leopard EA's compatibility with both XAUUSD and USDJPY allows traders to diversify their portfolios. Diversification can help spread risk and potentially enhance overall returns.

5. Timeframe Flexibility

As mentioned earlier, the EA's adaptability across multiple timeframes caters to various trading styles. Whether you're a scalper, day trader, or swing trader, there's a timeframe that suits your needs.

6. Potential for Profit

Ultimately, the goal of any trading tool is to generate profits. While past performance is not indicative of future results, the Golden Leopard EA has shown potential in capturing profitable trading opportunities on its designated pairs and timeframes.

Implementing the Golden Leopard Brushing EA V1.0 MT4

Now that you're familiar with the benefits, let's discuss how to implement this EA in your trading strategy.

Step 1: Obtain the EA

The first step is to acquire the Golden Leopard Brushing EA V1.0 MT4. You can typically find it on trading forums, websites specializing in EAs, or from the developer's official source. Ensure that you download it from a reputable source to avoid potential issues.

Step 2: Install the EA on MT4

Once you have the EA file, follow these steps to install it on your MetaTrader 4 platform:

- Open your MT4 terminal.

- Go to the "File" menu and select "Open Data Folder."

- Navigate to the "MQL4" folder and then to the "Experts" folder.

- Copy the EA file into the "Experts" folder.

- Close and restart MT4.

Step 3: Attach the EA to a Chart

To start using the EA, follow these steps:

- Open the desired currency pair chart (XAUUSD or USDJPY) on the chosen timeframe (H1, H4, M1, or M5).

- Right-click on the chart and select "Navigator" from the dropdown menu.

- In the Navigator window, go to the "Experts" folder and find the Golden Leopard EA.

- Drag and drop the EA onto the chart.

- A settings window will appear. Configure the parameters according to your preferences and risk tolerance.

- Click "OK" to attach the EA to the chart.

Step 4: Monitor and Adjust

After attaching the EA, it will begin analyzing the market and executing trades based on its algorithm. It's essential to monitor its performance regularly, especially during the initial stages.

Keep an eye on the following:

- Profit/Loss: Track the EA's profitability over time.

- Settings: Be prepared to adjust settings if market conditions change significantly.

- Updates: Check for updates or new versions of the EA from the developer.

Risk Considerations

While EAs can be powerful tools, it's crucial to approach their use with caution. Here are some risk considerations:

Market Volatility

Forex markets can be highly volatile, especially during news events or economic releases. Sudden price swings can lead to unexpected losses, even with an automated system.

Over-Optimization

Over-optimizing an EA's settings based on past data can lead to "curve fitting," where the EA performs exceptionally well on historical data but fails in live trading. It's essential to strike a balance between optimization and practicality.

Broker Compatibility

Ensure that your broker supports the use of EAs and that there are no restrictions or issues with the trading conditions that could affect the EA's performance.

Continuous Monitoring

While EAs automate trading, they are not entirely hands-off. Regular monitoring is necessary to address technical issues, adjust settings, and respond to changing market conditions.

Conclusion

The Golden Leopard Brushing EA V1.0 MT4 is a promising addition to the world of automated Forex trading. Its compatibility with XAUUSD and USDJPY pairs, coupled with its adaptability across multiple timeframes, makes it an attractive option for traders of various styles.

However, it's essential to approach the use of this EA with a clear understanding of its mechanisms, risk management principles, and the ever-changing nature of the Forex market. While it has the potential to enhance profitability, no trading tool can guarantee success.

As with any trading endeavor, thorough research, testing, and careful implementation are key to harnessing the power of the Golden Leopard EA effectively. When used wisely, it can be a valuable asset in your trading arsenal, helping you navigate the complexities of the Forex market with confidence and precision.

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment