In the world of technical analysis, few candlestick patterns are as significant as the hammer. It's simple, visual, and often signals a shift in momentum. But identifying these patterns and executing trades manually can be time-consuming and inconsistent. That's where Hammer Candle EA v2.40 for MetaTrader 5 comes into play.

Built to detect both bullish and bearish hammer candlesticks, this EA automatically executes reversal trades based on configurable criteria, eliminating hesitation and emotional interference. It's ideal for traders who rely on price action and who want a hands-off, systematic approach to entering potential market turning points.

Let’s explore what this expert advisor offers and why it can be a smart addition to your trading arsenal.

What is Hammer Candle EA v2.40?

Hammer Candle EA v2.40 is a fully automated Expert Advisor designed for MetaTrader 5. Its core strategy revolves around identifying hammer-type candlesticks—patterns that commonly indicate the possibility of a price reversal after a trend.

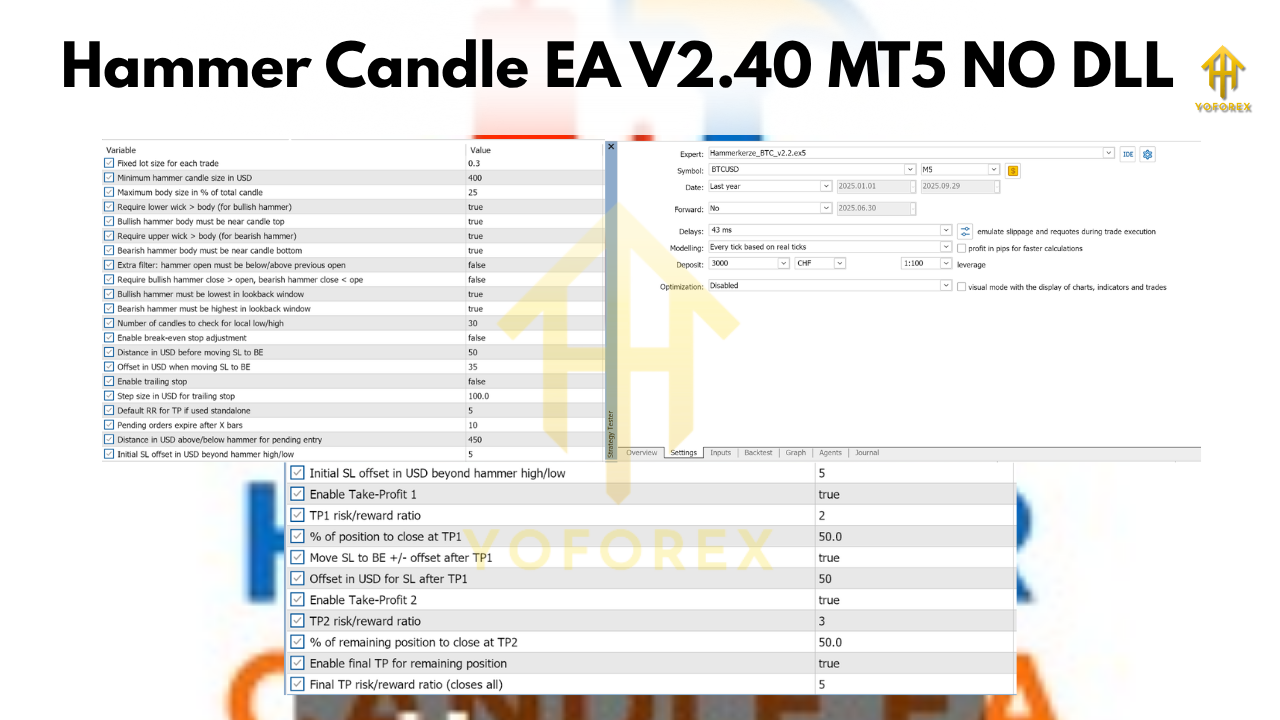

Rather than using indicators or lagging systems, this EA focuses on raw price behaviour. It places trades when strict conditions around candle shape, size, and position are met. You get full control over the entry logic, stop-loss levels, and profit targets, allowing the EA to be adapted for different instruments and market environments.

Most importantly, it does not rely on Martingale, grid, or arbitrage logic—making it suitable for traders who prioritise capital preservation and steady returns.

Why Hammer Candles?

A hammer candle forms when price pushes strongly in one direction but gets rejected before the candle closes, resulting in a long wick and a compact body near the end of the range. This structure is often interpreted as a rejection of the prevailing trend.

- A bullish hammer appears after a decline and signals a possible bottom.

- A bearish inverted hammer forms after a rally and may suggest a top.

Many traders use this formation to identify potential reversal zones, especially when it appears at key support or resistance areas. However, manually scanning for valid hammer candles can be tedious. That’s where automation adds real value.

Core Capabilities of the EA

Hammer Candle EA v2.40 isn't just a basic pattern recognition tool. It incorporates advanced logic to filter out weak or unreliable setups and focuses only on high-probability reversal opportunities.

Pattern Validation

You can define what a “valid” hammer candle looks like:

- Minimum wick size in USD

- Maximum body percentage relative to candle size

- Wick direction and body position rules

- Optional checks for candle close direction

This filtering ensures the EA only acts when the pattern is strong and clear.

Trade Entry and Order Control

The EA gives you total control over how orders are placed:

- Set an entry buffer above or below the hammer candle

- Use pending orders with expiration (measured in bars)

- Define a fixed stop-loss in USD distance

- Cancel untriggered orders automatically after expiration

This type of entry logic prevents early or false trades and helps time the market more precisely.

Profit Management and Risk Handling

It includes several layers of profit control:

- Multiple Take Profit levels (TP1, TP2, Final TP)

- Partial close percentages for each level

- Option to move SL to break-even at TP1

- Trailing Stop feature to protect profits

- Time-based exit to avoid prolonged exposure

With these features, the EA can lock in gains and exit cleanly when market momentum stalls.

Recommended Markets and Timeframes

While the EA is compatible with many instruments, it is particularly fine-tuned for shorter timeframes like M5 and M15. It's been used effectively on:

- Crypto pairs like BTCUSD and ETHUSD

- Major forex pairs such as EURUSD and GBPUSD

- Commodity assets like gold (XAUUSD), depending on volatility

- It’s important to adjust settings for each instrument. What works on crypto may not work well on traditional forex pairs due to different price behaviour and volatility ranges.

Benefits of Using Hammer Candle EA

This Expert Advisor offers a range of practical benefits:

- Fully automated trading of reversal patterns

- No grid or Martingale, making it suitable for conservative strategies

- Detailed input customization for pattern strength and trade rules

- Works across multiple asset classes and brokers that support MT5

- Reduces emotional decision-making by executing trades consistently

For traders who believe in price action but want an efficient and disciplined way to trade it, this EA provides a structured solution.

Considerations and Drawbacks

Every trading tool has its limitations, and the Hammer Candle EA is no exception:

- Reversal trades may fail in trending markets without confirmation

- Requires time to optimise for different pairs and timeframes

- Performance depends on broker execution quality and spread conditions

- Market structure and external news events can affect results

- No built-in trend filter—you’ll need to use it in context or add your own indicators

To reduce these risks, it's essential to combine the EA with good trading habits such as backtesting, forward testing on demo accounts, and proper money management.

How to Start Using the EA

Getting started with Hammer Candle EA v2.40 is a simple process:

- Install it on your MT5 platform and apply it to your chosen chart.

- Use a smaller lot size initially and test on a demo account.

- Configure candle validation rules that suit your strategy.

- Define clear risk management settings before going live.

- Monitor trade behaviour in different market conditions.

It’s best to run the EA on a VPS to ensure stable performance, especially for low-timeframe charts.

Tips for Maximising Performance

Here are some practical suggestions to help you get the most from this EA:

- Use the EA only during high-volume trading sessions to avoid slippage

- Avoid using it during high-impact news events

- Combine with basic trend direction filters like moving averages or trendlines

- Backtest with at least one year of data to verify performance

- Review trades weekly and adjust settings if market behaviour changes

As with any automated strategy, regular review and smart oversight are key to long-term success.

Who Should Use This EA?

The Hammer Candle EA is ideal for:

- Traders who prefer price action and visual candlestick setups

- Beginners who want to automate simple reversal strategies

- Experienced traders looking for a supplement to manual trading

- Anyone who wants to avoid complex indicator stacking or risky systems

If your strategy revolves around catching tops and bottoms using candle structure, this EA gives you a programmable, rules-based way to do it consistently.

Final Thoughts

Hammer Candle EA v2.40 offers a powerful way to turn a classic trading concept into an automated system. It’s built with flexibility in mind and gives you full control over how trades are chosen, managed, and exited. For traders who trust candle patterns and are comfortable with reversal logic, this EA can be a valuable tool to streamline entries and exits without emotional interference.

As always, results depend on testing, optimization, and ongoing monitoring. But with the right approach, this EA could help you spot and trade market turning points with greater consistency.

Comments

No comments yet. Be the first to comment!

Leave a Comment