In the competitive world of forex trading, success often depends on precision, discipline, and adaptability. Automated trading systems have become powerful allies for traders, and one standout among them is the Hedging Hero EA V1.0 MT4. This Expert Advisor is designed to execute trades strategically using a hedging methodology that focuses on reducing risk while maintaining consistent profitability.

What is Hedging Hero EA V1.0 MT4

The Hedging Hero EA V1.0 is a fully automated trading robot built for the MetaTrader 4 platform. It uses a hedging approach that involves opening both buy and sell positions simultaneously. This technique allows traders to balance their exposure, minimize potential drawdowns, and maintain control even during high volatility.

Unlike typical directional systems, this EA thrives in unpredictable market environments. Its algorithm continuously monitors multiple technical indicators to identify safe entry and exit points while maintaining a balanced portfolio of open trades.

Core Strategy and Functionality

Hedging Hero EA V1.0 employs a dual-position logic that ensures one trade always counteracts the other. When the market moves in favor of one side, the EA gradually closes losing positions while optimizing profit from the winning side.

Main Components of the Strategy:

- Dynamic Position Hedging: Automatically opens counter trades to safeguard capital during adverse market movement.

- Smart Recovery System: Adjusts lot sizes intelligently without relying on dangerous martingale strategies.

- Adaptive Profit Targeting: The EA identifies when to close both positions to lock in the best combined result.

- Spread & Volatility Filters: It avoids trades during low liquidity or news spikes, ensuring stability in execution.

This combination of advanced trade management and adaptive filters allows the EA to perform efficiently on pairs like EURUSD, GBPUSD, and XAUUSD.

Risk Management and Control

The EA’s core strength lies in its multi-layered risk control. Traders can set a maximum drawdown limit, configure stop-loss parameters, and determine safe levels for trade multipliers. It ensures capital preservation — an essential factor for long-term sustainability in automated trading.

Furthermore, the system includes a configurable hedge distance (default 30 pips), enabling traders to fine-tune how frequently opposing trades are triggered. This flexibility allows users to adapt to both trending and ranging markets with minimal manual oversight.

Installation and Setup Guide

Installing the Hedging Hero EA V1.0 MT4 is straightforward:

- Download and Extract Files – Obtain the EA file and move it to your MT4 installation folder under

MQL4 > Experts. - Restart MetaTrader 4 – Relaunch the platform and find “Hedging Hero EA V1.0” in the Navigator panel.

- Attach to Chart – Drag it onto your desired trading pair and select your lot size, risk percentage, and hedge distance.

- Enable AutoTrading – Click on the AutoTrading button to allow the EA to start analyzing and trading automatically.

It is strongly recommended to test the EA on a demo account before switching to live trading. This helps evaluate its risk profile and performance with your broker’s execution speed and spreads.

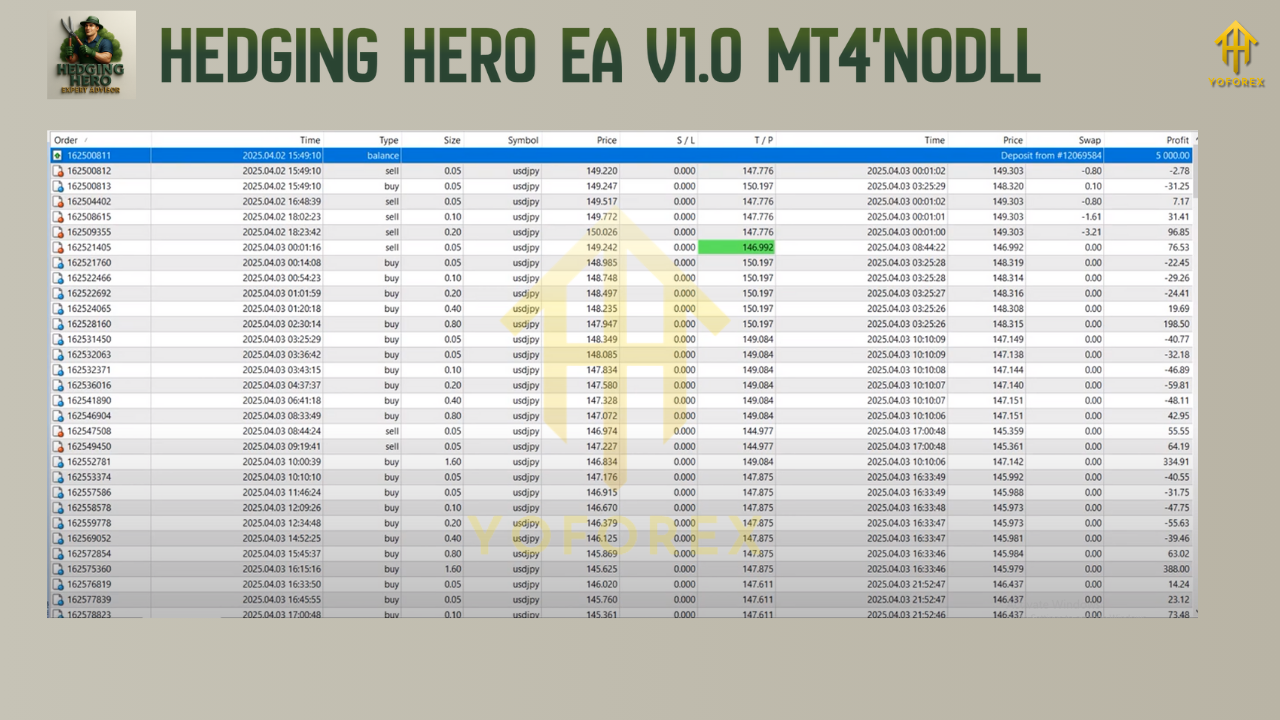

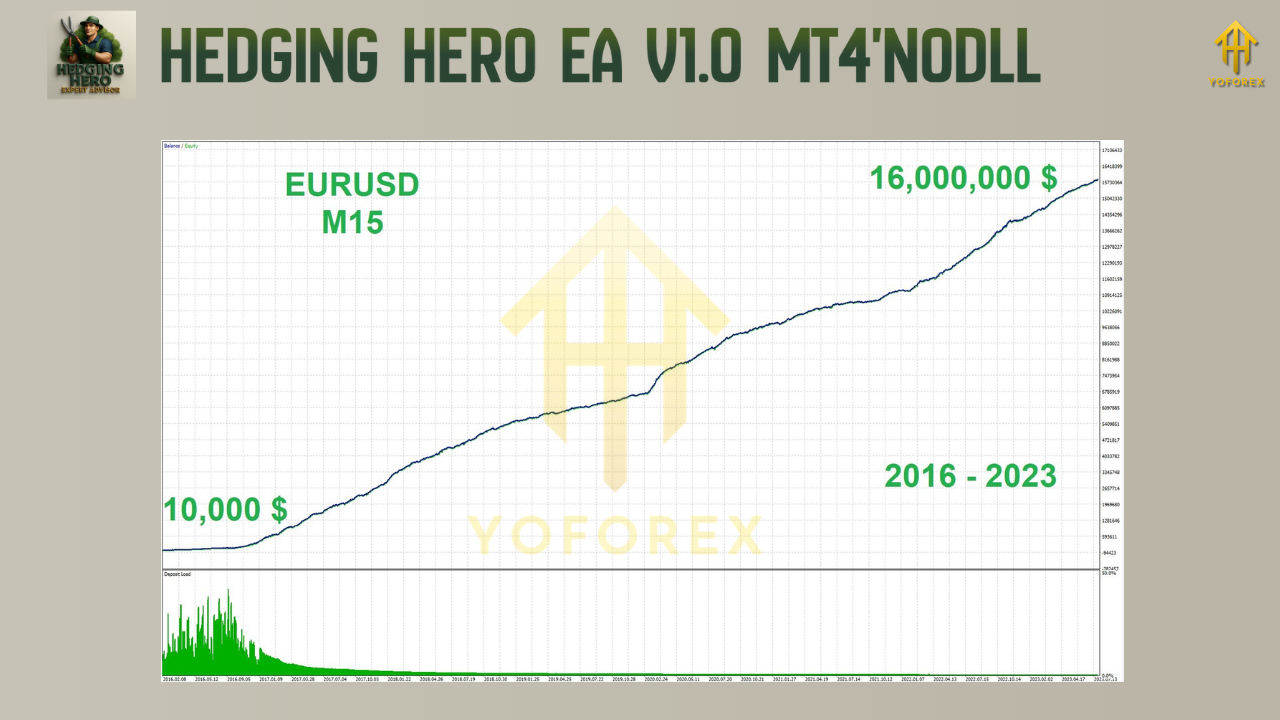

Backtesting Insights

During backtests across multiple pairs and timeframes, Hedging Hero EA V1.0 demonstrated stability and low drawdown performance. It performed best on H1 and H4 timeframes, where volatility is moderate but consistent.

The results showed that even in sideways markets, the EA’s dual-position logic effectively maintained equity balance, while in trending markets, its adaptive profit algorithm captured strong moves efficiently. The absence of excessive grid or martingale tactics makes it safer than many aggressive systems.

Best Trading Conditions

- Minimum Deposit: $1000 recommended per 0.1 lot

- Preferred Brokers: ECN accounts with tight spreads and fast execution

- Timeframes: H1 and H4 recommended

- Currency Pairs: EURUSD, GBPUSD, XAUUSD

- Account Type: Hedging enabled

The EA operates best under brokers that support hedging and offer 1:500 leverage or higher, providing enough flexibility for both protective and profit-driven trades.

Advantages of Using Hedging Hero EA

- Reduced Emotional Trading: Full automation removes human error and impulsive decisions.

- Steady Returns: Instead of chasing high-risk profits, it focuses on sustainable growth.

- Capital Preservation: Advanced drawdown protection helps maintain trading balance.

- Beginner Friendly: Simple interface, minimal setup requirements, and optimized presets.

- Multi-Pair Support: Operates on several instruments, giving traders portfolio diversification.

Limitations to Keep in Mind

Despite its advantages, no EA is perfect. Hedging Hero EA requires careful broker selection and proper lot management. In trending markets, it may take time to neutralize open positions. Continuous monitoring is recommended, especially during high-impact news events or sudden market gaps.

Tips for Maximizing Profitability

- Use VPS Hosting: Ensures continuous operation with minimal latency.

- Avoid Over-Leveraging: Stick to conservative lot sizing for better risk control.

- Monitor Economic Calendar: Pause trading during major financial announcements.

- Optimize Settings Regularly: Market behavior evolves; backtest monthly for improvements.

Final Thoughts

The Hedging Hero EA V1.0 MT4 is a well-balanced automated trading tool designed for traders who prioritize capital safety and controlled profit accumulation. It delivers consistent performance by combining intelligent hedging, adaptive recovery, and real-time market analysis.

Traders seeking a stable and risk-adjusted approach can find this EA a valuable addition to their trading toolkit. With proper testing and disciplined execution, it can serve as a dependable partner in navigating volatile markets with confidence.

For more details and the latest EA updates, visit forexfactory.cc or join our trading community below:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

No comments yet. Be the first to comment!

Leave a Comment