Meta PX EA V15.0 MT4 is one of those Expert Advisors (EAs) that has sparked curiosity among traders in recent times. While information around it remains limited compared to mainstream robots, many in the Forex community are searching for answers about its functionality, legitimacy, and whether it can truly deliver consistent profits.

In this blog post, we will dive into every essential detail about Meta PX EA V15.0 MT4, covering its potential features, use cases, risks, and best practices for testing it. The aim is to help new and intermediate traders understand what to expect and how to approach this EA wisely.

Introduction: What Is Meta PX EA V15.0?

Meta PX EA V15.0 is described as an advanced automated trading system designed for the MetaTrader 4 platform. As its version number indicates, this is the fifteenth release, implying multiple updates or refinements from earlier versions.

Unlike many popular EAs listed on public marketplaces, Meta PX EA V15.0 is not widely documented, which raises questions about its background. However, its positioning suggests it aims to provide:

- Automatic execution of trades

- Pre-set strategies with optimized entry/exit logic

- Options for money management and risk control

Why Traders Are Interested in Meta PX EA

There are several reasons why Meta PX EA V15.0 has caught attention despite limited public information:

- Ease of Automation: Like any MT4 EA, it promises hands-off trading once configured.

- Continuous Updates: A version 15.0 tag suggests multiple refinements.

- Potential for Customization: Many such EAs allow traders to adjust risk settings and adapt to market volatility.

For beginners especially, the idea of letting a program handle trades sounds attractive. However, without transparent track records, it’s crucial to stay cautious.

Possible Trading Approaches of Meta PX EA

Although specific strategies are undisclosed, Meta PX EA V15.0 might employ one or more of the following methods commonly seen in Forex robots:

- Trend Following: Entering trades when the price moves in a clear direction.

- Scalping: Targeting quick profits on small price moves.

- Breakout Logic: Capturing trades during high-impact moves after consolidation.

- Grid or Martingale Systems: Opening multiple trades to average price entries (risky if not controlled).

Key Factors to Consider

When analyzing any EA—including Meta PX EA V15.0—keep these considerations in mind:

- Performance Transparency

Without verified results, any profitability claims should be treated with caution. - Risk Management

Can the EA manage stop losses, trailing stops, or maximum drawdown levels effectively? - Broker Compatibility

Not all brokers support high-frequency or scalping EAs. Always check trading conditions like spreads and execution speed. - Updates and Support

An EA with multiple versions should ideally come with user support and updates.

Benefits of Using Meta PX EA V15.0 MT4

If Meta PX EA V15.0 lives up to its promise, traders could expect:

- 24/5 automated trading with no emotional bias

- Quick response to market changes

- Multiple strategy filters for different conditions

- Reduction of manual workload for part-time traders

Risks and Red Flags

Every EA carries risks, and Meta PX EA V15.0 is no exception. Here are potential downsides:

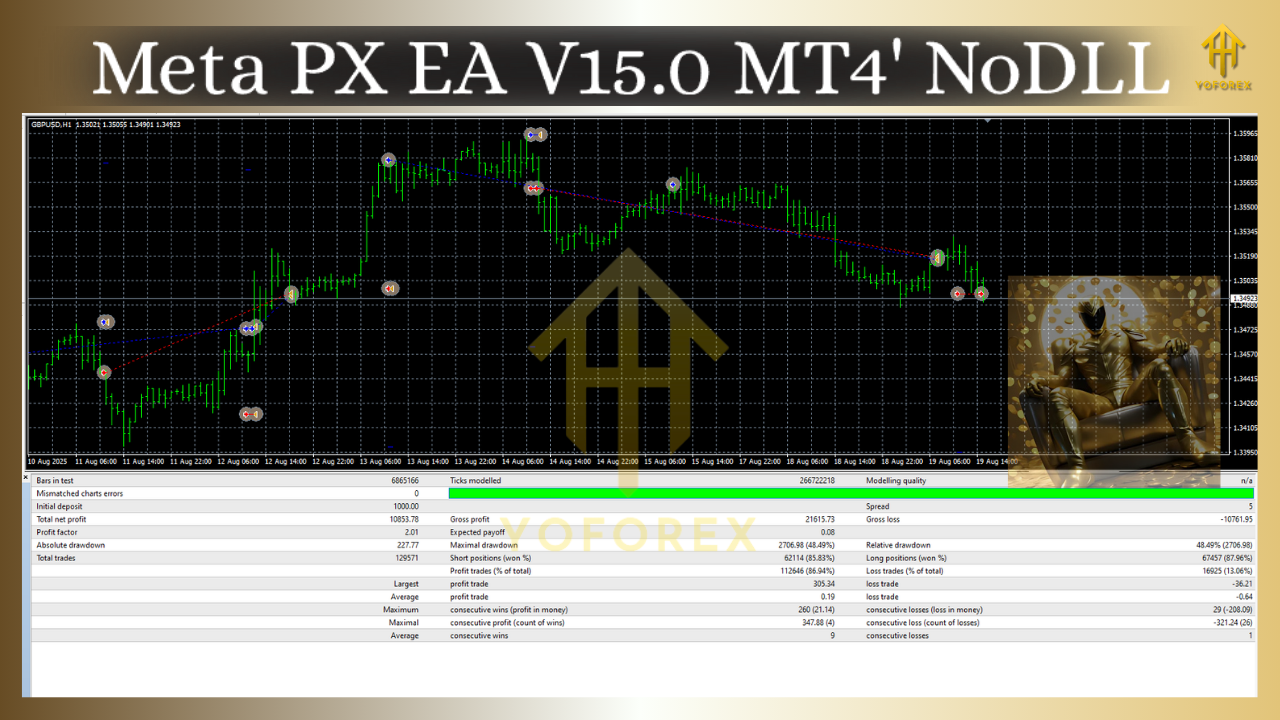

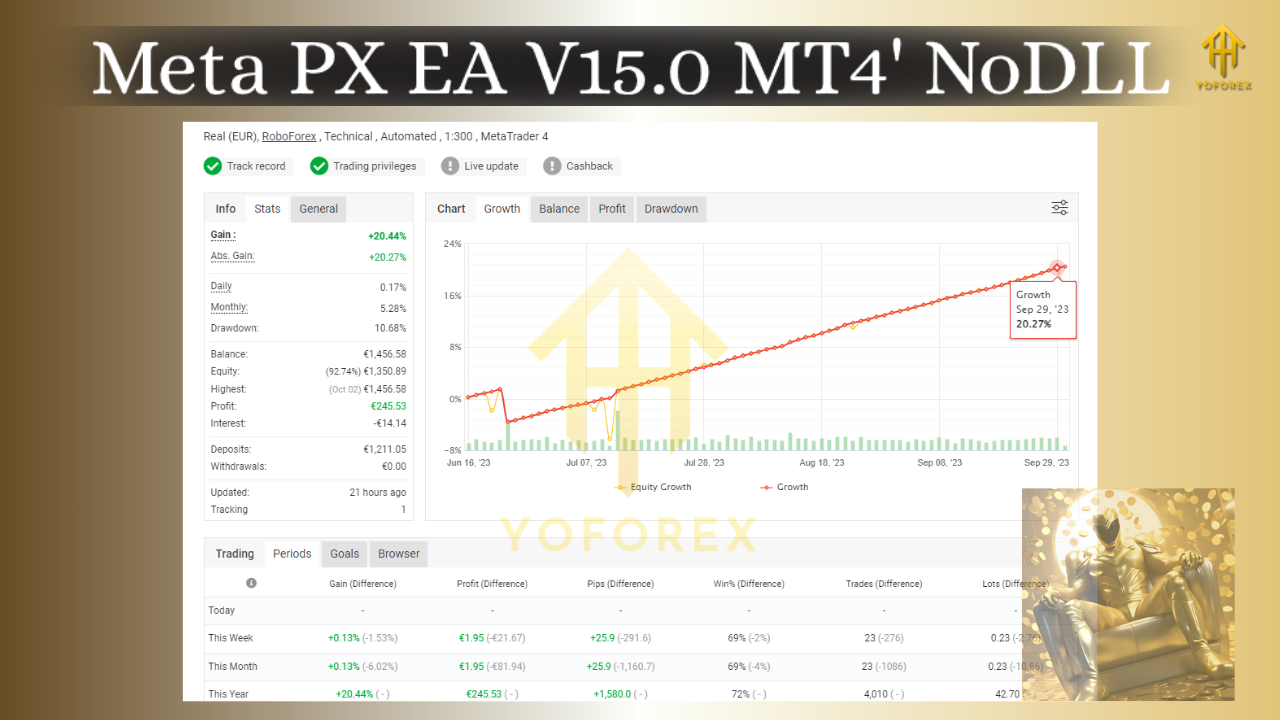

- Lack of Verified Proof: No independent Myfxbook or FX Blue records available.

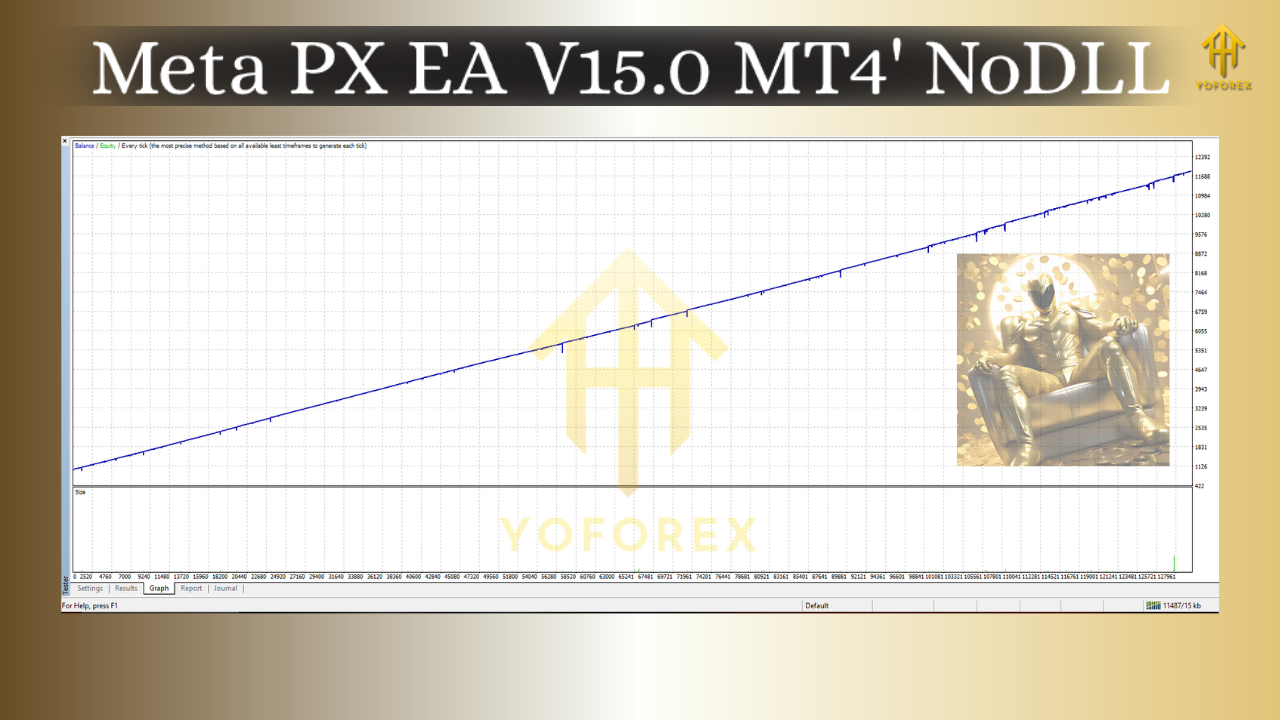

- Possibility of Overfitting: Some EAs look good in backtests but fail live.

- Drawdown Exposure: If using grid/martingale, losses can escalate quickly.

- Unclear Vendor Background: Without a known developer, accountability is uncertain.

Best Practices Before Using Meta PX EA

To minimize risks, follow these steps:

- Test in Demo Mode – Never deploy directly on a live account.

- Check Settings Carefully – Adjust lot size, stop loss, and risk per trade.

- Use a VPS – Ensure uninterrupted 24/5 execution for reliable performance.

- Risk Only a Small Portion – Don’t put your entire capital at stake.

- Monitor Results Weekly – Don’t treat any EA as “set and forget.”

Setting Up Meta PX EA V15.0 on MT4

If you acquire the EA file (.ex4 or .mq4), installation is straightforward:

- Open MT4 → Go to

File > Open Data Folder. - Place the file in the MQL4/Experts folder.

- Restart MT4 and enable AutoTrading.

- Drag the EA onto a chart and configure inputs.

- Run a backtest first, then forward-test on demo.

Final Thoughts

Meta PX EA V15.0 MT4 might offer automated opportunities for traders seeking less manual involvement. However, the absence of verified records means extra caution is necessary. Treat it as an experimental tool, not a guaranteed profit generator.

If you’re curious about testing it, always begin with a demo account, use strict risk controls, and only transition to live trading once results prove consistent.

On ForexFactory.cc, we aim to provide transparent information so that traders can make informed choices. Remember: in Forex, knowledge and risk management are as important as any EA you install.

Comments

No comments yet. Be the first to comment!

Leave a Comment