Polish EA V1.0 MT4 – Clean, Adaptive Entries for Everyday Traders

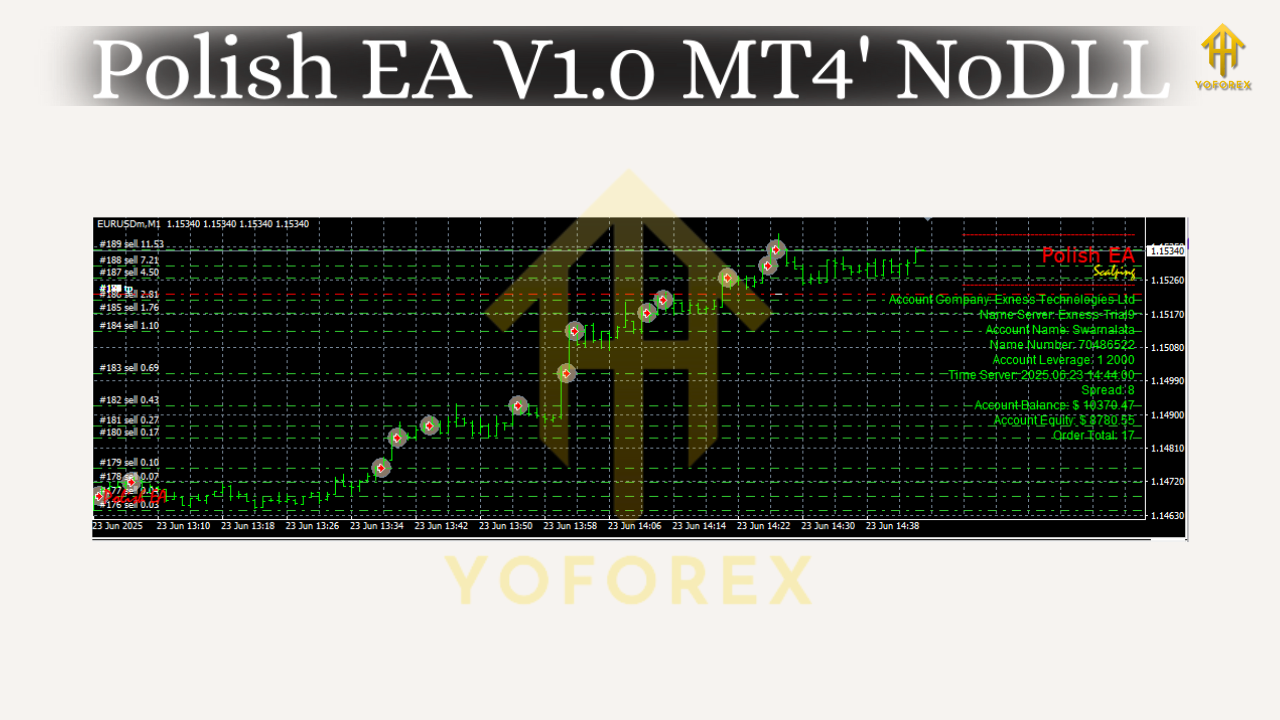

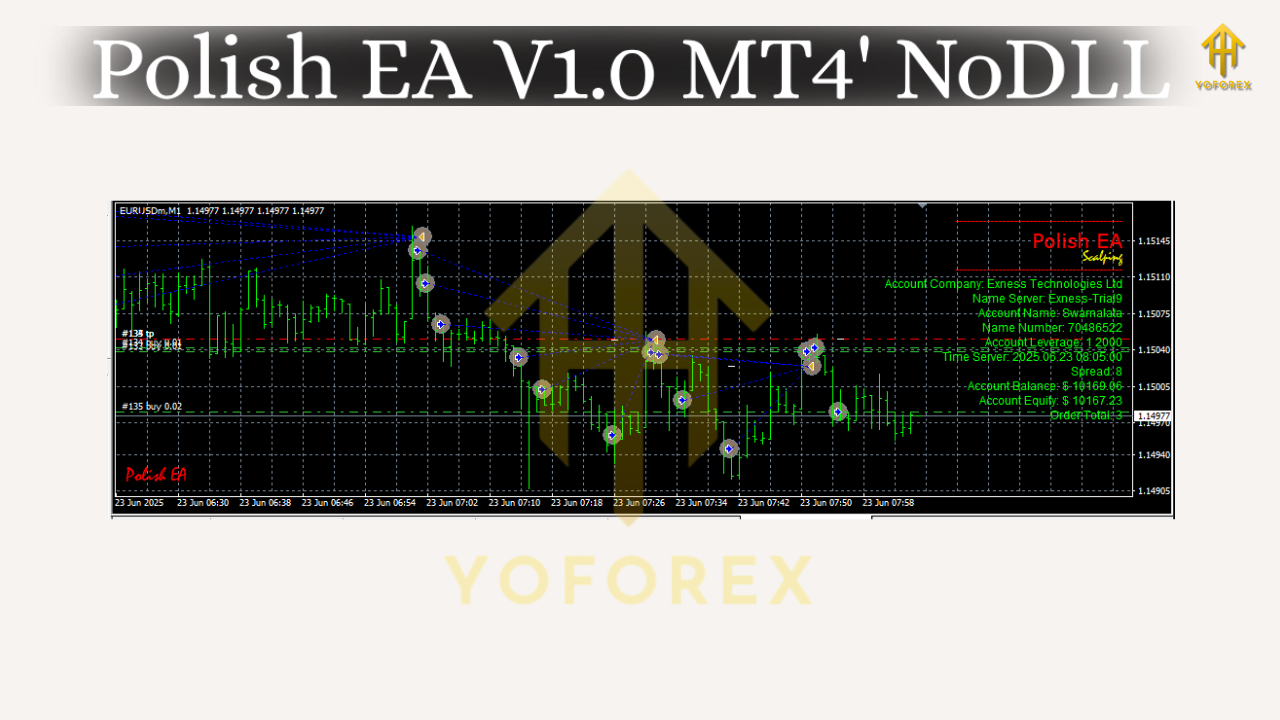

Sick of EAs that promise the moon, then nuke your account by Friday? Same. Polish EA V1.0 MT4 was built for traders who just want clean entries, steady risk, and a bot that doesn’t throw tantrums in choppy markets. It’s an adaptive trend–pullback expert advisor for MetaTrader 4 that focuses on high-probability setups, filters the noise, and prioritizes capital protection first. You’ll get clear signals, consistent execution, and a straightforward setup—no 200-step manual, no gimmicks. Just a tidy workflow you can live with day to day.

What Is Polish EA V1.0 MT4?

Polish EA V1.0 MT4 is an automated trading system that “polishes” raw market structure into tradable, low-drama entries. It combines three pillars:

- Directional Bias (uses moving-average structure and volatility context to define trend),

- Pullback Confirmation (RSI/EMA confluence + wick analysis to avoid chasing),

- Risk Controls (hard SL, dynamic trailing, spread/time filters, and a soft news-avoidance window).

That combo keeps decision-making clean and coherent. The EA doesn’t martingale, it doesn’t grid, and it won’t average down into oblivion. If a setup isn’t there, it’s cool to sit out—capital preservation > FOMO, coz that’s how you stick around long enough to actually compound.

Who it’s for: swing-minded scalpers and intraday traders who like structured rules. If you’re comfy letting the bot handle execution while you handle portfolio oversight (and occasional parameter tweaks), you’ll vibe with this EA.

Key Features (the stuff that matters)

• Non-martingale, no grid – one clear position per signal; no “death spirals.”

• Directional bias engine – filters trades to align with the broader move.

• Pullback + wick confirmation – avoids entries on exhausted candles.

• Time & spread filters – skip low-liquidity or widened-spread windows.

• Hard Stop Loss, dynamic trailing – SL is placed immediately; trailing activates only after structure confirms.

• Break-even logic – optional, kicks in after X pips to protect winners.

• News-avoidance buffer – configurable “quiet time” around scheduled events.

• Session control – choose London/NY focus or run full day with exceptions.

• Risk per trade – percent-based position sizing for consistency.

• Multi-pair capable – run multiple charts; EA keeps tracking per-symbol.

• Low CPU footprint – efficient checks at bar close; minimal tick spam.

• Prop-friendly defaults – conservative lot sizing and max daily loss guardrails.

Recommended Pairs, Timeframes & Deposits

- Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD (Gold).

- Timeframes: M15 and H1 are the sweet spot; M5 works for active sessions if your spreads are tight.

- Minimum Deposit: $200 (standard retail). For Gold or multi-pair setups, many traders choose $500–$1,000 for smoother risk.

How the Strategy Works (in plain English)

- Find trend context: The EA looks at slope, distance and compression around EMAs to judge trend strength. If the market is muddled (low ADX, overlapping structure), it dials down aggression or stands aside.

- Wait for pullback: Instead of buying into extended candles, Polish EA wants a measured pullback into a value area (think EMA zone + previous minor structure). RSI helps spot overreactions; wick analysis reduces entries into “fake strength” bars.

- Confirm and execute: When confluence is met (trend bias + pullback + candle confirmation + acceptable spread), the EA places a market order with a hard SL right away. No games.

- Manage the trade: Once price moves in favor, optional break-even kicks in, then the trailing stop follows structure—never too tight to choke a trade, never too loose to give it all back. If the market flips (clear opposite signal), exits can be tightened.

Why It’s Called “Polish”

Because that’s the job: take messy price action, polish it into an entry that’s paced, deliberate, and statistically sensible. You’ll still see losers (that’s trading), but the EA’s whole ethos is to avoid chaos, keep losses small, and let the winners breathe.

Setup & Installation (quick and painless)

- Download & save the file

Polish EA V1.0.ex4. - In MT4, click File → Open Data Folder.

- Drop the file into MQL4 → Experts.

- Restart MT4 (or right-click Experts and hit Refresh in Navigator).

- Enable Algo Trading (top toolbar), then attach the EA to your chosen chart(s).

- In Inputs, set:

- RiskPercent (e.g., 0.5% to 1.0% per trade)

- MagicNumber (unique per chart)

- UseBreakEven = true (with sensible trigger)

- TrailingMode = Structure (recommended)

- Session & News buffers to taste

7. Run on a demo for a week or two. Save your preferred settings as a .set file. Then go live gradually.

Best-Practice Settings (start here, then iterate)

- EURUSD M15: Risk 0.5%, SL 1.2×ATR(14), TP 2.0×ATR, BreakEven after 1.0×ATR, trailing by last swing.

- GBPUSD M15: Risk 0.4% (cuz volatility), SL 1.4×ATR, TP 2.2×ATR, slightly wider news buffer.

- XAUUSD M15: Risk 0.25–0.35%, SL 1.6×ATR, TPs partial at 1.5×ATR then trail; ensure broker spreads are tight.

- USDJPY H1: Risk 0.6%, SL 1.1×ATR, TP 1.8×ATR, break-even quicker due to mean-reversion tendencies.

These aren’t magic—just sensible baselines that keep you in the game while you learn how the EA behaves across pairs and sessions.

Risk Management (the part most folks skip—don’t)

- Keep total daily risk in check (e.g., 1–2% max).

- Use unique MagicNumbers per chart to avoid crosstalk.

- If spreads spike (rollover, surprise news), the EA’s spread filter should block entries—still, it’s smart to pause during major red-flag events.

- No stacking five correlated charts at the same risk; diversify sessions and symbols.

- If you fail a prop rule, it’s usually over-risk or trading into news; tighten those two.

Optimization Tips (light, not overfit)

- Re-optimize quarterly for ATR multipliers and pullback tolerance; markets evolve.

- Walk-forward tests > single long “perfect” backtests; avoid curve-fitting.

- Small, robust edges scale better than hyper-tuned “wonders” that break next week.

Final Thoughts

Polish EA V1.0 MT4 won’t pretend to “win every trade.” It’s here to filter, confirm, and execute—and to protect your capital when the market gets weird. If you value an EA that respects risk and lets you scale without drama, this one’s a solid fit. Start on demo, get your .set files dialed in, then deploy live with confidence and discipline. Slow is smooth, smooth is fast.

Comments

No comments yet. Be the first to comment!

Leave a Comment