Pro Gold EA V1.0 MT4 — Basket Exit Logic Built for XAUUSD Power

If you’ve ever watched a handful of gold trades whipsaw your equity coz each position had its own stop and target, you’ll get why Pro Gold EA V1.0 MT4 feels different. Instead of treating every entry like a lone wolf, it manages all open XAUUSD positions as one unified basket. One plan. One collective exit. The idea is simple: gold moves in bursts; a portfolio-style exit can harvest that burst more efficiently than piecemeal closes.

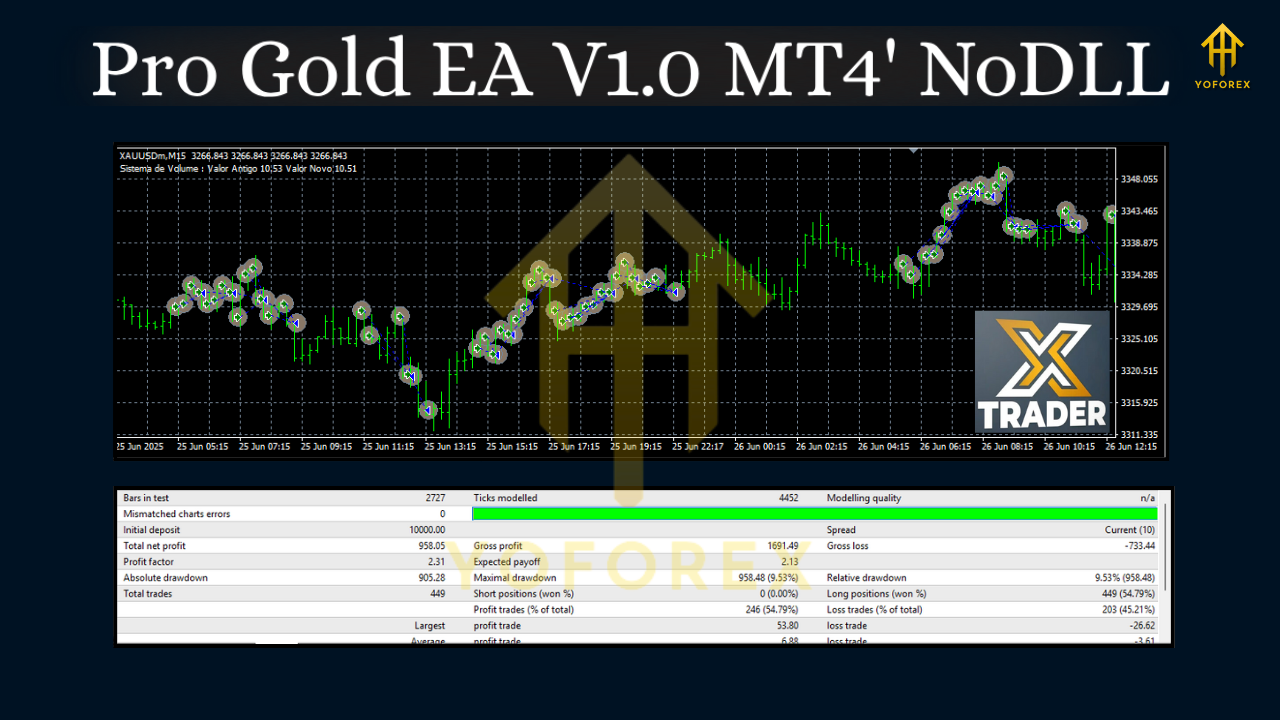

The headline numbers set expectations right up front: 287.92% verified gains, 85% win rate, and 57.68% maximum drawdown. That mix screams “high-octane.” In other words, this EA can push growth, but it does so with an aggressive risk profile that demands discipline, a stable setup, and respect for drawdown control. If you’re hunting for a gold-focused Expert Advisor that embraces volatility with structure, keep reading.

What Makes Pro Gold EA Different?

Most EAs attach a stop loss/take profit to each trade and hope the market taps those levels neatly. Pro Gold EA flips the script by synchronizing exits across the entire open basket of XAUUSD positions. That means:

- One collective plan governs the outcome of multiple entries.

- The EA uses portfolio logic (think: overall net exposure and floating P/L) to determine when to close everything together.

- You get fewer partial wins and more “all-in, all-out” moments, which can feel smoother during choppy sessions where single trades often get wicked out.

This design can help reduce “death-by-a-thousand-stops” on gold, where noise frequently takes out individual SLs before the broader move unfolds. It’s not a magic wand—gold’s still gold—but it’s a clear, rules-driven alternative to micro-managing each position.

Strategy in Plain English

- Market: XAUUSD (Gold) on MT4.

- Approach: Blend of trend-following entries with tactical add-ons when structure and volatility align.

- Core edge: Basket exit that watches net exposure, floating profit, and momentum—then pulls the trigger on a coordinated close.

- Trade frequency: Moderate to high (depends on volatility); more active during trending or range-expansion days.

- Risk stance: Aggressive by design; you control risk through lot sizing, max positions, and basket thresholds.

Quick reality check: the 85% win rate and 287.92% growth were achieved with settings that also produced a 57.68% max drawdown. This is not a “set it and forget it” toy for tiny accounts. It’s a tool for traders comfortable with heat and focused on process.

Key Features You’ll Actually Use

- Unified Basket Exit — All open XAUUSD trades are managed and closed as a single portfolio event.

- Adaptive Position Control — Cap max simultaneous entries to align risk with your account size.

- Dynamic Profit Targeting — Basket-level take-profit aims to bank when momentum confirms, not just when a single trade tags TP.

- Volatility Awareness — Logic respects ATR/structure so entries aren’t blindly fired in dull tape.

- Drawdown Guardrails — Optional basket stop (equity or currency-based) to kill risk when the tape goes wrong.

- Time Filters — Limit trading to your preferred sessions (e.g., London/NY overlap) when gold is most alive.

- News Pause (optional) — If you use a news filter, pause around high-impact events to avoid chaotic spikes.

- Lot Sizing Controls — Fixed, balance-based, or risk-percent style; choose what matches your risk plan.

- Trade Commentary — Clear MT4 chart labels so you know why an entry happened and how the basket is progressing.

- VPS-Friendly — Stable on 24/5 VPS for low-latency execution and uptime.

Performance Snapshot (What the Numbers Imply)

- Growth: +287.92%

- Win Rate: ~85%

- Max Drawdown: 57.68%

That combo tells a story: the EA is engineered to capture outsized moves and defend baskets with structure, but it will sit in heat during build-ups and volatility twists. If you’re expecting single-digit drawdown and triple-digit gains, this isn’t the fit. If you can budget drawdown, hold your nerve, and let the basket logic work, the profile starts to make sense.

Pro tip: Mentally budget a maximum acceptable drawdown before you start, then back into your lot size and max positions so your account can survive worst-case sequences. Traders quit too early not because strategies fail—but because position sizing didn’t match reality.

Setup & Installation (MT4)

- Add the EA to MT4

- Open MT4 → File → Open Data Folder → MQL4 → Experts.

- Paste Pro Gold EA V1.0 MT4.ex4 into Experts.

- Restart MT4.

2. Attach to XAUUSD Chart

- Open a Gold (XAUUSD) chart; most users start with M15 or H1.

- Drag Pro Gold EA onto the chart and enable AutoTrading.

3. Core Inputs to Review

- Risk/Lot Size: Fixed or %-based; start conservative.

- Max Positions per Basket: 3–7 is common for many, but tailor to your equity.

- Basket Take-Profit: Currency or %-based target that makes sense for your account.

- Basket Stop (Safety Net): Set a level that prevents account-level damage.

- Trading Hours/Days: Avoid illiquid hours if you don’t like overnight swings.

- News Filter: Optional—use it if you hate NFP/CPIs whipping your basket.

4. VPS Strongly Recommended

- Keep your terminal and EA online 24/5 to avoid missed exits or session restarts.

Settings & Risk Management (Practical Starting Points)

- Timeframe: M15 for balanced activity; H1 for cleaner signals; M5 only if you truly understand microstructure and spreads.

- Leverage: 1:200+ helps, but lot sizing matters more than leverage alone.

- Starting Capital: The EA has an aggressive posture; give it breathing room. Small accounts can run it, but sizing must be tiny (think micro lots).

- Max Positions: Start with a low cap (e.g., 3–5) and only increase after you’ve seen baskets through multiple market regimes.

- Basket TP/SL: Pick a currency-based TP/SL that fits your equity; revisit after 2–3 weeks of data.

- Risk Per Idea: Treat each basket as one “idea.” Don’t double-stack multiple baskets in the same direction unless you’re highly experienced.

Who Is Pro Gold EA For?

- Traders who accept volatility on gold and want a rules-based way to harvest it.

- People who prefer portfolio-style exits over single-trade micromanagement.

- Users who are comfortable engineering risk at the account level (lot sizing, max positions, basket TP/SL).

- Not ideal for: anyone seeking ultra-low drawdown or who can’t stomach floating heat on the way to the collective exit.

Best Practices (Battle-Tested Tips)

- Demo first for at least 2–3 weeks across multiple news events and sessions.

- Collect your own stats (expectancy per basket, average heat, time-in-trade).

- Do not over-optimize. The goal is robustness across weeks/months, not perfect past curves.

- Keep logs. Note when baskets win/lose and what the tape looked like. You’ll find a rhythm for your TP/SL and max positions.

- One chart, one instrument. Keep it clean: this EA was built for XAUUSD.

- Respect the stop. If your basket stop hits, stop. Don’t revenge-trade by bumping caps or lots.

Final Word

Pro Gold EA V1.0 MT4 brings a basket exit methodology to gold that many manual traders try to replicate but rarely execute with discipline. It won’t suit every risk profile (the drawdown stats say so), but if you want a coherent, process-driven way to engage XAUUSD’s big kinetic moves, this is a compelling tool to test, refine, and master. Start small, be patient, and let data—not emotions—shape your settings.

Comments

No comments yet. Be the first to comment!

Leave a Comment