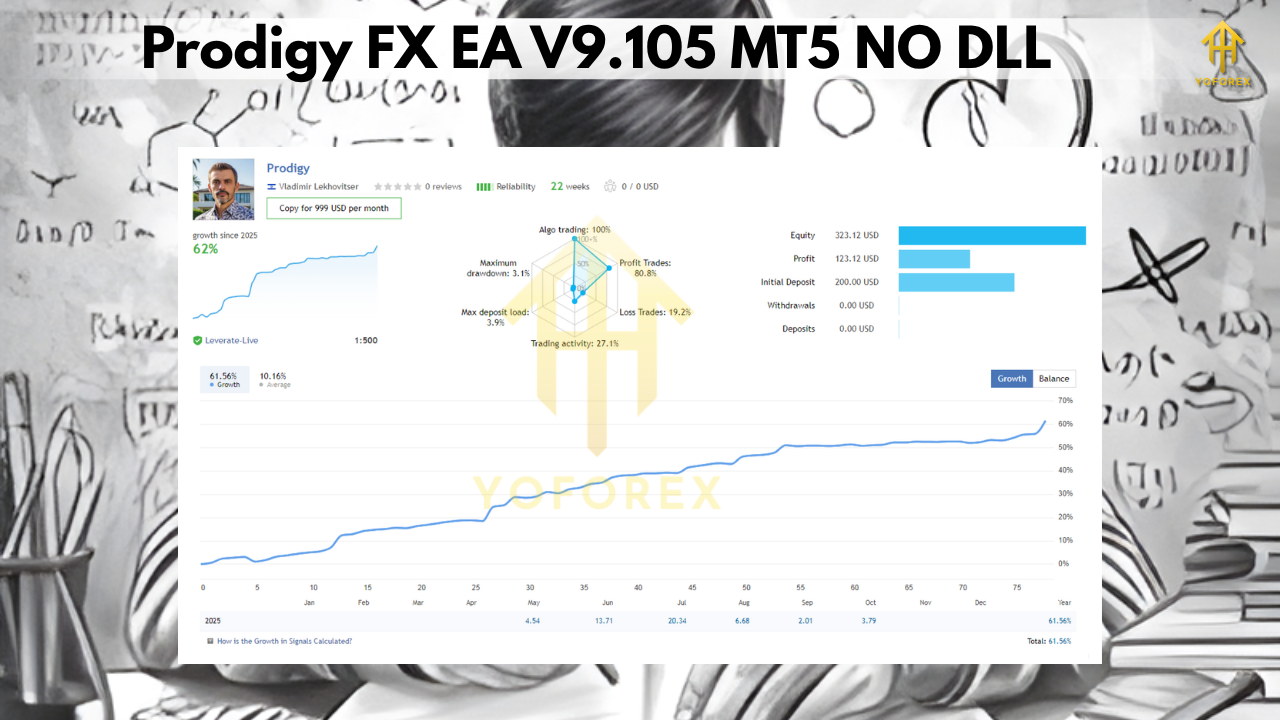

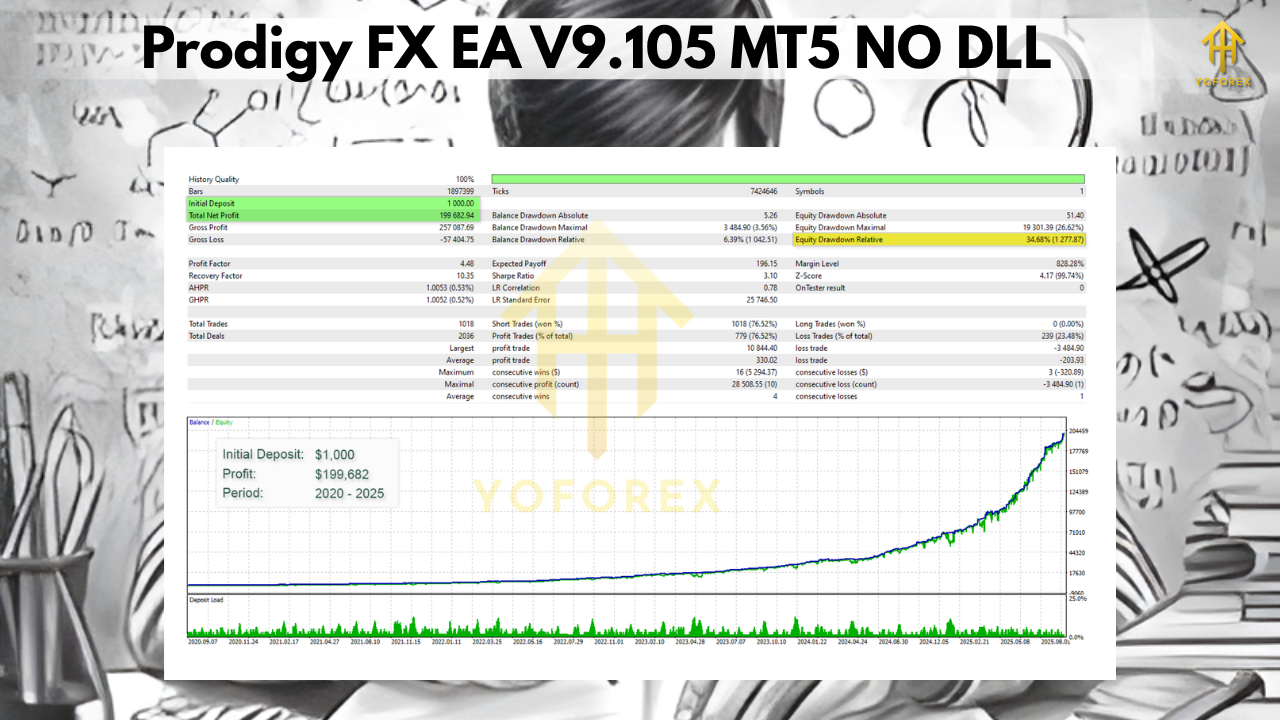

If you prefer focused robots over “one-size-fits-all” systems, Prodigy FX EA V9.105 for MetaTrader 5 takes a narrow, disciplined path. It is built specifically for CAD/CHF and uses Bollinger Bands to frame mean-reversion entries, then manages exposure with an averaging methodology and adaptive take-profit/stop-loss per position. The current listing shows version 9.105, a $299 price tag, and states that the strategy was fine-tuned on six years of data (2020–2025) using a Standard (no-commission) environment, which provides a clear baseline you can replicate before live trading.

What Makes Prodigy FX Different?

Most EAs try to cover many pairs and timeframes, which often dilutes the logic. Prodigy FX commits to one cross (CAD/CHF) whose structure frequently alternates between range-bound and episodic trends. The EA’s description emphasises Bollinger-guided entries and adaptive exits—two design choices that make sense for a mean-reverting idea because bands expand/contract with volatility, while adaptive targets respect context rather than fixed pip counts. According to the product page, each trade slot has its own TP/SL, rather than a static global exit, which is crucial when multiple entries are layered during a deviation.

How the Core Logic Works (In Plain Terms)

Bollinger Bands are a moving-average centerline with upper and lower envelopes set by standard deviation. When price pushes toward the outer bands, it’s statistically farther from its recent mean; in mean-reverting regimes, that’s where fade setups can emerge. Because band distance is volatility-scaled, the signals adapt: wider bands imply higher volatility, while tighter bands suggest consolidation. That adaptive nature is precisely why Bollinger logic is common in systems that attempt to buy weakness/sell strength back toward the mean.

Vendor-Stated Specs & Setup Snapshot

From the listing and “new experts” pages, the vendor highlights the following: pair = CADCHF, version = 9.105, price = 299 USD, averaging with Bollinger Bands, adaptive TP/SL per position, optimization window 2020–2025 on a Standard account, timeframe = any (internal handling), with a preference for Standard (no commission) over Raw. Published on 7 October 2025 with activations and demo metrics visible on the comments tab. These are the conditions you should mirror in testing to approach the posted context.

Why the Account Type Matters

Averaging increases trade count as a move extends, so transaction costs compound. In a Standard account, you pay via spread only; Raw/ECN adds a commission per turn. Even small commissions can skew the breakeven math for tight targets used in layered exits. That practical difference is why the listing points to Standard as the preferred environment, though Raw is possible. If you opt for Raw, re-check the expectancy with commission factored in.

Strengths for CAD/CHF Traders

- Single-pair specialisation: Narrow scope reduces parameter sprawl and usually improves reproducibility; you’re not fighting ten different microstructures at once.

- Volatility-aware entries: Bollinger bands respond to volatility - an advantage when CAD/CHF oscillates.

- Adaptive TP/SL per position: Position-specific exits can prevent the “all trades share one target” problem, smoothing equity during chop. The vendor’s description explicitly notes these adaptive exits.

Important Limitations to Respect

Averaging is inherently path-dependent. When CAD/CHF trends on macro catalysts—such as oil-sensitive CAD moves, SNB tone shifts, or broader risk-off CHF flows—layering can accumulate exposure into the adverse direction. Adaptive stops help, but they do not eliminate tail risk. You must define hard guardrails (maximum layers, daily loss, equity draw limits) and be intentional about event filters around BoC/SNB decisions and key data. This isn’t unique to Prodigy FX; it’s the reality of any disciplined averaging approach.

Deployment Guide (Step-by-Step)

- Mirror the vendor’s testbed: Use CAD/CHF on an MT5 Standard account with realistic spreads. Start on demo or micro-live. The product page ties the optimisation window to 2020–2025; you should match those costs and spread profiles in your backtest if possible.

- Attach and verify permissions: Install into the Experts directory, restart MT5, enable algo trading, and attach to a CAD/CHF chart. Timeframe choice is flexible because the EA runs internal logic.

- Risk first, not last: Set conservative starting lots. Cap the maximum number of entries the EA is allowed to build. Even a robust strategy can stumble without exposure caps.

- Session/rollover awareness: Spreads can widen at rollover or in thin liquidity. Averaging into wide spreads degrades the edge; consider schedule filters.

- Hosting: If you plan to run 24/5, place the platform on low-latency, stable hosting so your entries/updates are not interrupted.

Backtesting, Walk-Forward, and Validation

Backtests demonstrate a strategy’s shape under certain assumptions; walk-forward shows how it behaves when you stop re-fitting constantly. For Prodigy FX, run three passes:

• Replication backtest: CAD/CHF, Standard-like costs, 2020–2025; aim to approximate the behavior described in the listing. behaviour

• Walk-forward: Split the data into multiple windows. Use one to optimise (or keep defaults), then trade into the next without re-fit.

• Monte Carlo: Shuffle trade order and volatility regimes to see how equity reacts to randomisation. Averaging thrives in chop but must be resilient to “wrong-way” streaks.

Risk-Control Playbook (Copy/Paste into Your Journal)

• Max layers: Hard stop at N entries; no exceptions.

• Daily loss: Halt trading for the day at x% draw or y units of adverse excursion.

• Equity guard: Pause the EA if overall draw hits a threshold; resume only after review.

• Event calendar: Flag BoC, SNB, CPI, and risk-events. Either reduce position size or disable opening new entries 30–60 minutes around releases.

• Review cadence: Weekly check on KPIs—profit factor, MAE/MFE per layer, average trade duration, and realised slippage.

Troubleshooting & Fine-Tuning

If you notice declining performance, ask:

• Have spreads/commissions changed? A broker moving from tight spreads to wider ones, or a switch to Raw without recalculating commission effects, can explain expectancy drift.

• Has the CAD/CHF regime shifted? Long, single-direction runs demand tighter caps and possibly fewer layers.

• Are session filters aligned? If your broker’s spreads balloon at certain hours, reduce risk there.

• Are TP/SL truly active per position? The EA intends to adapt exits for each layer; confirm that your inputs haven’t overridden defaults inadvertently.

Who Will Like Prodigy FX?

You’ll appreciate this EA if you:

• Favour mean-reversion over strong trend-following.

• Value single-pair focus that’s easier to audit and maintain.

• Are comfortable enforcing strict exposure caps and following a calendar.

Traders seeking multi-asset coverage, ultra-high-frequency scalping, or pure trend logic may find a better fit elsewhere.

Frequently Asked Questions

Does the EA require a specific timeframe?

The listing notes “timeframe: any”, indicating internal timeframe management. Attach to CAD/CHF and let it operate.

Why does the vendor emphasise a Standard account?

Because averaging multiplies trade count, commission charges on Raw can erode small-target exits. Standard’s spread-only pricing often aligns better with the strategy’s assumptions; Raw is possible, but not the stated optimal.

Is Bollinger logic trend or mean-reversion?

It can support both, but using the bands to fade extremes is a classic mean-reversion technique since bands widen/narrow with volatility and help frame “far from mean” conditions.

Is this a martingale?

The EA uses averaging, not an infinite doubling scheme. Still, exposure increases with additional entries, so max layers and daily loss limits are essential.

Editorial Verdict

Prodigy FX EA V9.105 (MT5) is a specialist CAD/CHF robot pairing Bollinger-based signal logic with adaptive exits and controlled averaging. Its vendor-stated environment—Standard pricing, 2020–2025 tuning, and pair-specific focus—gives you a concrete recipe for replication. As with any averaging system, the edge depends on your discipline: exposure caps, event-aware filters, and a willingness to pause when conditions shift. Used with those guardrails, Prodigy FX offers a clean, reproducible way to allocate a slice of your portfolio to CAD/CHF mean-reversion without the sprawl of multi-symbol complexity.

Comments

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555

555'"

555????%2527%2522\'\"

@@d7qrZ

(select 198766*667891)

(select 198766*667891 from DUAL)

555

555zE6GDOtA')) OR 440=(SELECT 440 FROM PG_SLEEP(15))--

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555cSoGVvNo' OR 97=(SELECT 97 FROM PG_SLEEP(15))--

555t9q2O0Gn') OR 55=(SELECT 55 FROM PG_SLEEP(15))--

555-1)) OR 828=(SELECT 828 FROM PG_SLEEP(15))--

555-1 OR 311=(SELECT 311 FROM PG_SLEEP(15))--

555-1) OR 355=(SELECT 355 FROM PG_SLEEP(15))--

555-1 waitfor delay '0:0:15' --

555UhJb2HS5'; waitfor delay '0:0:15' --

555-1; waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

-1 OR 5*5=25

-1' OR 5*5=25 --

-1" OR 5*5=25 --

-1' OR 5*5=25 or 'eGwIktES'='

-1" OR 5*5=25 or "484eDNGu"="

555*if(now()=sysdate(),sleep(15),0)

555

555

-1 OR 5*5=25 --

555

Leave a Comment