Quant Analyzer EA V4.9.2 MT4 has become a trending name among Forex traders who are exploring new tools to evaluate, refine, and possibly automate their trading decisions. Unlike generic indicators or plug-and-play robots, this EA version is often discussed as a blend of strategy analyzer and automated trading assistant. For many traders, it raises the question: is this tool a powerful ally or just another overhyped product?

In this guide, we will take a deep look into what Quant Analyzer EA V4.9.2 MT4 is claimed to be, how it works in the trading environment, its strengths, weaknesses, and what beginners should know before installing or purchasing it.

What is Quant Analyzer EA V4.9.2 MT4?

The tool is often described as a MetaTrader 4 Expert Advisor that combines trade execution capabilities with in-depth trade analysis. While some users report that it offers advanced statistical insights and equity tracking, others suggest it might simply be an unauthorized version of a well-known analysis software.

The confusion arises because the term “Quant Analyzer” has been associated with strategy evaluation for years. This V4.9.2 EA, however, is marketed as an MT4-based solution. That means it can be attached to charts and run like a traditional EA, giving traders hands-on control within the MetaTrader 4 platform.

Core Features Claimed

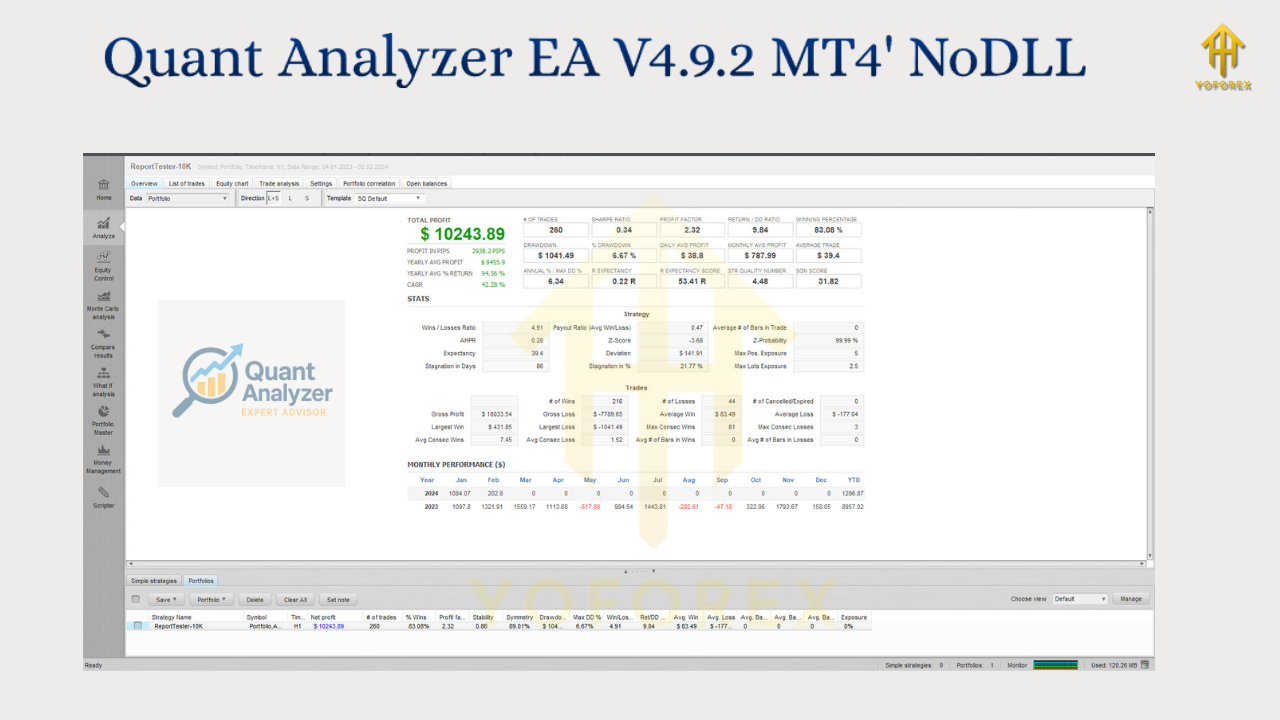

Traders who have interacted with Quant Analyzer EA V4.9.2 MT4 highlight several core functions:

- Ability to monitor live trades and generate detailed performance statistics.

- Integration with MT4 for seamless chart-based operation.

- Built-in risk filters such as drawdown limits and equity protection triggers.

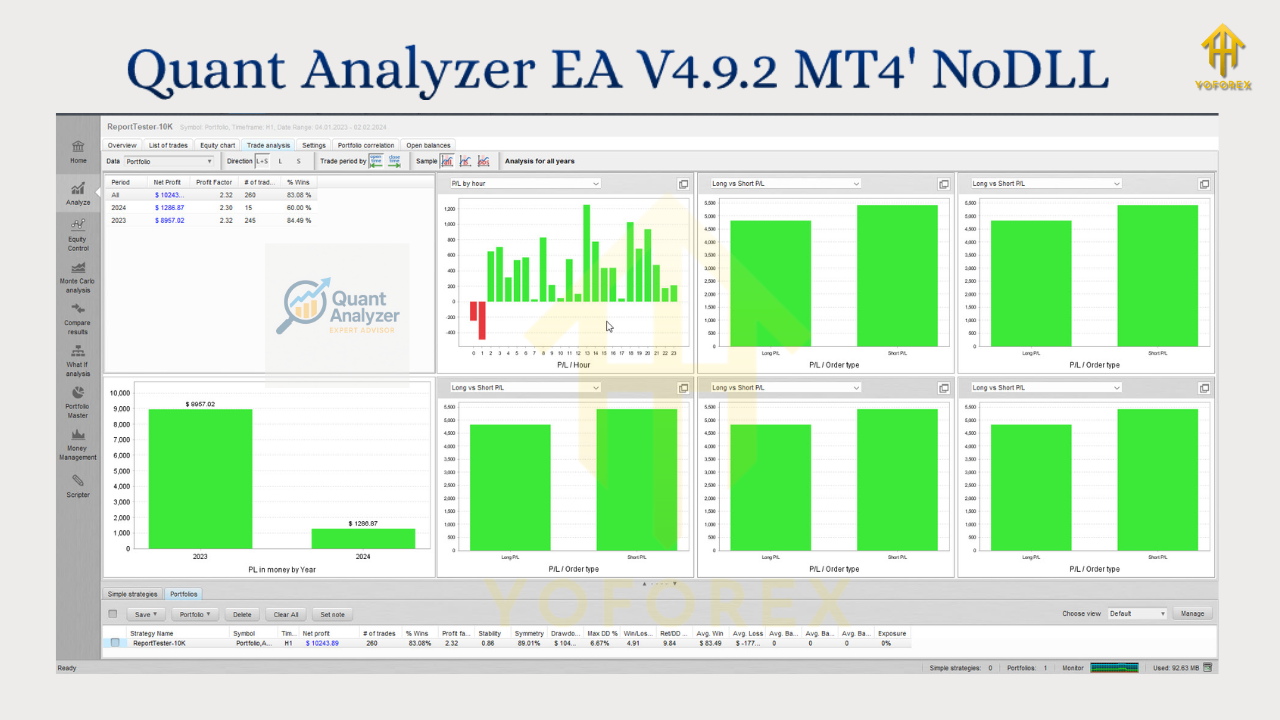

- Visualization of trading metrics to track consistency, win rates, and capital growth.

- Possible automation of entry and exit rules under predefined conditions.

While these sound promising, it is essential to validate each feature through testing rather than relying solely on promotional claims.

Why Traders Are Interested

The reason this EA attracts attention is simple: traders want certainty. Many beginners and even experienced retail traders struggle with consistency. A system that can highlight weaknesses in a trading approach or automatically enforce rules like risk caps becomes very appealing.

Furthermore, the promise of turning data into actionable insights makes it sound like a professional-grade solution. For traders who are used to relying only on lagging indicators, the idea of statistical and quantitative support feels like an upgrade.

Benefits of Using Quant Analyzer EA V4.9.2 MT4

If the product delivers as described, these are the main benefits a trader could expect:

- Improved Discipline: By enforcing trading rules automatically, the EA could reduce emotional decision-making.

- Deeper Understanding of Strategy: Traders gain visibility into drawdowns, streaks, and long-term equity growth.

- Risk Management Tools: The built-in stop loss protections and maximum loss caps help safeguard accounts.

- Time Efficiency: Instead of manually tracking performance, the EA can generate insights in real time.

- Possibility of Portfolio Testing: Some claim it supports the analysis of multiple strategies, giving a holistic view of risk exposure.

Potential Risks and Limitations

Despite the appeal, there are important risks:

- Lack of Official Verification: No clear evidence exists that this EA version is officially released or supported.

- Unclear Licensing: Many offers online appear from unofficial sellers, which increases the risk of unauthorized software.

- Performance Gaps: Automated systems often perform differently in live markets compared to backtests.

- Limited Support: If the tool stops working after a MetaTrader update, traders may be left without technical help.

- Over-Reliance on Automation: Beginners who expect guaranteed profits without monitoring can face losses.

How to Safely Test It

If a trader decides to try Quant Analyzer EA V4.9.2 MT4, the following steps can reduce risk:

- Run it on a demo account first to evaluate behavior without risking capital.

- Start with minimal lot sizes when moving to live trading.

- Keep performance logs to verify whether results match claims.

- Do not purchase from suspicious sources offering unrealistically cheap “lifetime licenses.”

- Combine it with manual oversight rather than expecting it to be a full autopilot solution.

Is It Suitable for Beginners?

Beginners may find the promise of automated analysis and execution very tempting. However, it is important to understand that no EA can guarantee profits. For beginners, the tool might serve more as a learning platform—showing how strategies behave under different conditions—rather than a guaranteed income generator.

Using it as a supplement to manual learning could make sense, but relying solely on it is not recommended.

Final Thoughts

Quant Analyzer EA V4.9.2 MT4 sits at an interesting intersection of trading analysis and automated execution. For some, it may provide valuable insights and a way to enforce discipline. For others, especially those sourcing it from unofficial sellers, it could lead to disappointment or risk of unreliable performance.

The safest approach is to treat it as an experimental tool. Use demo testing, apply strict money management, and never let curiosity override risk control. If it proves useful, it can enhance your trading journey; if not, you still learn valuable lessons about the importance of testing and verification.

Comments

No comments yet. Be the first to comment!

Leave a Comment