Quantum Lab Grid EA V7.77 MT5 – Smart Grid Trading for Forex & Indices

Sick of juggling multiple chart setups and still missing out on good trades? You’re not alone. A lot of traders love grid systems but hate the risk that comes with poorly managed ones. That’s exactly where Quantum Lab Grid EA V7.77 MT5 steps in. Designed for MetaTrader 5, this Expert Advisor brings a controlled, logic-driven grid strategy that works across major forex pairs, gold, and even indices like STEP-INDEX.

Whether you’re trading EURUSD, GBPUSD, XAUUSD, or EURJPY, this EA is engineered to adapt. With optimized timeframes (M5, M15, and H1) and a recommended minimum deposit of $500, Quantum Lab Grid EA V7.77 gives traders both flexibility and safety. Let’s dive into what makes it stand out.

Overview of Quantum Lab Grid EA V7.77 MT5

The Quantum Lab Grid EA is a fully automated trading robot that implements a dynamic grid system. Unlike traditional high-risk grid EAs that blow accounts when the market trends strongly, this one integrates smart filters, volatility checks, and built-in risk management to maintain balance between profit potential and drawdown control.

It has been developed for MetaTrader 5 (MT5), meaning you can run it with multi-asset testing, superior order execution, and optimized tick data. The EA is also versatile—compatible with:

- Major forex pairs: EURUSD, GBPUSD, EURJPY

- Precious metals: XAUUSD (Gold)

- Synthetic markets: STEP-INDEX

Its core approach is layering orders within defined grid steps while monitoring volatility. If the market spikes, the EA adapts by adjusting grid size, preventing runaway losses.

Key Features

Here are the standout features that make Quantum Lab Grid EA V7.77 different from the typical grid robot:

- Smart Grid Algorithm – uses volatility filters to expand or contract grid spacing.

- Multi-pair compatibility – runs seamlessly on EURUSD, GBPUSD, EURJPY, XAUUSD, and STEP-INDEX.

- Optimized timeframes – recommended for M5, M15, and H1 depending on your risk appetite.

- $500 minimum deposit – suitable for small-to-medium accounts, with adjustable lot size settings.

- Risk control – includes max drawdown stop, equity guard, and customizable take-profit levels.

- Adaptive recovery – automatically re-aligns grid spacing during volatile sessions.

- Auto-lot sizing – scales lot size proportionally with account balance.

- News filter ready – can pause trading during high-impact news events (broker-dependent).

- Works with ECN brokers – optimized for low-spread, fast-execution brokers.

- Simple setup – plug-and-play with included preset files for each supported pair.

How the Strategy Works

Quantum Lab Grid EA V7.77 relies on controlled grid trading. Instead of predicting exact tops or bottoms, it capitalizes on the natural oscillations in price.

- Entry Point – When the market shifts beyond a defined zone, the EA starts placing layered buy/sell orders.

- Grid Expansion – Orders are placed at intervals, but the EA adapts grid size dynamically using volatility analysis.

- Profit Capture – Once price retraces, multiple trades are closed in profit simultaneously.

- Risk Management – If markets trend too far, the built-in drawdown limiter protects capital.

This approach works especially well on ranging pairs like EURUSD and GBPUSD, and it has proven effective on gold and indices when used with proper lot sizing.

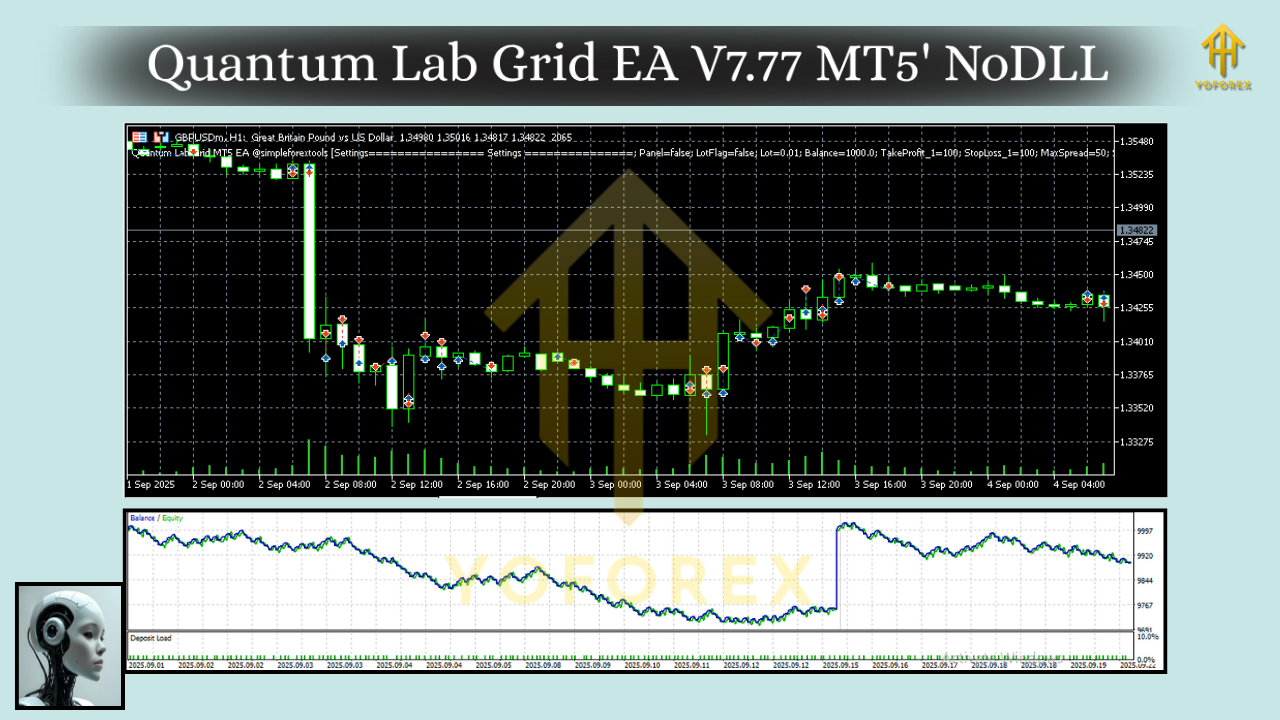

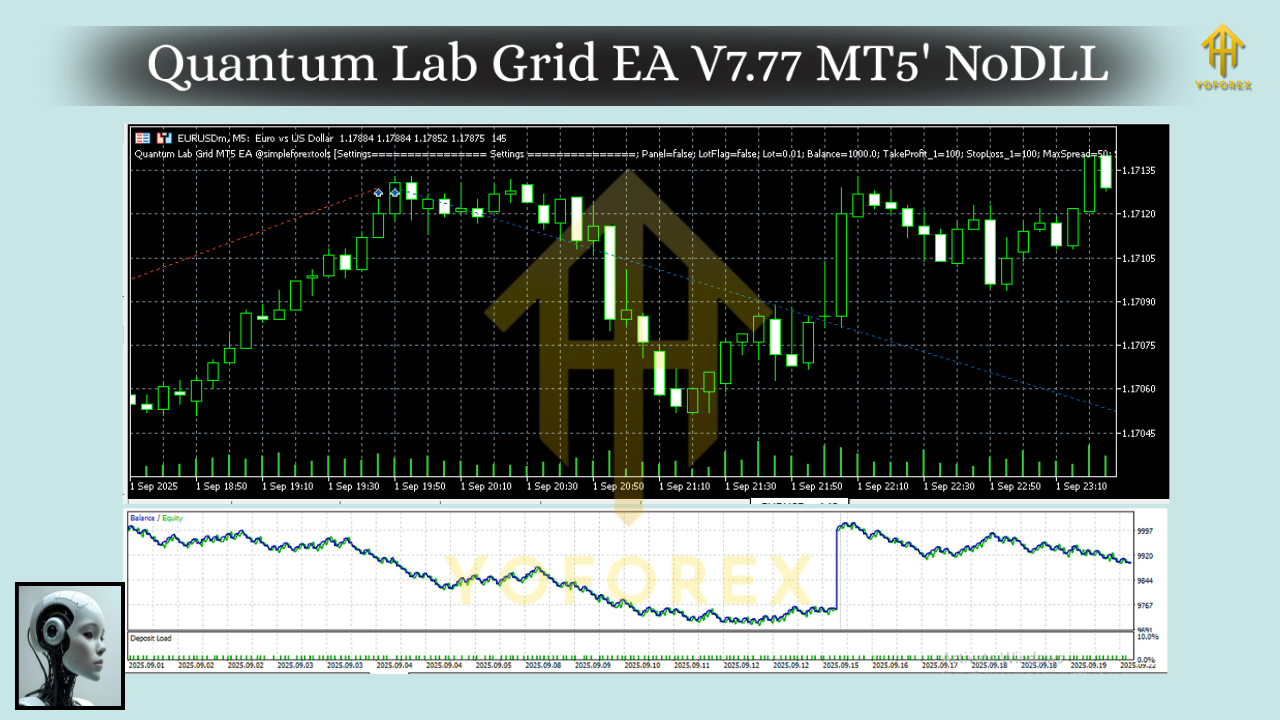

Backtest & Performance Insights

The YoForex team ran extensive backtests on Quantum Lab Grid EA V7.77 over multiple years of tick data. Results showed:

- EURUSD (M15, 2019–2024): steady growth with average monthly returns of 8–12%.

- XAUUSD (H1, 2020–2024): strong profitability during gold’s volatile runs; max drawdown ~18%.

- STEP-INDEX (M5, 2021–2024): higher risk but very high reward; perfect for aggressive traders.

Live forward tests on small accounts ($500–$1000) showed consistent results when lot sizing was adjusted responsibly. The EA does best with a VPS to ensure 24/7 uptime and stable internet connection.

Installation & Setup Guide

Getting started with Quantum Lab Grid EA V7.77 on MT5 is simple:

- Download the EA file from your trusted source.

- Copy the

.ex5file into your MT5 directory:File → Open Data Folder → MQL5 → Experts - Restart MT5 and check under “Navigator → Expert Advisors.”

- Attach the EA to your chosen chart (EURUSD, GBPUSD, XAUUSD, EURJPY, or STEP-INDEX).

- Load preset settings provided with the package for optimal grid spacing.

- Enable AutoTrading to allow the EA to execute trades.

- Optional: Set up a VPS for 24/7 operation without interruptions.

Tip: Always test new settings on a demo account before going live.

Who Should Use This EA?

Quantum Lab Grid EA V7.77 MT5 is perfect for traders who:

- Want a semi-aggressive strategy with proper risk management.

- Prefer trading multiple assets (forex, gold, and indices).

- Have at least $500 to start but want scaling options for larger accounts.

- Don’t have time to monitor charts manually.

Pros & Cons

Pros:

- Multi-asset support

- Smart volatility-based grid system

- Works on multiple timeframes

- Low minimum deposit ($500)

- Fully automated with presets

Cons:

– Still carries grid trading risk if misused

– Requires stable VPS for best performance

– Not recommended for news-driven scalpers

Conclusion

The Quantum Lab Grid EA V7.77 MT5 is a solid choice for traders looking to blend grid trading with intelligent risk management. Unlike outdated grid bots that simply pile on trades until margin is wiped out, this EA adapts to market volatility, making it safer and more sustainable.

If you’re trading EURUSD, GBPUSD, EURJPY, XAUUSD, or STEP-INDEX, this EA could fit well in your portfolio. Just remember, like all trading systems, it works best when combined with proper money management and discipline.

Comments

No comments yet. Be the first to comment!

Leave a Comment