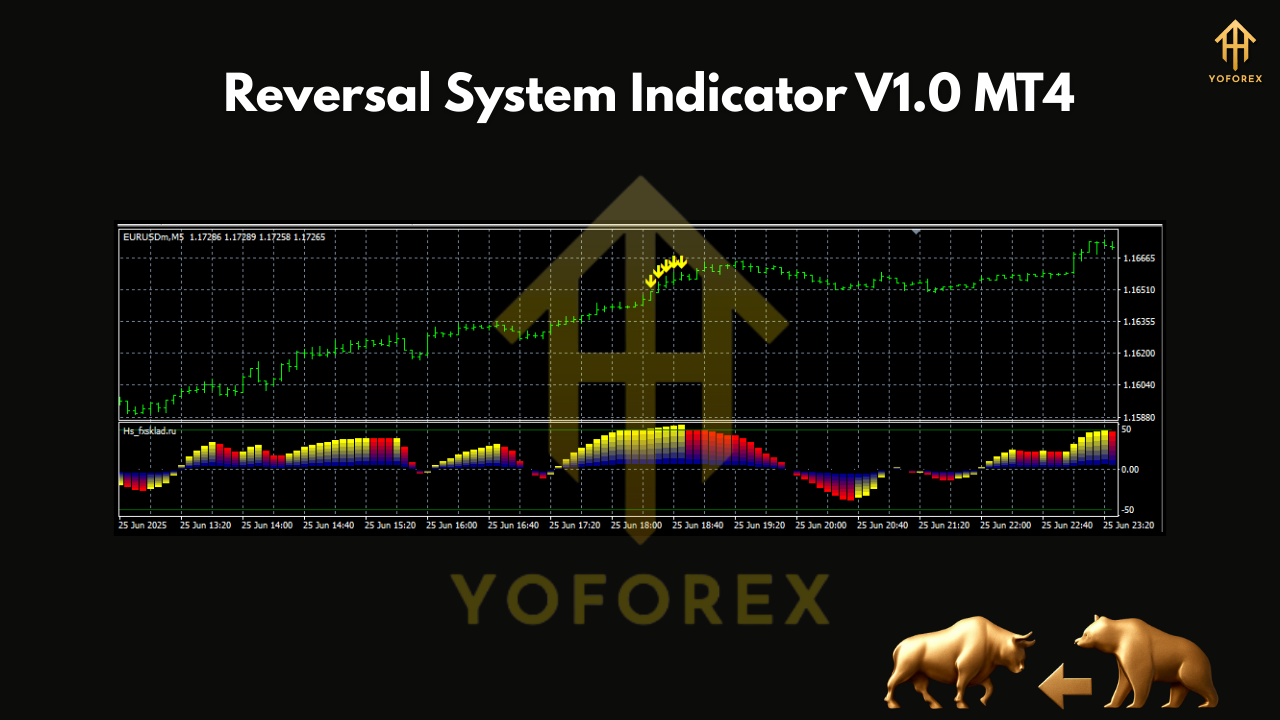

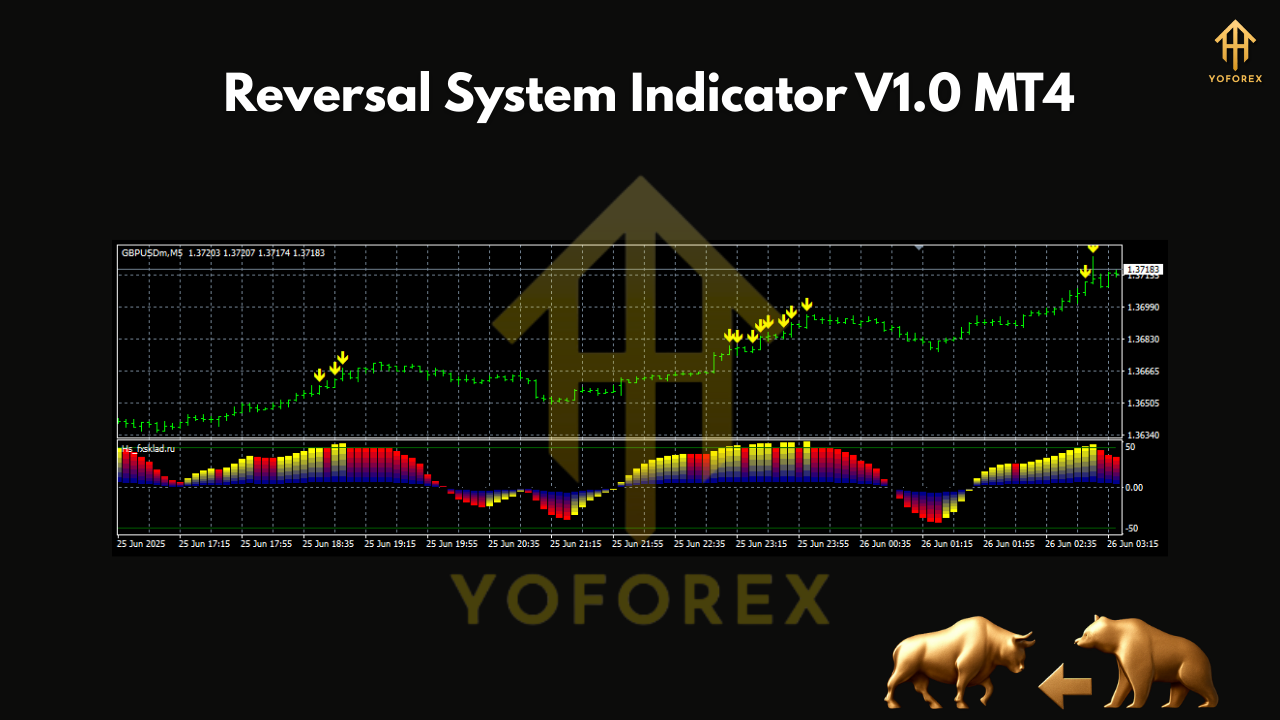

Reversal System Indicator V1.0 MT4 — Catch Trend Turns With Confidence

Sick of chasing moves only to enter right before price snaps back? Yeah, that feeling’s universal. The Reversal System Indicator V1.0 MT4 is built to help you spot cleaner turning points before momentum shifts become obvious to everyone else. It doesn’t promise magic (nothing does), but it does give you a structured, visual way to identify exhaustion, hidden divergences, and key supply/demand turns—minus the clutter. If you’ve been waiting for a practical reversal tool you can actually read at a glance, this one fits like a glove. Use it as your primary signal or as a confirmation layer to your existing strategy; either way, you’ll likely find your entries tighter and your stops more deliberate.

What Is the Reversal System Indicator?

This is an MT4 indicator designed to highlight probable trend reversals and exhaustion zones using a blend of market structure cues and momentum/volatility context. In plain English: it looks for when a move is running out of steam, then paints clean, unambiguous visual prompts so you can plan a high-probability setup—not guess.

Rather than slapping arrows all over your chart, it’s intentionally selective. You’ll see reversal markers near swing highs/lows, pressure zones where buying or selling is stretched, and optional confirmation filters to avoid signals fighting the higher-timeframe trend. Traders who love confluence will appreciate how naturally it pairs with EMAs, ATR-based stops, or supply/demand boxes.

Key Features

- Clean reversal markers: Highlights likely turning points at/near swing extremes.

- Momentum + structure blend: Considers both impulse/exhaustion and recent HH/HL or LL/LH patterns.

- Adaptive sensitivity: Dial signals tighter for scalping or looser for swing confirmation.

- HTF bias filter (optional): Aligns signals with your chosen higher timeframe trend to cut counter-trend noise.

- Multi-asset friendly: Works on majors, crosses, gold (XAUUSD), and index CFDs.

- Timeframe-agnostic: Readable on M5 for fast entries or H4 for bigger swings.

- Visual clarity: Minimalist design—you won’t fight your chart to interpret it.

- Alerts ready: Configure pop-ups/alerts so you don’t need to stare at screens all day.

- Risk-aware by design: Encourages ATR or structure-based stops, not blind fixed pips.

- Backtest-friendly: Easy to evaluate with MT4’s visual mode (bar-by-bar) for your pair/timeframe.

Best Markets & Timeframes

You can run the indicator on anything with decent liquidity, but it truly shines where trends are clean and pullbacks are orderly.

- Pairs: EURUSD, GBPUSD, USDJPY, AUDUSD, USDCAD, USDCHF, EURJPY, plus XAUUSD for gold lovers.

- Timeframes:

- M5–M15: For scalpers who want more opportunities (expect more signals; use a stricter filter).

- M30–H1: Intra-day traders’ sweet spot—balanced signals with manageable noise.

- H4: Swing traders who prefer fewer but weightier signals.

Tip: If you’re just starting, begin with M15–H1 on EURUSD/GBPUSD to learn how the signals evolve, then branch out.

How to Install & Set Up (MT4)

- Download the indicator file.

- In MT4, go to File → Open Data Folder.

- Navigate to MQL4 → Indicators and paste the

.ex4/.mq4file. - Restart MT4 (or right-click Indicators → Refresh in the Navigator).

- Drag Reversal System Indicator V1.0 onto your chart.

- In the Inputs tab, tweak:

- Signal Sensitivity: Higher = more signals (good for scalping), lower = more selective.

- HTF Filter: Choose the higher timeframe that defines your bias (e.g., H1 when trading M15).

- Alert Options: Enable pop-ups/sounds if you want notifications.

Suggested Settings (Start Here)

- M15 Intra-day (EURUSD/GBPUSD):

- Sensitivity: Medium

- HTF Filter: H1 trend alignment ON

- ATR Multiple for SL (manual): 1.5–2.0× ATR(14)

- TP: 1.5–2.5R or prior structure

- M5 Scalping (XAUUSD):

- Sensitivity: High

- HTF Filter: M15

- Spread filter: Prefer low-spread sessions (London/NY overlap)

- Reduce risk per trade (gold can spike)

- H4 Swing (Majors):

- Sensitivity: Low

- HTF Filter: Daily

- SL: Below/above last swing + ATR buffer

- TP: Trail behind structure or partials at 2R/3R

These aren’t rigid rules—just solid starting points. Forward-test on demo till it clicks.

Entry, Stop, and Target Logic (A Simple Plan)

- Entry: When a reversal marker appears and price confirms with a structure break (e.g., break of minor swing or a strong rejection candle), consider entering on the next candle open.

- Stop Loss: Place stops beyond the invalidation point—below a higher low for longs / above a lower high for shorts—or use ATR(14) × 1.5–2.0 as a dynamic cushion.

- Take Profit:

- Conservative: 1.5–2R

- Structure-based: Prior swing high/low or liquidity pool

- Advanced: Partial at 1.5–2R, trail with swing lows/highs or a multiple of ATR.

Remember: position sizing matters more than any indicator. Keep risk per trade sensible (typically 0.5–1.5%).

Workflow Tips (What Pros Do)

- Top-down confluence: Check H4 → H1 → M15 to ensure your entry aligns with a bigger picture.

- Session timing: London open and NY overlap often give higher-quality reversals.

- News filter: Step aside during major data releases (NFP, CPI, rate decisions), especially on gold.

- Journal everything: Save screenshots of entries, exits, and thoughts. Your edge compounds when you learn from your own data.

- One change at a time: When optimizing, tweak only one parameter per week so you know what actually helped.

Backtesting & Forward Testing

While MT4 can’t “Strategy Test” indicators the same way as EAs, you can use visual mode or manual bar-replay (scroll/press F12) to walk through months of data. Track:

- Number of signals

- Win/loss distribution

- Average R multiple per trade

- Drawdown during clusters of losing trades

Then forward-test on a demo for 2–4 weeks to confirm the behavior matches your expectations. If you’re satisfied, move to a small live risk.

Who Will Love This Indicator?

- Newer traders who need objective reversal prompts instead of second-guessing.

- Intermediate traders who want a light, visual layer to confirm supply/demand or SMC concepts.

- Swing traders aiming for cleaner turns with lower chart noise.

- Scalpers who need frequent (but filterable) signals on M5/M15.

Risk & Money Management (Non-Negotiable)

Even the best signals have losing streaks. That’s normal. Keep risk per trade small (0.5–1.5%), avoid stacking correlated positions, and pause after 3 consecutive losses to reassess. With a $1000 starting deposit, the goal is longevity and compounding—steady progress beats forcing trades, always.

Final Thoughts

The Reversal System Indicator V1.0 MT4 strips out guesswork and gives you clean, actionable prompts where reversals are most likely brewing. Keep it simple: pick one or two pairs, one timeframe, and execute a consistent plan for several weeks. Refine as you log results. Do that and you’ll naturally build the discipline and data you need to trade with confidence—no hype, no clutter, just structure and clarity.

Comments

No comments yet. Be the first to comment!

Leave a Comment