Sliding Blocks EA V1.0 MT4 – A Powerful Auto-Lot Expert Advisor for Medium to High ATR Instruments

Forex trading continues to evolve with advanced Expert Advisors (EAs) that bring automation, precision, and discipline to traders of all levels. Among these is the newly released Sliding Blocks EA V1.0 MT4, a robust algorithmic trading solution built for traders who demand structured execution and risk management. Designed for MetaTrader 4, this EA is ideal for trading instruments with medium to high Average True Range (ATR) values such as EURUSD, GBPUSD, and XAUUSD.

If you’re working with a larger capital base and want a trading system that adapts lot sizes automatically while focusing on trending momentum, Sliding Blocks EA might be your next top-performing forex tool.

What is Sliding Blocks EA V1.0 MT4?

Sliding Blocks EA is an automated trading bot for MetaTrader 4 that excels in volatility-based trading environments. It’s engineered to handle high-ATR instruments using a dynamic approach where positions are calculated with precision using auto-lot algorithms. This means as your account equity increases or decreases, your position sizing is adjusted accordingly—preserving capital during drawdowns and maximizing opportunities during trending phases.

Unlike typical scalpers or martingale systems, Sliding Blocks EA follows a momentum and block-entry logic. It seeks price blocks or zones where trend continuation is statistically likely. The EA places trades around these "blocks" and monitors them with a trailing mechanism for optimal exits.

Technical Specifications

To run Sliding Blocks EA efficiently, traders need to consider the following:

- Recommended Symbols: Use on high-ATR pairs such as EURUSD, GBPUSD, XAUUSD, or other volatile instruments with reliable price movement.

- Timeframes: Optimized for M15, M30, and H1. These timeframes offer a balance of trade frequency and signal accuracy.

- Minimum Deposit: A starting capital of $10,000 is advised, especially when auto-lot feature is enabled.

- VPS Hosting: A 24/5 VPS setup is strongly recommended to ensure the EA runs continuously without interruption.

Sliding Blocks EA thrives in markets that trend smoothly or exhibit range expansion behavior. This makes it highly effective in post-news movements or during sessions with elevated liquidity.

Key Features of Sliding Blocks EA

1. Auto-Lot Sizing:

One of the standout features of this EA is its automatic lot size calculation. Instead of relying on fixed lots, Sliding Blocks EA scales positions based on account equity and user-defined risk percentage. This makes it suitable for portfolio managers, prop traders, or investors with sizeable capital.

2. Block-Based Entry Logic:

The EA identifies "sliding blocks" or consolidation zones with breakout potential. Once price exits these zones, the EA confirms trend direction and enters trades accordingly. This block approach reduces false signals and enhances trend-following precision.

3. Multi-Timeframe Compatibility:

Sliding Blocks EA works across M15 to H1 timeframes, allowing traders to test various strategies across different levels of market structure. It’s especially effective on M30 charts for instruments like gold and GBP pairs.

4. Safe Exit Strategy:

Built-in trailing stop-loss and break-even mechanisms protect profits while reducing drawdowns. The EA doesn’t just enter blindly—it manages exits intelligently.

5. Non-Martingale Strategy:

Sliding Blocks EA avoids the use of martingale or grid systems, which are inherently risky. Each trade is independent, and lot size growth is proportionate, not exponential.

6. Broker Compatibility:

Compatible with most MT4 brokers that allow expert advisors, provided fast execution and tight spreads are available. ECN brokers are preferred for gold or GBPUSD setups.

How Sliding Blocks EA Works

Once installed, the EA continuously scans for price consolidation zones (blocks) with a defined range. These zones often precede strong directional movement. Once the price breaks out of a block with confirmation from volatility filters, the EA initiates a trade in the direction of the move.

The trailing mechanism kicks in as price moves in favor. Stops are adjusted based on real-time ATR shifts and market volatility. This creates a “sliding” effect, where the trade rides the trend until exhaustion.

The system is designed to execute only during high-liquidity hours, avoiding unnecessary exposure during sideways or illiquid markets.

Installation and Setup

Step 1: Place the .ex4 file in the Experts folder of your MT4 installation.

Step 2: Restart the MT4 terminal.

Step 3: Open a chart of your chosen high-ATR instrument (e.g., XAUUSD) on a recommended timeframe.

Step 4: Drag and drop the EA onto the chart and adjust the inputs (risk %, max lot size, time filter, TP/SL parameters).

Step 5: Enable AutoTrading.

A quick demo test on your preferred broker is advised before running it live. You may optimize settings using MT4’s Strategy Tester to identify the best-performing pairs and timeframes.

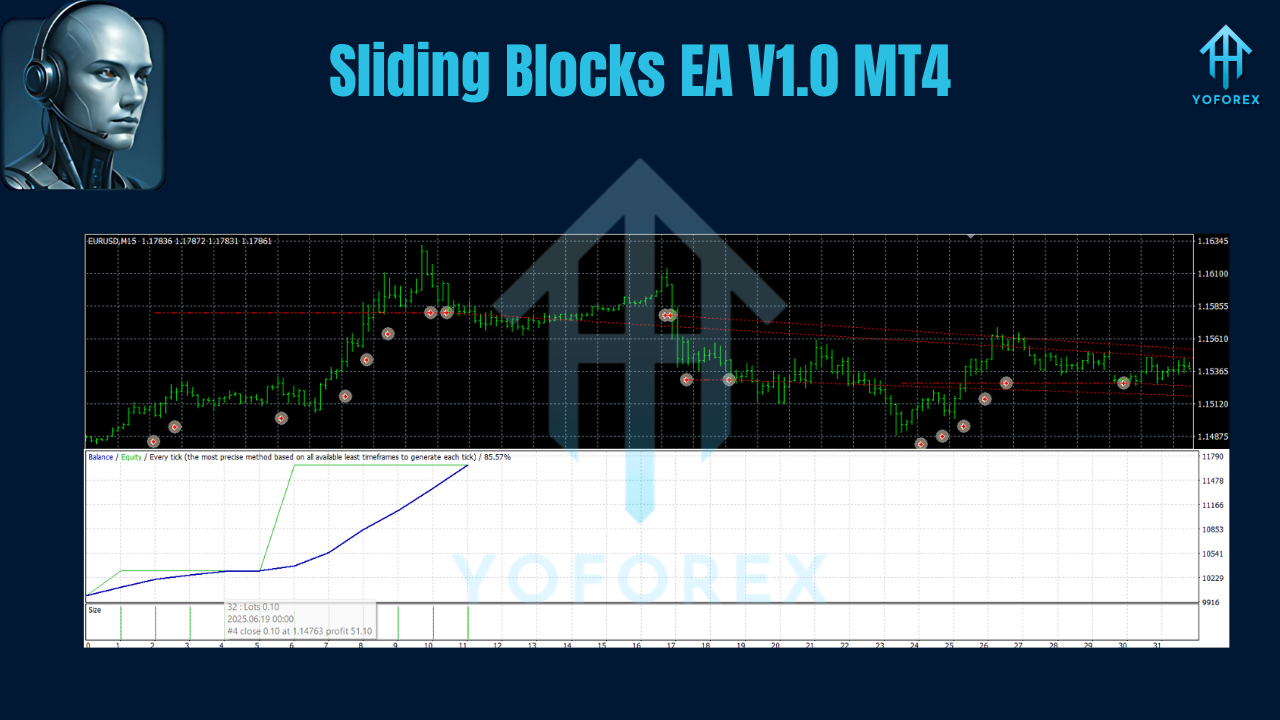

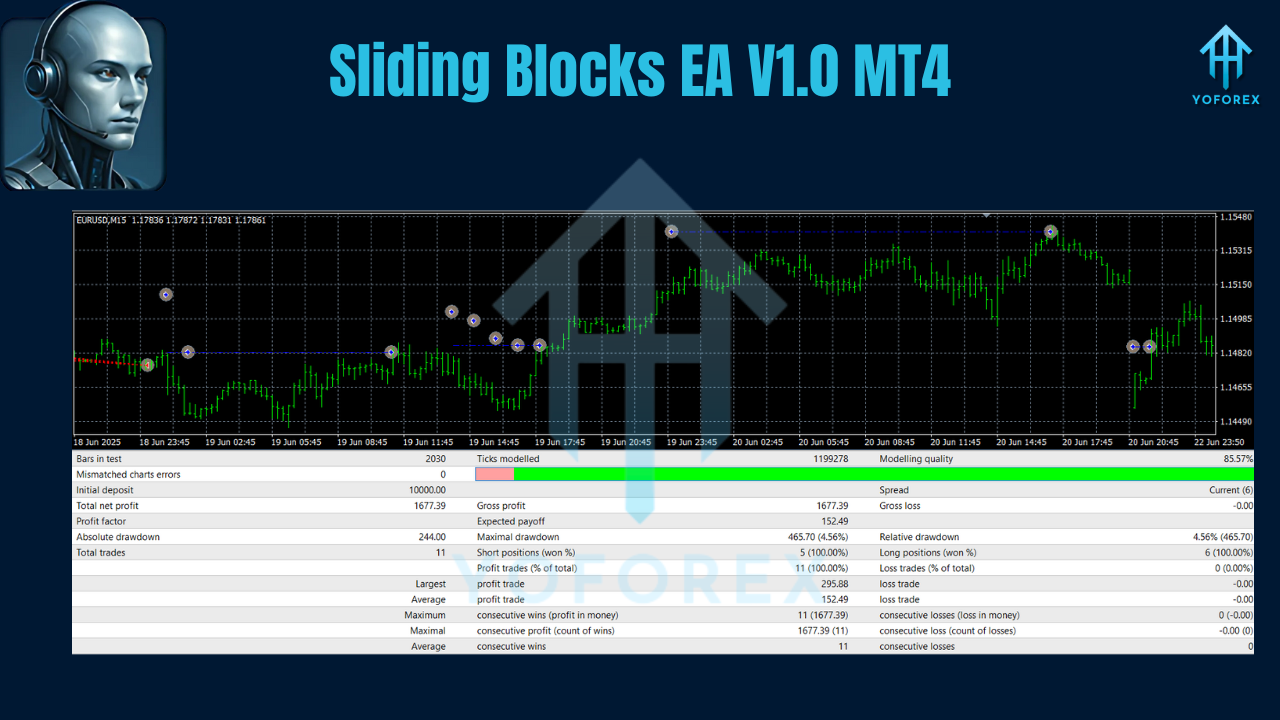

Performance Insights

Preliminary backtests and forward testing with capital exceeding $10,000 have shown monthly returns ranging between 8% and 18%, depending on the instrument and session hours. The system performs best during London and New York sessions due to higher volatility.

The drawdown remains moderate (below 20%) when running on pairs like EURUSD and XAUUSD with 1:100 leverage. Risk settings can be fine-tuned, but the EA is inherently built to protect capital rather than chase unrealistic gains.

With a reliable VPS and proper capital management, Sliding Blocks EA can become a cornerstone of a long-term forex portfolio.

Who Is Sliding Blocks EA For?

This EA is not for traders looking to flip $100 into $1000 in a week. Instead, it is ideal for:

- Professional traders managing larger portfolios

- Prop firm traders seeking consistent auto-lot performance

- Institutional users deploying automated strategies across multiple accounts

- Serious retail traders who value long-term growth over gambling

If you have access to $10,000+ in capital, want a low-maintenance solution, and are ready to host it on a dedicated VPS, Sliding Blocks EA can deliver both performance and peace of mind.

Best Practices for Optimal Use

- Use a VPS to ensure the EA runs uninterrupted during trading hours.

- Avoid interfering manually with open trades unless necessary.

- Trade only high-ATR instruments like gold, GBPUSD, EURUSD.

- Test different timeframes like M15 and M30 to find the sweet spot.

- Withdraw monthly profits and avoid increasing risk percentage too fast.

- Stick to ECN brokers for tight spreads and accurate execution.

Final Verdict

Sliding Blocks EA V1.0 MT4 is a high-level trading tool for serious forex investors. It blends trend logic, volatility signals, and dynamic lot sizing into one powerful EA. While it requires a higher capital threshold than typical bots, the performance and reliability make it a worthwhile investment for those looking to trade smart—not aggressively.

If you’re ready to automate your trades using real data, institutional-level logic, and robust risk management, Sliding Blocks EA may be the edge you need in today’s volatile forex markets.

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment