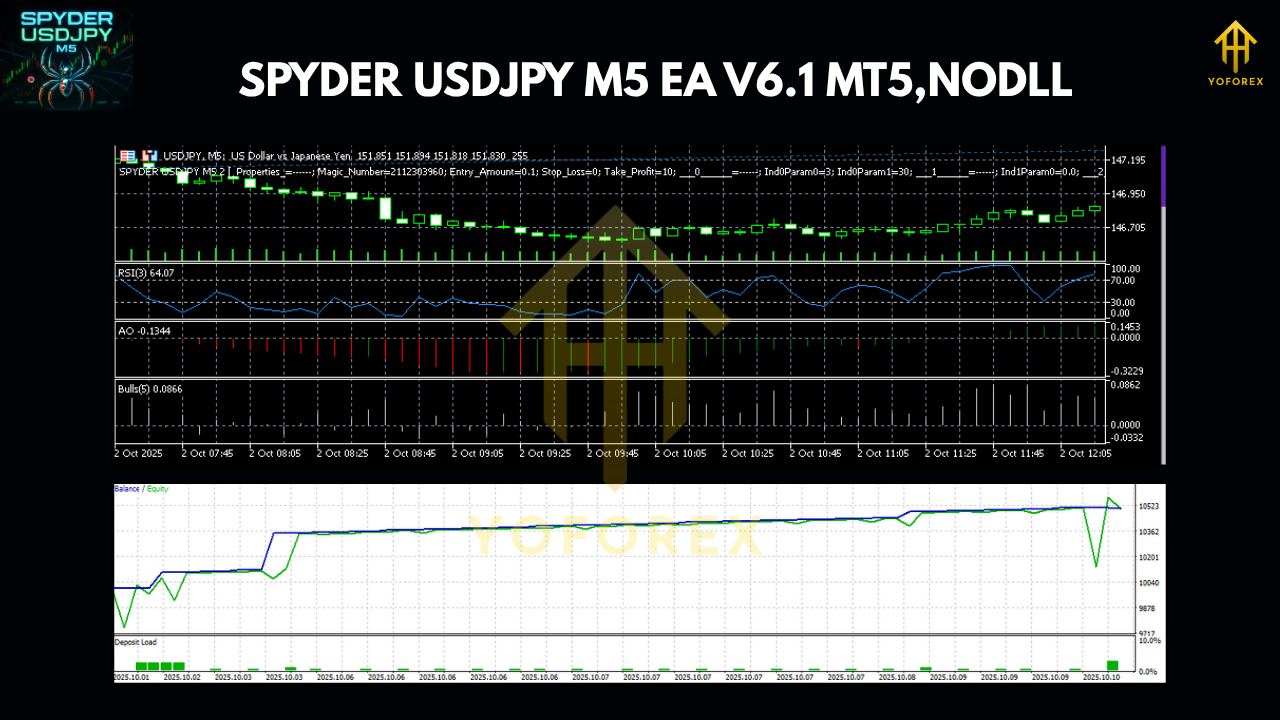

SPYDER USDJPY M5 EA V6.1 MT5 — Precision Scalping on a Fast Chart

Pair Focus: USDJPY, GBPJPY

Timeframe: M5 (5-minute)

If you’re after clean, quick entries on USDJPY and GBPJPY without babysitting every candle, the SPYDER USDJPY M5 EA V6.1 for MT5 is built for you. It specializes in 5-minute execution, where timing, spreads, and execution quality decide whether you stack pips or bleed them. By locking onto market micro-structure, this EA scans for high-probability setups, executes them automatically, and manages risk consistently—so you don’t have to hover over the screen all day. Whether you’re new to automation or already running a portfolio of robots, SPYDER helps you keep your trading plan tight, disciplined, and scalable.

Why the SPYDER EA Exists (and where it fits)

Scalping on M5 can be a grind. Fast markets, sudden wicks, news spikes… and the “should I take it or skip it?” dilemma every other minute. SPYDER EA V6.1 removes that second-guessing by turning a rules-based blueprint into consistent, automated action. It looks for momentum confirmation, volatility alignment, and clean entries—especially during liquid sessions—so your plan is executed with the same discipline at 9:15 as it is at 14:30.

What makes it stand out isn’t just entries. It’s the combination of smart filtering (to avoid low-quality conditions), position sizing (to keep risk sane), and exit logic (partials, trailing, and time-based exits when volatility dries up). The end result: fewer random trades, more structured ones.

Core Features You’ll Actually Use

- Tuned for M5: Built specifically for the 5-minute chart where spreads matter and timing is everything.

- Currency Pair Focus: Optimized for USDJPY (primary) and GBPJPY (secondary) so the logic stays sharp, not generic.

- Momentum + Pullback Logic: Looks for continuation setups with shallow pullbacks instead of chasing extended moves.

- Session Awareness: Option to trade only during specific market sessions (e.g., Tokyo/London overlap) to reduce dead hours.

- Spread & Slippage Filters: Auto-skip trades when spreads widen or execution quality drops.

- Dynamic Stop & Take-Profit: ATR-informed stops with adaptive take-profit or trailing to capture runner moves.

- News Pause (optional): Ability to stand down before/after key events on JPY/USD to avoid whipsaws.

- Capital Protection: Daily loss limit and max open positions safeguards built-in.

- Risk by Percent: Position sizing by account % risk per trade for consistent exposure.

- Partial Close + Breakeven: Take some off near the first target, move stop to breakeven, let the rest ride.

- Dashboard & Alerts: Clean on-chart status, with alerts when conditions align or when trading suspends due to filters.

- No Martingale, No Grid: Straightforward, transparent risk—no dangerous lot multipliers.

How It Trades on M5

1) Market Scan

On each new candle, SPYDER checks momentum direction, recent volatility, and micro-structure (higher-highs/higher-lows or the opposite). It also checks your enabled filters: session window, max spread, max slippage.

2) Entry Confirmation

Entries trigger on impulse + pullback confirmation (think: small retrace into a dynamic zone), not on blind breakouts. This reduces slippage and false moves, especially on JPY pairs.

3) Risk Setup

Stops are placed just beyond recent structure or ATR levels. Take-profit is staged—TP1 for partials, TP2/runner guided by a trailing mechanism when momentum continues.

4) Management & Exit

If price reaches TP1, partial close executes and stop is moved to breakeven. If momentum fades or the session ends, the EA can time-exit to avoid overnight drift.

Recommended Settings (a sensible starting point)

- Timeframe: M5

- Pairs: USDJPY (primary), GBPJPY (secondary)

- Risk Per Trade: 0.5%–1.0% (scalping; keep it conservative)

- Max Concurrent Trades: 1–2 per pair

- Daily Loss Limit: 2% (EA stops trading for the day if hit)

- Session Window: Tokyo open through pre-NY (adjust to your broker time; avoid very illiquid hours)

- Spread Filter: Enable; skip trades if spread > 1.5–2.0 pips equivalent on JPY pairs (broker-dependent)

- Slippage Control: Enable; useful during news spikes

- News Pause: Enable around high-impact USD/JPY events if your broker supports consistent execution

Tip: Start with USDJPY only for the first 2–3 weeks. Add GBPJPY once you’re comfortable and your VPS/execution is stable.

Installation & Setup (MT5)

- Copy Files: Place the EA file into

MQL5/Experts/in your MT5 data folder. - Restart MT5: So the platform loads the new EA.

- Attach to Chart: Open USDJPY M5, drag the EA onto the chart, and tick Allow Algo Trading.

- Inputs & Risk: Set risk per trade, session filters, spread limit, and news options.

- Algo Button: Make sure the global Algo Trading button is green.

- Run on VPS: For best uptime and low latency, host MT5 on a reliable VPS close to your broker.

Risk Management Philosophy (the part that keeps you in the game)

Scalping can tempt you to crank risk. Don’t. The EA’s edge compounds when risk is small and consistent. Keep daily limits tight, accept that some sessions will be flat, and let the runners pay for the day. If you bump into consecutive losses (it happens), the daily stop will preserve mental capital. That discipline is where most traders slip—let the rules save you from yourself.

Avoid common pitfalls:

- Don’t disable filters “just for today” because the chart looks juicy.

- Don’t increase lot size after a loss streak to “win it back.”

- Don’t run during extremely illiquid hours. The edge lives in liquidity.

Who Benefits Most

- Intraday scalpers who want rule-driven discipline without staring at Level 2 all day.

- Busy traders who can’t watch every 5-minute candle but still want consistent, short-term exposure.

- Portfolio EA users adding an M5 JPY component to diversify timeframes/strategies.

- Prop-firm aspirants aiming for stable daily behavior with strict risk caps (always check your firm’s rules).

Backtesting & Forward Expectations (read this before you judge results)

When you backtest on M5, tick data quality matters a lot. Use high-quality tick data with variable spreads and include realistic slippage. Expect performance differences across brokers and months—JPY pairs can switch gear during macro cycles. Good tests typically show:

- Higher trade frequency during liquid sessions;

- Modest average R with occasional extended runners;

- Drawdown containment thanks to partials + daily loss limits;

- Edge concentration around impulse-pullback structures, especially during Tokyo/London overlap.

Forward demo for 2–3 weeks before going live. It’s the fastest way to align the EA’s assumptions with your broker’s reality (spreads, execution, swaps).

Simple Operating Plan (so you don’t overcomplicate it)

- Run on USDJPY M5 with conservative risk.

- Enable filters (spread, session, slippage, news).

- Let it execute—don’t second-guess mid-trade.

- Review weekly: If spread/latency is hurting, switch server, broker, or VPS.

- Scale slowly: Add GBPJPY once you’re satisfied with stability.

FAQs

Q: Can I run it on other pairs?

A: The logic is built around USDJPY/GBPJPY behavior. Use at your own risk on other pairs and validate thoroughly.

Q: Does it use martingale or grids?

A: No. Straight entries with fixed risk and intelligent exits.

Q: What leverage should I use?

A: 1:100 or 1:200 is usually sufficient for M5 scalping with small risk per trade. Always prioritize risk control over leverage.

Q: VPS necessary?

A: Strongly recommended. Lower latency = better fills and fewer skipped signals due to spread/filter checks.

Final Word

SPYDER USDJPY M5 EA V6.1 is not a magic wand, but it is a disciplined executor. It filters, it times entries, it manages risk, and it respects your guardrails. If you’re serious about M5 scalping on USDJPY (and later GBPJPY), this kind of structure is what keeps you consistent long enough to let edge compound. Start small, keep your filters tight, and let the plan run. That’s how you build repeatable results—day after day.

Comments

No comments yet. Be the first to comment!

Leave a Comment