SuperTrend Indicator V1.0 MT4 — Complete Guide (Pairs, Timeframes, Settings & Pro Tips)

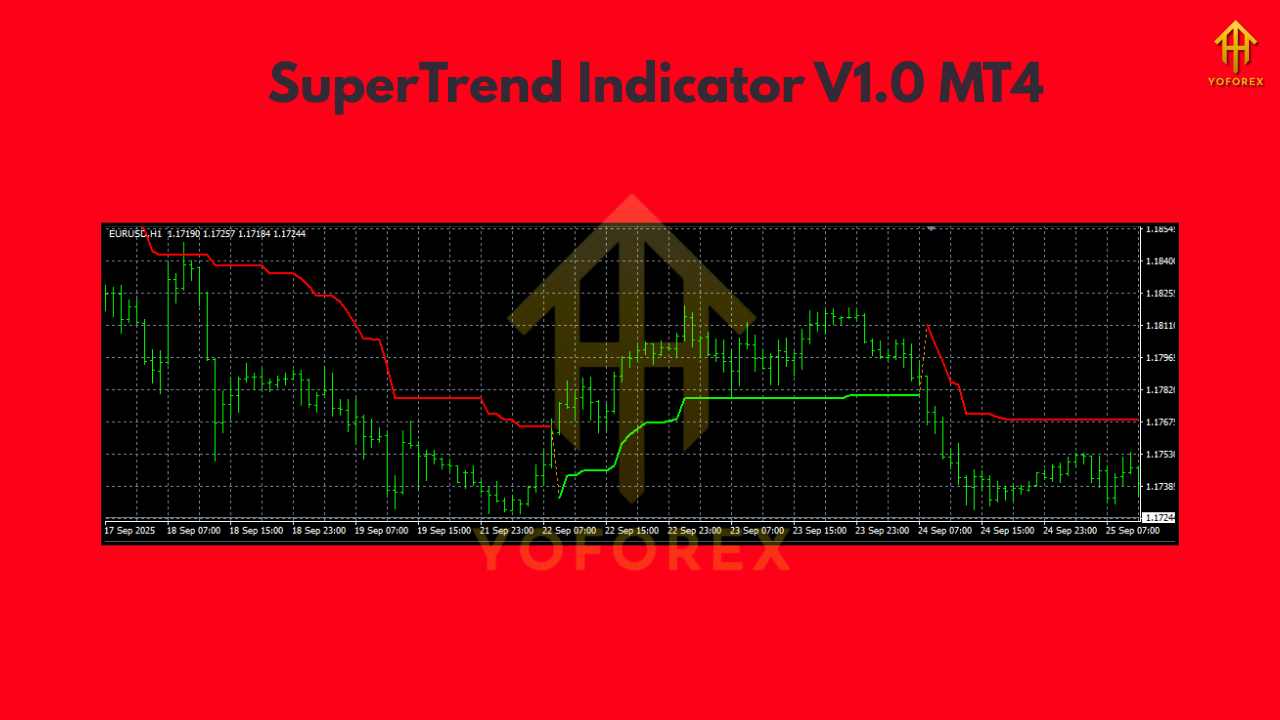

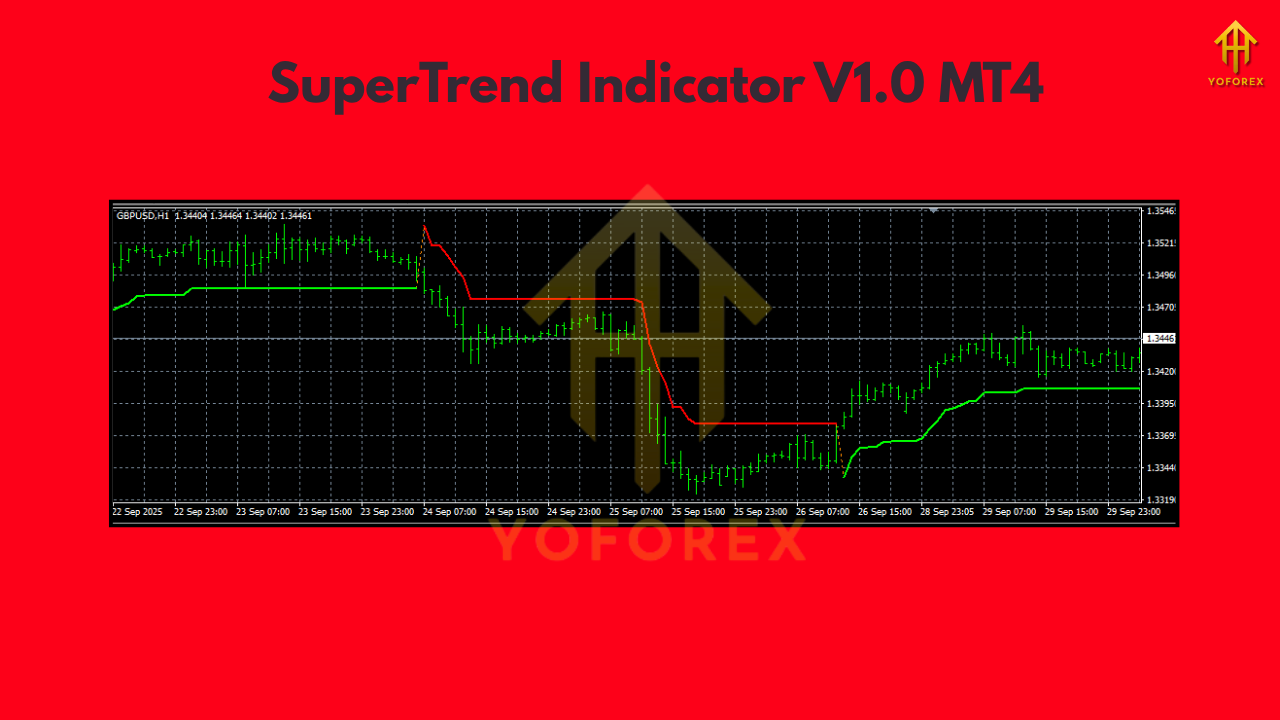

Pair: Works on all FX majors (EURUSD, GBPUSD, USDJPY), minors, XAUUSD (Gold), indices (US30, NAS100), and crypto CFDs (where your broker allows).

Timeframe: Any from M1 to D1. Best balance of noise vs. signal on M15, M30, and H1.

Tired of second-guessing entries, exits, and trend direction every few candles? The SuperTrend Indicator V1.0 MT4 is a clean, rule-based overlay that simplifies decision-making. It plots a dynamic line—green for bullish, red for bearish—built from ATR-based volatility logic. When price crosses and closes beyond that line, your bias flips… no drama, no guesswork.

This guide breaks down how SuperTrend works, optimal pairs and timeframes, practical settings, and step-by-step trade plans you can run right away. I’ll also cover risk management, filtering tricks, and a few “don’t do this” pitfalls that catch new users. Whether you scalp on M5 or swing trade on H4, this indicator slots nicely into your workflow, helping you stay on the right side of momentum and reduce whipsaw. Let’s dig in.

What Is SuperTrend (and Why Traders Love It)

At its core, SuperTrend is a volatility-adaptive trend filter. It uses the Average True Range (ATR) to keep its distance from price during choppy phases and tighten up during directional moves. That’s the big edge: it adapts. Unlike static moving averages, this line shifts with current volatility, so your signals feel more “alive” to the market.

How it displays:

- Green line below price → uptrend bias

- Red line above price → downtrend bias

- Flip occurs when price closes beyond the line by a volatility-adjusted margin

Quick wins you’ll notice:

- A cleaner directional read at a glance

- Objective entries on flips or pullbacks to the line

- Built-in discipline: if the line hasn’t flipped, you don’t force trades

Best Pairs & Timeframes (With Rationale)

Pairs: SuperTrend works across the board, but it shines on instruments that actually trend. That means EURUSD, GBPUSD, USDJPY, XAUUSD, and trend-heavy indices like US30 / NAS100. For range-bound crosses, you’ll still get use—but you may want extra filters (RSI/MACD) to avoid chop.

Timeframes:

- Intraday scalping: M5–M15 (more signals, more noise)

- Intraday swing: M30–H1 (solid balance; recommended for most)

- Position trading: H4–D1 (fewer yet stronger signals)

If you’re starting out, stick with M15 or H1 on majors or gold. It’s the sweet spot for many traders.

Core Settings (And What They Actually Do)

Most MT4 variations of SuperTrend expose two primary inputs:

- ATR Period (default often 10): The lookback used to measure volatility.

- Lower = faster, more signals, more flips

- Higher = slower, fewer flips, steadier trend lines

- ATR Multiplier (default often 3.0): How far the line sits from price.

- Lower (e.g., 2.0–2.5) = earlier entries, higher false flips

- Higher (e.g., 3.0–3.5) = later entries, fewer false flips

Recommended starting points:

- M15/M30 Forex majors: ATR 10, Multiplier 3.0

- H1 XAUUSD (Gold): ATR 10–14, Multiplier 3.0–3.5

- US30/NAS100: Start with ATR 10–14, Multiplier 3.5 (indices can be jumpy)

Pro tip: if your broker’s spreads are wide or you’re on a volatile session, bump the multiplier slightly to avoid noise.

How To Trade With SuperTrend (Three Practical Playbooks)

1) The Flip-and-Go (Breakout Entry)

- Signal: Candle closes beyond the SuperTrend line and the line flips color.

- Entry: Enter at the next candle open in the new trend direction.

- Stop-loss: A few pips beyond the SuperTrend line (plus spread).

- Take-profit: Set 1:1.5 to 1:2 RR or trail behind SuperTrend for runners.

- When it shines: After news shocks, London/NY overlaps, or fresh session trends.

2) The Pullback-to-Line (Trend Continuation)

- Signal: Trend already established (line color steady). Price pulls back toward the line but fails to close beyond it.

- Entry: On the first bullish/bearish confirmation candle away from the line.

- Stop-loss: Just beyond the SuperTrend line.

- Take-profit: Next swing high/low or fixed RR (1:1.5+).

- When it shines: Grinding trend days, post-breakout consolidations.

3) The Multi-TF Confirmation (Filter False Starts)

- Setup: Use H1 as the bias chart and M15 to time entries.

- Rule: Only take M15 longs if H1 SuperTrend is green; only take shorts if H1 is red.

- Why it works: Filters many countertrend whipsaws on the lower timeframe.

- Exit: Trail on M15 line or partials at 1:1.5 and 1:2.

Risk Management (Non-Negotiables)

- Fixed fractional risk: 0.5%–1% per trade for most accounts; 2% is aggressive.

- Spread awareness: If spread > average candle body on your timeframe, skip.

- Sessions: SuperTrend performs best when liquidity is healthy (London, NY).

- No martingale, no grid: The indicator gives clean signals; don’t sabotage it with risky money management.

- News filter: For gold and indices, avoid entries minutes before high-impact news.

Avoid These Common Mistakes

- Chasing late flips after an extended move. If the candle is huge, wait for a minor pullback.

- Over-tuning ATR to fit yesterday’s chart. Keep parameters stable and evaluate over a large sample.

- Trading against higher-TF bias purely because M5 flipped. That’s asking for trouble.

- Ignoring structure: SuperTrend is great, but confluence with recent swing highs/lows or demand/supply zones improves quality.

- Forcing trades in dead ranges: When candles are tiny, spreads eat your edge—stand down.

Example Workflow You Can Copy

- Market scan (H1): Mark pairs where SuperTrend is green/red and price respects the line.

- Drop to M15: Wait for a pullback close to the line.

- Trigger candle: Enter when a strong candle forms away from the line (engulfing or momentum bar).

- Stops: A tick beyond the line.

- Manage: Partial at 1:1.5, move SL to breakeven, then trail using the SuperTrend itself.

- Review: Screenshot winners and losers. Track whether flips near session opens/outside session perform better for your plan.

Who Is This Indicator For?

- Beginners who want an objective yes/no trend read.

- Intraday traders who hate cluttered charts and prefer one clean overlay.

- Swing traders who want a disciplined, trail-friendly exit rule.

- Rule-based system builders who combine SuperTrend with RSI/volume/structure.

Settings Cheatsheet (Quick Reference)

- Scalping (M5/M15 FX): ATR 10, Mult 2.5–3.0

- Intraday (M30/H1 FX & Gold): ATR 10–14, Mult 3.0–3.5

- Indices (US30/NAS100): ATR 10–14, Mult 3.5

- Crypto CFDs: Start conservative—ATR 14, Mult 3.5 (volatility spikes)

If your signals flip too often, increase the multiplier. If entries feel late, decrease it slightly.

Final Tips From Real-World Use

- Pair SuperTrend with session boxes (e.g., London/NY) to focus on high-liquidity windows.

- Use alerts on line flips so you’re not glued to charts.

- Keep a watchlist of 4–6 instruments that trend consistently for you. Depth beats breadth.

- Journal the context around your best trades: time of day, news backdrop, volatility regime.

Stick to one set of rules for 30–50 trades before you judge the strategy. Consistent application beats constant tweaking, coz that’s where most traders slip.

Comments

No comments yet. Be the first to comment!

Leave a Comment