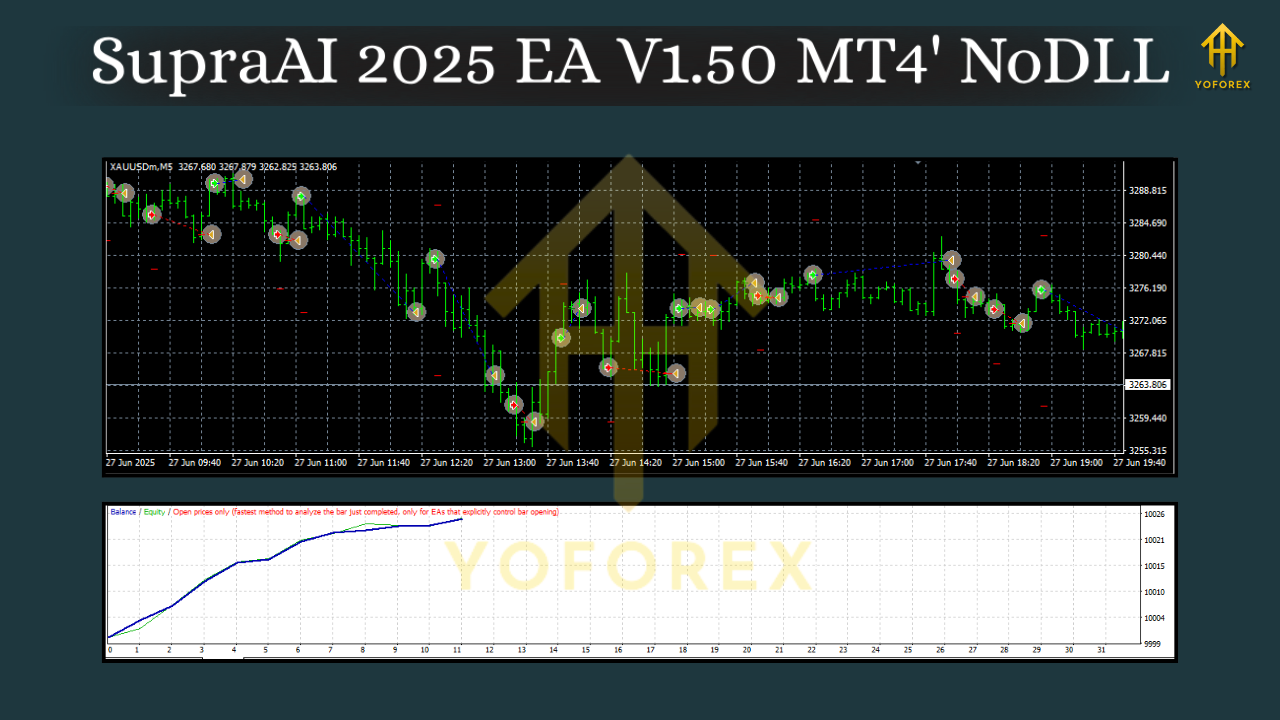

SupraAI 2025 EA V1.50 MT4 – The Adaptive AI Robot Built for 2025 Volatility

Sick of staring at charts all day and still second-guessing entries? You’re not alone. The forex market never sleeps—global headlines, surprise data prints, and late-session liquidity bursts make sure of that. For traders who want consistent, rules-first execution (without being chained to a screen), automation isn’t a luxury anymore; it’s the edge. Enter SupraAI 2025 EA V1.50 MT4—a next-gen Expert Advisor that blends machine-driven pattern recognition with human-style risk discipline. If you’ve been hunting for an EA that adapts as markets shift—trend, range, micro-volatility spikes—this one’s built to be your daily driver in 2025 and beyond.

What Exactly Is SupraAI 2025 EA V1.50 MT4?

At its core, SupraAI 2025 is an adaptive trading engine for MetaTrader 4 that responds to changing market regimes in real time. It evaluates volatility, momentum, and short-term liquidity to decide when to position, when to stand down, and how to exit with minimal regret. The “V1.50” update refines the model selection layer (think: smarter filters for trending vs. ranging behavior), tightens the protective logics, and adds better session-aware handling so you don’t get clipped by dead zones or random chop.

Design philosophy (in plain English):

- Trade less, capture more. You won’t see over-trading here; the system prefers quality signals over quantity.

- Confluence over clutter. Filtering by trend context + volatility makes entries cleaner and exits calmer.

- Risk first. Built-in guardrails keep equity curves steadier, coz account survival > any single trade.

How the Strategy Thinks (Without the PhD Jargon)

SupraAI 2025 uses a layered approach:

- Regime Detection: Labels the market as trend, range, or transition using volatility structure and directional bias.

- Entry Logic:

- In trend regimes: looks for pullback-continuation setups (momentum confirmation + volatility squeeze).

- In range regimes: prefers mean-reversion around clearly defined bands.

- In transition: reduces size or stays flat to avoid whip.

- Exit Engine: ATR-anchored stops, dynamic take-profit with partial scaling out, and trailing logic that only tightens after the trade proves itself.

- Risk Management: Position sizing by balance or equity (your call), hard equity protection, optional daily loss pause, and no martingale.

- News & Session Awareness: Optional news window avoidance + session filters (London/New York focus) for pairs like XAUUSD and majors.

Result? An EA that behaves differently when the market changes—because it’s supposed to.

Recommended Symbols, Timeframes, and Deposits

- Pairs: XAUUSD (Gold), EURUSD, GBPUSD, USDJPY.

- Timeframes: M5 and M15 for active traders; M30–H1 for conservative setups.

- Minimum Deposit: From $200 (conservative lot sizing); $500–$1,000 recommended for more headroom.

- Leverage: 1:100 to 1:500 (choose a reputable, low-spread broker).

- Prop-Firm Mode: Daily drawdown guard + max trade cap recommended if you’re chasing evaluations.

Key Features You’ll Actually Feel in Live Trading

- Adaptive AI core that shifts between trend and range logic.

- Clean trade filters to reduce “almost there” false starts.

- Partial take-profits to bank wins while letting runners run.

- ATR-anchored stops for volatility-aware risk.

- No martingale / no dangerous grids (optional scale-in only if trade is already in profit).

- Daily equity guard to avoid death-by-a-thousand-cuts.

- Session filter so you’re active when liquidity is real.

- Magic number isolation for multi-chart deployments.

- News buffer (optional) to sit out high-impact chaos.

- Lightweight footprint—runs smoothly on most VPS setups.

Installation & First-Run Setup (MT4)

- Copy files: Place the EA file into MQL4/Experts. Restart MT4.

- Enable trading: In MT4, allow Algo Trading (and DLLs if prompted by your broker environment).

- Attach to chart: Open your chosen symbol (e.g., XAUUSD M15), drag SupraAI 2025 EA V1.50 onto it.

- Load a preset: Start with a conservative preset (0.5–1.0% risk per trade).

- Check journal/experts tabs: Confirm license/inputs loaded correctly.

- Forward test on demo (strongly recommended): Let it run through at least a full week across session transitions before going live.

Suggested Inputs (Baseline)

- Risk Per Trade: 0.5–1.0% (new users)

- Max Daily Loss: 2–4% (prop-style guard)

- Max Open Trades: 1–3 (symbol-dependent)

- Take-Profit Logic: Enable partials at 1R and 2R, trail remainder

- News Filter: On for red-label events (NFP, CPI, FOMC)

- Session Filter: London + New York preferred; skip low-liquidity Asia for gold if spread is poor

Backtesting Like a Pro (So Results Make Sense)

Backtests can mislead if you cut corners. If you want something that mirrors live:

- Data Quality: Use high-quality tick data with 99% modeling where possible.

- Spread & Slippage: Set realistic spreads; inject slippage for XAUUSD during newsy periods.

- Test Length: At least 2018–2025 for robustness across different regimes.

- Walk-Forward: Periodically re-optimize filters, not entries. You want stability, not curve-fit.

- What to Look For: Smooth equity slope, controlled drawdowns, stable win/loss distribution (no “all wins then one blow-up” pattern).

You’ll typically find that M15–H1 offers the best “stress/return” balance on gold and majors; M5 can shine on liquid conditions but demands broker quality and a stable VPS.

Going Live—Best Practices That Save Accounts

- Start small, scale slow. Double size only after 30–50 trades with stable risk metrics.

- One change at a time. Don’t tweak multiple inputs simultaneously; you won’t know what helped or hurt.

- Respect the daily stop. If it’s hit, you stop—that’s the point.

- Journal the context. Note spread, slippage, and session. If a pair behaves badly after a regime shift, pause it.

- Broker choice matters. Tight spreads + fast execution change everything for gold/majors.

Who Will Love SupraAI 2025 (and Who Won’t)

- Great fit: Traders who value rules, patience, and longevity—those comfortable letting the system sit flat when the edge isn’t there.

- Not a fit: Anyone expecting “every-hour action” or lottery-style flips. The EA’s selective by design; it aims for consistency over adrenaline.

Final Word

Markets in 2025 are noisy, fast, and often unforgiving. SupraAI 2025 EA V1.50 MT4 leans into that reality with adaptive logic, strict risk, and a “trade when it matters” attitude. If your plan is to build a track record with steadier swings—rather than chase every tick—this EA earns a serious look. Start on demo, learn its rhythm, then scale with intention. Consistency first; growth follows.

Comments

No comments yet. Be the first to comment!

Leave a Comment