The world of forex trading continues to evolve, and with it, the demand for powerful trading tools grows stronger each year. Automated systems, better known as Expert Advisors (EAs), have become essential for traders who want consistent execution without being tied to their screens. Among the new generation of forex robots, one name has been gaining attention—Theranto V3 EA V1.2 MT4.

This EA is marketed as a refined pullback trading system built specifically for the MetaTrader 4 platform. Unlike many generic robots that claim to handle multiple pairs and strategies, Theranto V3 focuses on a single approach: capturing market pullbacks and turning them into profitable entries. In this review, we will explore its design, strategy, potential benefits, risks, and whether it’s truly worth adding to your trading setup.

Understanding the Idea Behind Theranto V3 EA

At its core, Theranto V3 EA is a trend-following system with a twist. Instead of jumping into trades the moment the market moves, it waits for a retracement. Pullbacks occur when the price temporarily moves against the trend before continuing in the same direction. For traders, this can be one of the most reliable moments to enter with reduced risk and better reward potential.

Theranto V3 automates this logic. It scans for strong momentum, identifies the pullback zone, and places trades with defined risk management. This kind of logic appeals to traders who believe in patience and precision over chasing price action.

Key Features

- Pullback-Focused Strategy

- The robot avoids random entries and relies on retracement confirmation.

- This reduces false entries during market spikes.

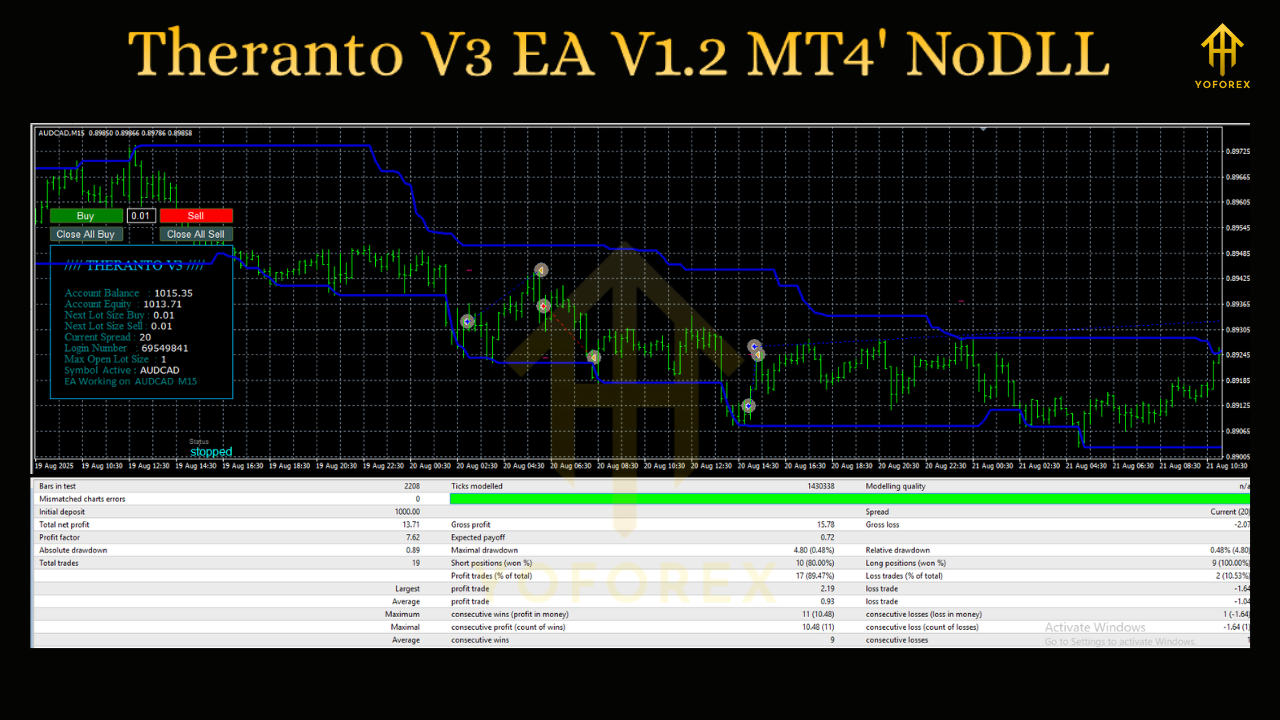

2. Optimized for AUD/CAD

- Most results show the EA performs best on the AUD/CAD pair, which tends to respect technical levels.

- The focus gives it sharper accuracy, though it may be tested on other pairs with caution.

3. Version 1.2 Enhancements

- Improved entry timing compared to older versions.

- Adjustments in trade exit rules for better capital protection.

4. Full Automation

- The EA places trades, adjusts stop-loss levels, and manages exits.

- Designed for traders who prefer minimal manual involvement.

5. User-Friendly Setup

- Can be installed quickly on MT4 without requiring advanced technical knowledge.

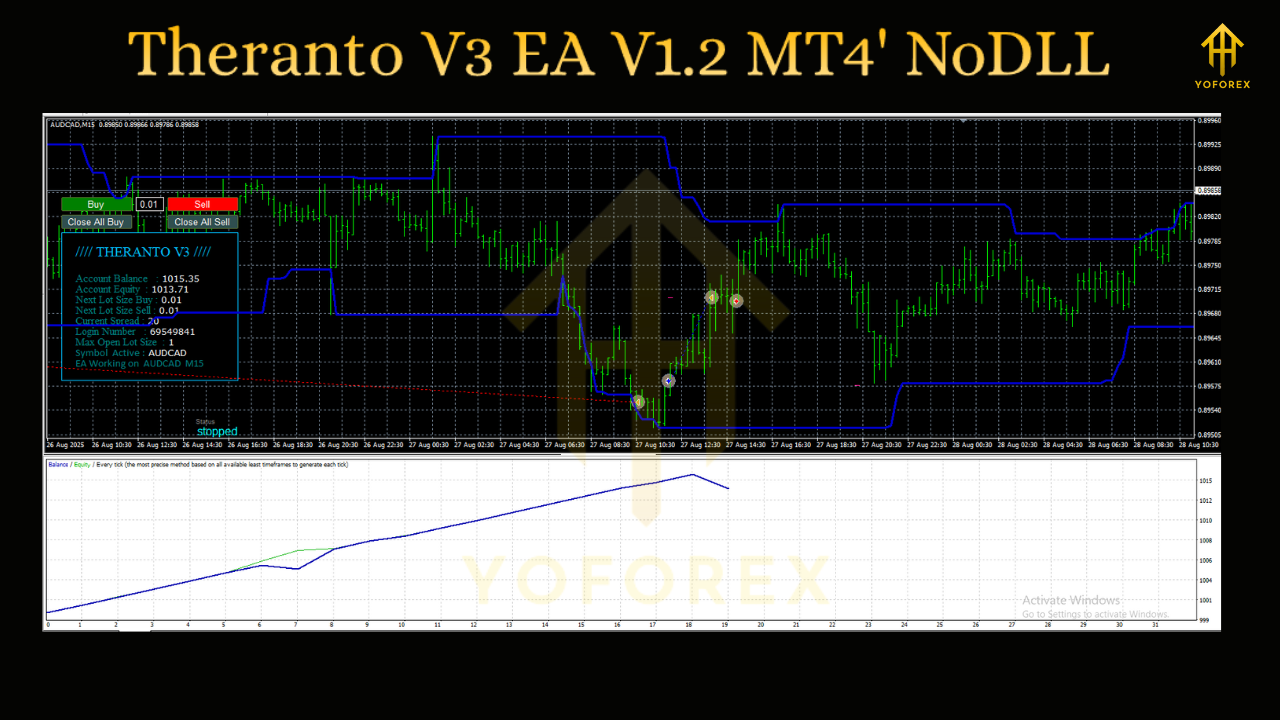

How It Works

The working process of Theranto V3 EA is straightforward:

- It identifies a strong move in one direction.

- Waits for the price to pull back.

- Places a trade in the direction of the main trend once the retracement is confirmed.

- Applies pre-set stop-loss and take-profit levels.

This structure makes it a rule-based system that removes emotional decision-making, which is often the cause of poor results for human traders.

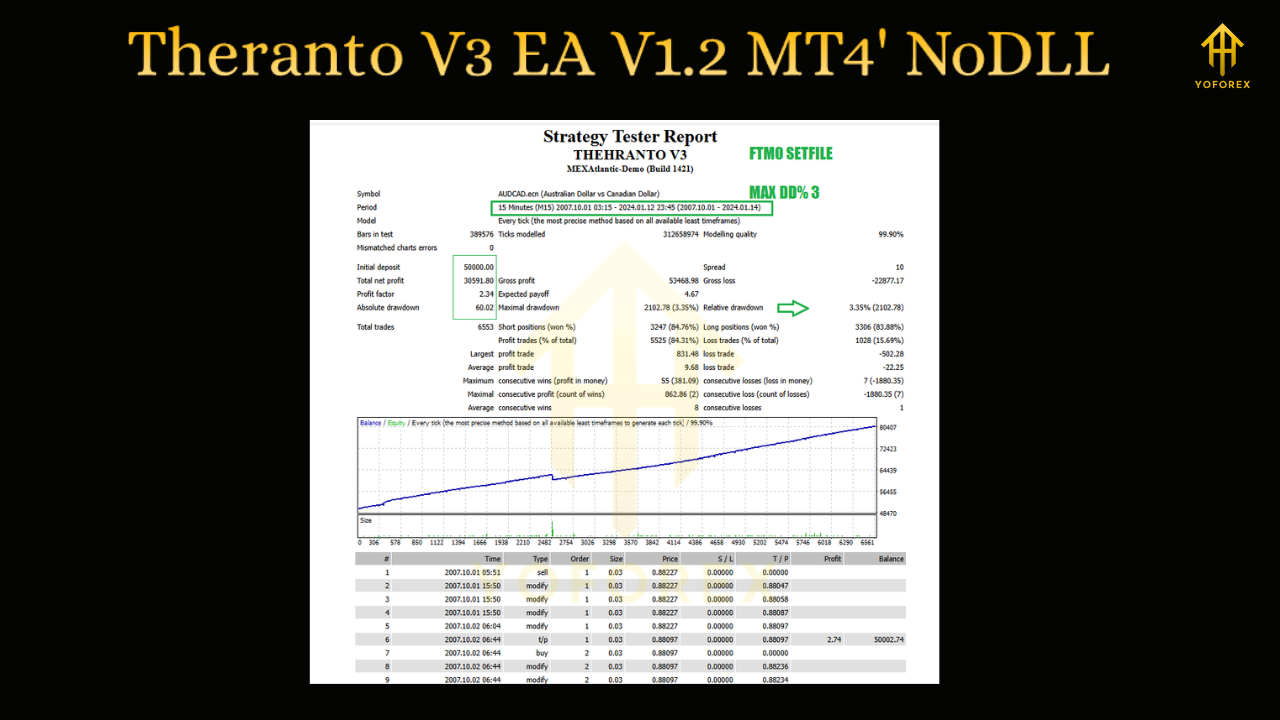

Claimed Results

Promotional sources suggest returns of over 300% using this EA. While these claims are impressive, they should always be approached with caution. Backtests often look better than live trading because they are optimized with historical data. In reality, markets change, spreads vary, and execution speeds differ across brokers.

Traders considering Theranto V3 EA should test it on a demo account before committing real funds.

Advantages of Theranto V3 EA

- It focuses on high-probability setups instead of random signals.

- Fully automated system that allows hands-off trading.

- Simple installation process suitable for traders at all levels.

- Optimized version offers more refined entry points.

- Provides stop-loss and money management features to reduce risk.

Disadvantages to Consider

- Works best only on AUD/CAD, limiting versatility.

- The high-profit figures advertised may not reflect real-world performance.

- Lack of verified long-term live results.

- May struggle in sideways or highly volatile conditions.

Suitable Traders

Theranto V3 EA may fit well for:

- Traders who prefer automated systems but want a strategy based on clear logic.

- Those who primarily trade AUD/CAD.

- Users who want a robot that prioritizes structured entries over frequent signals.

It may not suit traders who:

- Expect guaranteed profits with no drawdowns.

- Want a multi-currency EA for diversified strategies.

- Prefer manual control over trade decisions.

Risk Management with Theranto V3

Any EA, no matter how sophisticated, carries risks. For best results with Theranto V3:

- Limit risk to 1–2% per trade.

- Avoid trading during major news releases.

- Use a reliable VPS for uninterrupted performance.

- Monitor results and make periodic adjustments to lot size or parameters.

Backtesting Insights

Backtests conducted on AUD/CAD suggest:

- Consistent profit potential with proper settings.

- Drawdowns ranging from 20–30% depending on aggressiveness.

- Higher accuracy when tested on H1 charts.

Backtests should not be seen as guarantees but as indicators of potential performance.

Installation Guide

- Download the EA file.

- Open MT4 and go to File > Open Data Folder > MQL4 > Experts.

- Place the EA file in the Experts folder.

- Restart MT4 and load the EA on an AUD/CAD chart.

- Adjust inputs such as lot size, risk percentage, and timeframe.

Always test in demo mode first to understand its behavior.

Final Thoughts

The Theranto V3 EA V1.2 MT4 stands out as a focused pullback trading robot. Its simplicity, discipline-based entries, and automation make it attractive to traders who want a systematic approach to forex. However, like all EAs, it is not a guaranteed profit-maker. Real results will depend on market conditions, broker execution, and risk management.

For traders who understand its strengths and limitations, Theranto V3 EA could be a useful tool in 2025. The key is to use it wisely, test thoroughly, and never risk more than you can afford to lose.

Comments

No comments yet. Be the first to comment!

Leave a Comment