Vigorous EA V3.40 MT4 — Lightning-Fast M1 Scalper for Multi-Pairs

If you’ve been hunting for a no-nonsense scalping EA that can move fast on M1 without blowing up your risk, Vigorous EA V3.40 MT4 is designed exactly for that job. It’s built for speed, but balanced with guardrails so you’re not just chasing ticks—you’re executing a structured playbook. Whether you mainly trade majors like EURUSD, GBPUSD, USDJPY or you like to mix in CADJPY, GBPCHF, USDCAD, even XAUUSD (Gold) and BTCUSD, this bot aims to keep your edge consistent across different volatility regimes.

Below you’ll find what Vigorous EA tries to do under the hood, how to set it up on MetaTrader 4, recommended conditions for M1 trading, and a practical checklist for risk control. If you’re new to M1 scalpers, don’t worry—this guide keeps it simple and focused on what actually matters in live execution.

What Is Vigorous EA V3.40 MT4?

At its core, Vigorous EA V3.40 is a multi-pair, M1 timeframe scalper designed to catch micro-impulses and fast mean-reversions when spreads are tight and execution is clean. It looks for short bursts of momentum after small consolidations, then manages each trade with strict stops and a fast take-profit logic. The idea: collect many small, asymmetric wins while defending aggressively when the market shifts tone.

Supported pairs:

CADJPY, EURUSD, GBPUSD, GBPCHF, USDCAD, USDJPY, XAUUSD (Gold), BTCUSD.

(Note: GBPUSD appeared twice in the spec; the EA supports it once—obviously!)

Primary timeframe: M1.

Why M1 for this EA?

Because the EA’s edge depends on micro-structure—spreads, small imbalances, and quick orderflow. On M1, you get more frequent setups, more data to condition your stops, and shorter holding times, which helps reduce overnight and weekend risk exposure (especially handy for BTCUSD and XAUUSD volatility).

Supported Pairs & Optimal Conditions

Here’s how these markets typically behave with an M1 scalper and what you should watch:

- EURUSD & GBPUSD: Great during London and early NY sessions. Tight spreads are crucial; aim for ≤ 10–15 points (1.0–1.5 pips on 5-digit pricing) on EURUSD whenever possible.

- USDJPY: Often cleaner micro-trends with steady liquidity. Good for lower slippage environments.

- CADJPY & USDCAD: Watch the news calendar; Canadian data can spike spreads. Best during overlapping sessions with North America.

- GBPCHF: Volatile; be stricter on spread filters and reduce lot size if spreads widen.

- XAUUSD (Gold): High energy. Use a slightly wider stop, smaller position size, and consider avoiding the first minutes after big data releases.

- BTCUSD: 24/7 behavior with bursts. Use tighter max-slippage and lower risk per trade; VPS strongly recommended.

Execution rule of thumb:

- Spread filter: ≤ 15 points on majors when possible; slightly looser for XAUUSD/BTCUSD, but still set a cap.

- Slippage cap: 1–2 points for majors; be conservative on gold and crypto.

- Sessions: London & early NY are prime for FX; crypto can set up all day, but liquidity varies.

How Vigorous EA V3.40 Works (High-Level)

Vigorous EA stacks a few simple but complementary ideas:

- Micro-Trend Pulse: Detects a short-term directional push following a low-range pause.

- Mean-Reversion Brake: If price snaps back too quickly, the EA steps out rather than martingaling into the move.

- Volatility Filter: ATR-like checks to avoid dead zones or chaotic spikes.

- Spread & Slippage Guard: No entry if costs eat the edge.

- Trade Management: Small fixed or ATR-scaled stop, dynamic take-profit with optional break-even and partials.

- Session Awareness (optional): User-controlled, so you can disable trading off-hours.

No grid. No martingale. The focus is small, controlled bites with consistent risk.

Key Features

- + M1 Scalping Logic: Built for the fastest actionable timeframe.

- + Multi-Pair Coverage: CADJPY, EURUSD, GBPUSD, GBPCHF, USDCAD, USDJPY, XAUUSD, BTCUSD.

- + Strict Risk Control: Fixed or ATR-based stops, optional break-even and partial close.

- + Spread/Slippage Filters: Trades only when costs make sense.

- + No Martingale/Grid: Clean, linear exposure—easier to manage.

- + Session Filters: Limit trading to your best liquidity windows.

- + News Lock (if you use one): Pause during high-impact events to reduce whipsaw risk.

- + Smart TP Logic: Scales out or hits predefined targets quickly.

- + Broker-Agnostic: MT4-compatible; just prefer low-spread, fast-execution brokers.

- + VPS Ready: Designed to run 24/5 on a stable, low-latency VPS.

- + Log Transparency: Each trade decision can be reviewed for performance tuning.

- + Easy Presets: Use pair-specific presets to avoid guesswork.

Installation & Setup (MT4)

- Add the EA to MT4

- Open MT4 → File → Open Data Folder → MQL4 → Experts.

- Copy

Vigorous_EA_V3.40.ex4(or.mq4) into Experts. - Restart MT4.

2. Enable Algo Trading

- Click Algo Trading (top toolbar) → make sure the green play icon is on.

- In Tools → Options → Expert Advisors, enable “Allow automated trading.”

3. Attach to Chart

- Open an M1 chart for your chosen pair (e.g., EURUSD M1).

- Drag Vigorous EA V3.40 from the Navigator → Expert Advisors onto the chart.

- Allow live trading in the EA settings window.

4. Load Presets

- Click Load in the Inputs tab to import pair-specific

.setfiles (recommended). - Save your profile once satisfied.

5. Start Small

- Begin with conservative risk per trade (e.g., 0.25%–0.5%).

- Run for a full session before scaling.

Risk & Money Management (Practical)

- Position Sizing: For M1 scalping, small is smart. Start at 0.25%–0.5% per position; scale only after reviewing 100+ trades.

- Daily Loss Cap: Set a max daily loss (e.g., 2%–3%). If hit, the EA halts—no revenge trading.

- Max Concurrent Trades: Keep the book tidy. For majors, 1–3 open positions total is plenty; for gold/crypto, often 1 is enough.

- Stop & TP: Prefer a hard stop with no “mental stop” nonsense; use precise TP or partial exits.

- News Control: Enable a news lockout around NFP, CPI, rate decisions, etc. Spreads can explode.

- VPS: A must for serious use—aim for < 20 ms latency to your broker if possible.

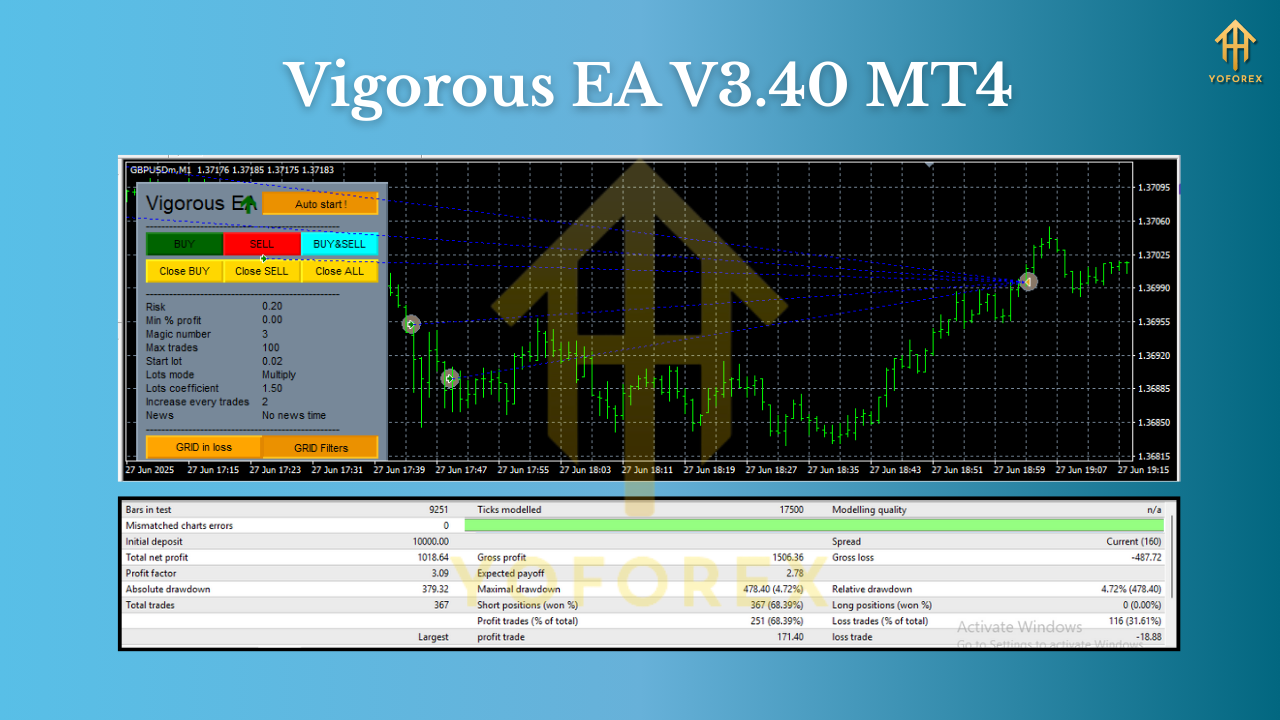

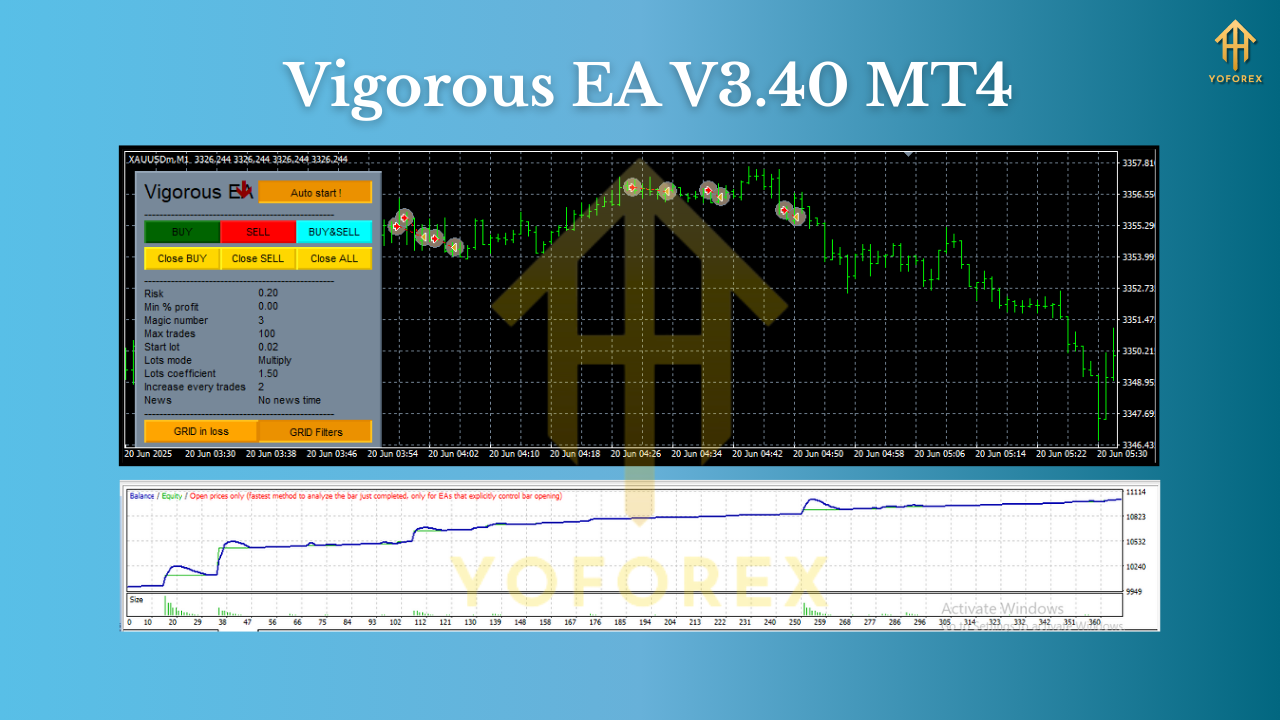

Backtesting & Optimization Tips

- Tick Quality: Use 99% tick data with variable spreads if available. M1 requires realistic ticks.

- Spread Settings: Simulate the average + a small buffer (e.g., 1.2–1.5x your broker’s typical).

- Session Windows: Test London-only, London + NY open, and NY-only to see where the edge shines.

- Per-Pair Presets: Don’t over-optimize; focus on robust settings that hold up out-of-sample.

- Walk-Forward: Run out-of-sample windows to validate you’re not curve-fitting.

- Risk Curves: Plot equity vs. max drawdown and inspect sequences of losers to size appropriately.

What you want to see: an equity line that climbs in steps (typical for scalpers), drawdowns that stay contained and recover, and a trade distribution with many small wins and limited tails on losses.

Best Practices & Live Execution

- Broker Choice: Low-spread ECN with fast fills. Commission + spread should stay competitive on M1.

- Symbol Filters: If a pair widens beyond your spread cap, let the EA skip entries—costs matter more than FOMO.

- Partial Closes: Consider taking 50–70% off early on gold/crypto then trail the rest.

- Weekends & Gaps: Disable trading late Friday; avoid crypto around known liquidity vacuums unless heavily risk-reduced.

- Logs & Journaling: Export trade history weekly, tag conditions (session, news, spread), and refine.

Final Thoughts

Vigorous EA V3.40 MT4 aims to do one thing well: systematic M1 scalping across multiple symbols with disciplined risk. If you give it the right environment—tight spreads, a solid VPS, clear risk rules—it can execute a consistent plan without second-guessing. Start small, gather data, and adjust pair-by-pair. M1 scalping rewards patience and process; the “vigorous” part should be the execution, not your risk.

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment