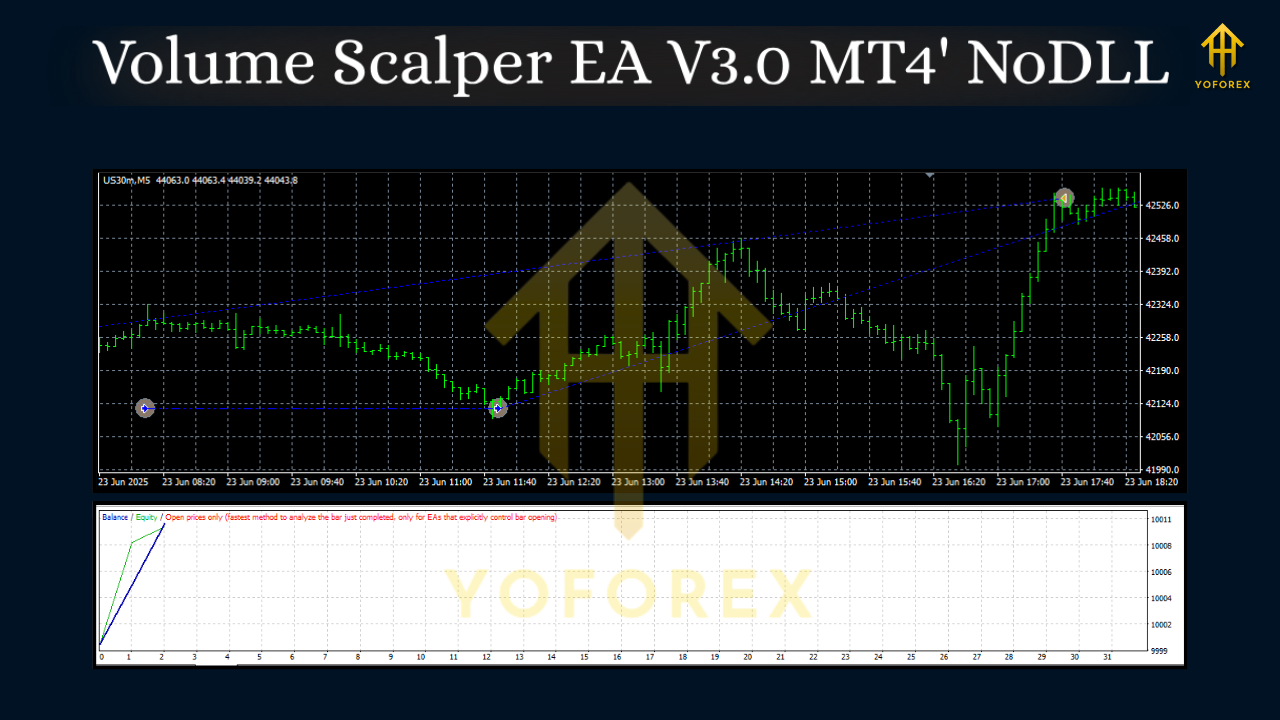

Volume Scalper EA V3.0 MT4 — Smart M5 Volume Entries for Gold, USDJPY & US30

If you love quick, clean scalps without the drama of grid, martingale, or hedging, you’ll vibe with Volume Scalper EA V3.0 MT4. This Expert Advisor focuses on what actually moves price in fast markets—volume impulses and momentum bursts—so you can catch concise M5 entries on XAUUSD (Gold), USDJPY, and US30. It’s designed for disciplined traders who want consistent trade logic, strict risk controls, and fewer curve-balls in execution. No fancy gimmicks, just a focused volume-based edge.

Why Volume Scalper EA?

Most scalpers drown in noise. They take every blip on the chart and hope it sticks. Volume Scalper EA V3.0 MT4 flips that script. It looks for real participation—the kind that shows up in surging tick volume, widening range, and clean follow-through. When those conditions sync with session timing and volatility filters, the EA strikes; if they don’t, it waits. Sounds simple… and that’s exactly the point.

What it trades (and why)

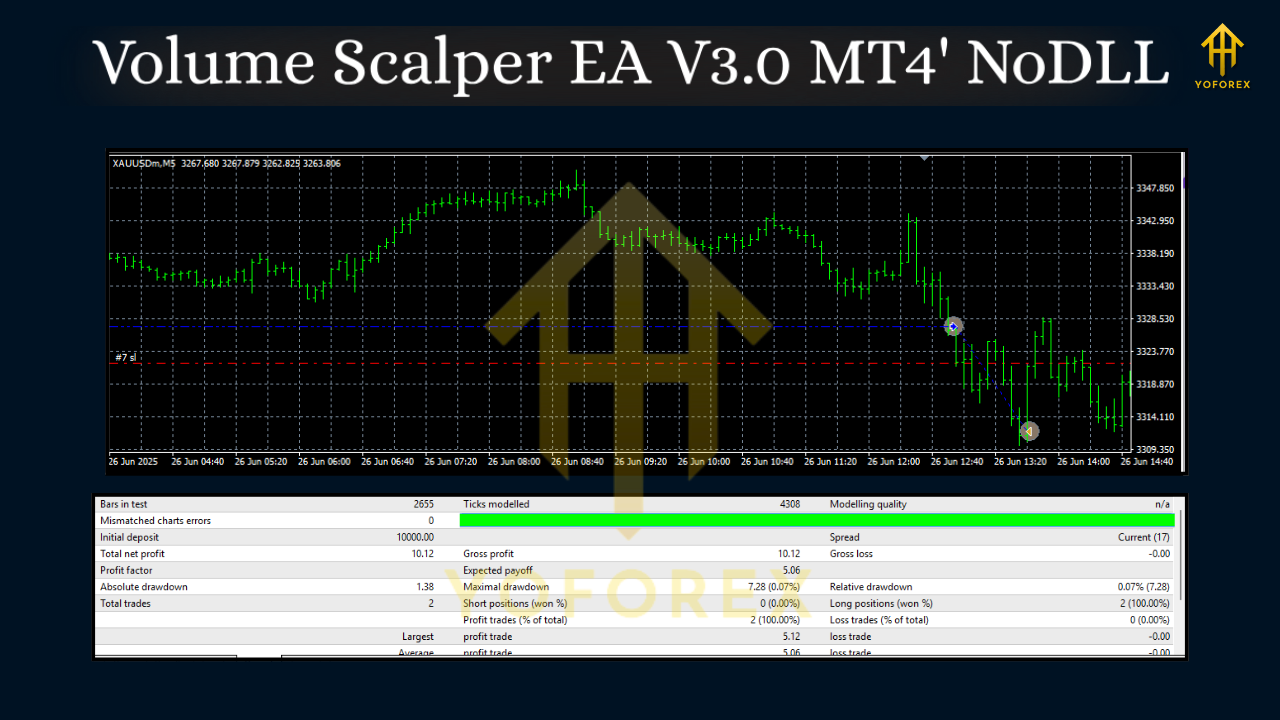

- XAUUSD (Gold), M5: Gold generates beautiful volume spikes around session overlaps, especially London–NY. The EA’s impulse detector thrives here.

- USDJPY, M5: Smooth intraday rotations with clear continuation legs. Great for controlled scalps with tight stops.

- US30 (Dow), M5: High beta, strong pushes on open. The EA filters out choppy pre-impulse moves, then rides the burst, not the chop.

How the strategy works (plain English)

The core is a volume-momentum confirmation. The EA checks:

- Relative Volume Surges vs. a rolling baseline (e.g., last N candles).

- Range Expansion: if the candle’s true range and body size validate the move.

- Directional Confluence: micro-trend bias (from M5) must align with the current impulse.

- Session & Volatility Filters: no trades when the market’s asleep or spiky without follow-through.

- Risk Guardrails: pre-defined stop distance, fixed or dynamic lot sizing, and daily loss cap.

If conditions line up, Volume Scalper EA V3.0 MT4 executes with pre-attached SL/TP and an exit manager that can trail on structure or cut losers quickly if the impulse fades. No grid averaging. No martingale “hail Marys.” Just professional entries with sane exits.

Key features at a glance

- Pure scalping on M5 for XAUUSD, USDJPY, US30

- No grid, no martingale, no hedging — risk stays linear, not exponential

- Volume impulse engine with range and momentum validation

- Time/session filter to avoid dead zones and news-shock chop

- Fixed or dynamic risk (e.g., %-of-balance) with daily loss stopper

- Smart trailing: optional breakeven shift and step-trail after partial progress

- Spread & slippage guards for fair fills only

- One-chart, one-asset deployment to keep execution clean

- Alerts & logs for full transparency of entry/exit reasons

- Broker-agnostic (ECN/RAW spread recommended) and VPS-friendly

Setup & best practices (read this first)

- MT4 Preparation

Open MT4 → File → Open Data Folder →MQL4/Experts→ paste the EA file → restart MT4. - Attach to chart

Open M5 chart for the asset you want (Gold, USDJPY, or US30). Drag the EA onto the chart. Allow algo trading. Confirm “Allow live trading.” - Configure risk

Start with 0.5–1.0% per trade while you learn the behavior. Set a daily loss cap (e.g., 3–4%) to stop the EA for the day if conditions aren’t ideal. - Filters

Keep spread filter on. For indices and gold, low-spread sessions matter. If your broker’s spreads spike, the EA will skip trades (that’s good). - VPS

Run it on a low-latency VPS so it doesn’t miss impulse entries. Scalping lives and dies on execution quality. - One asset per chart

Don’t load multiple symbols on one chart. If you want all three markets, attach one EA instance to each symbol’s M5 chart. - Demo first

Always forward-test on demo for at least 1–2 weeks to observe behavior, session timing, and broker execution.

Trade logic, deeper dive (for the nerds)

The EA uses a rolling relative volume index to spot unusual participation. When volume spikes, it doesn’t auto-fire; it cross-checks range expansion (true range and body ratio), micro-trend slope, and recent swing structure to avoid “one-bar wonders.” It then sizes the position using your chosen model (fixed lots or risk-percent to SL) and places a hard stop outside the local noise.

For exits, you can run fixed TP, structure-based trailing, or a hybrid (partial at TP1, trail remainder). The hybrid works great on Gold and US30 when impulses extend; USDJPY often behaves better with modest TPs and quicker breakeven moves.

When it shines (and when to chill)

- Shines during London open, NY open, and London–NY overlap, when true participation floods in.

- Chill during late-NY and pre-Asia doldrums, or right before big scheduled news. The EA’s session filters already help, but being mindful boosts results.

Risk management the right way

Look—compounding via martingale looks cute on a backtest until it blows up live. Volume Scalper EA V3.0 MT4 doesn’t touch any of that. You get linear, bounded risk every single trade. Keep it consistent, and the math works in your favor, especially when you let the winners breathe with a sensible trail. This is the kind of behavior prop firms actually like, btw.

Suggested starting profile (tweak as you learn)

- Risk: 0.75% per trade

- Daily loss cap: 3% (auto-pause for the day)

- Max open positions per symbol: 1

- Spread guard: enabled (set a practical threshold per asset)

- Trailing: activate after +0.8R, move to BE; step-trail every +0.5R

- News filter: optional manual pause around Tier-1 events

Final word

Volume Scalper EA V3.0 MT4 is a no-nonsense tool for traders who want to capitalize on real intraday participation without bloating risk. It won’t overtrade sleepy markets; it waits for momentum, confirms the impulse, then executes with clarity. Test it on demo, get comfortable with the flow, dial in your risk, and let the volume do the talking. If you stick to process over hype, this EA can become your go-to M5 companion for Gold, USDJPY, and US30—small edges, repeated often, compounding cleanly over time. No shortcuts, just a solid plan.

Comments

No comments yet. Be the first to comment!

Leave a Comment