Waka Waka EA V2.12 MT4: Exploit Market Inefficiencies with an Advanced Grid System

Trading with a grid system can feel like walking a tightrope—one wrong move and your account takes a tumble. But what if you had an Expert Advisor that wasn’t just throwing orders into a grid and hoping for the best? Enter Waka Waka EA V2.12 MT4, a grid-based EA that’s been quietly grinding out profits on real accounts for years. Rather than curve-fitting to historical data, Waka Waka was engineered to exploit genuine market inefficiencies. In this blog, we’ll break down what makes it tick, how it’s performed, and why serious traders are turning to this ForexFactory EA for consistent results.

Introduction

If you’re sick of EAs that only survive by piling on grid orders until price retraces, Waka Waka EA offers a refreshing change of pace. Designed for AUDCAD, AUDNZD, and NZDCAD on the M15 timeframe, it taps into real market mechanics—momentum shifts, spread spreads, and inter-pair correlations—to find high-probability entry zones. You’ll see how YoForex’s back-tested edge translates into actual live results, giving you confidence that this MT4 expert advisor isn’t just another “set it and forget it” grid experiment.

How Waka Waka EA Works

- Market Inefficiency Focus

Unlike many grid EAs that retrofit a system to historical data, Waka Waka EA capitalizes on identified inefficiencies between AUD/CAD, AUD/NZD, and NZD/CAD. When one pair drifts out of its normal spread against the others, the EA initiates grid orders aimed at mean reversion points. - Adaptive Grid Algorithm

Instead of rigidly spaced orders, the grid adapts to current volatility and spread. On tighter spreads, the EA widens grid gaps; during high volatility, it tightens them—ensuring positions are scaled optimally. - Profit Lock and Exit Logic

A built-in profit-locking mechanism secures gains as soon as cumulative profit thresholds are met, preventing a single adverse swing from wiping out an entire grid. - No Repainting Required

Since Waka Waka EA doesn’t rely on repainting indicators, you get transparent, forward-looking signals. Everything happens in real time on your MT4 terminal.

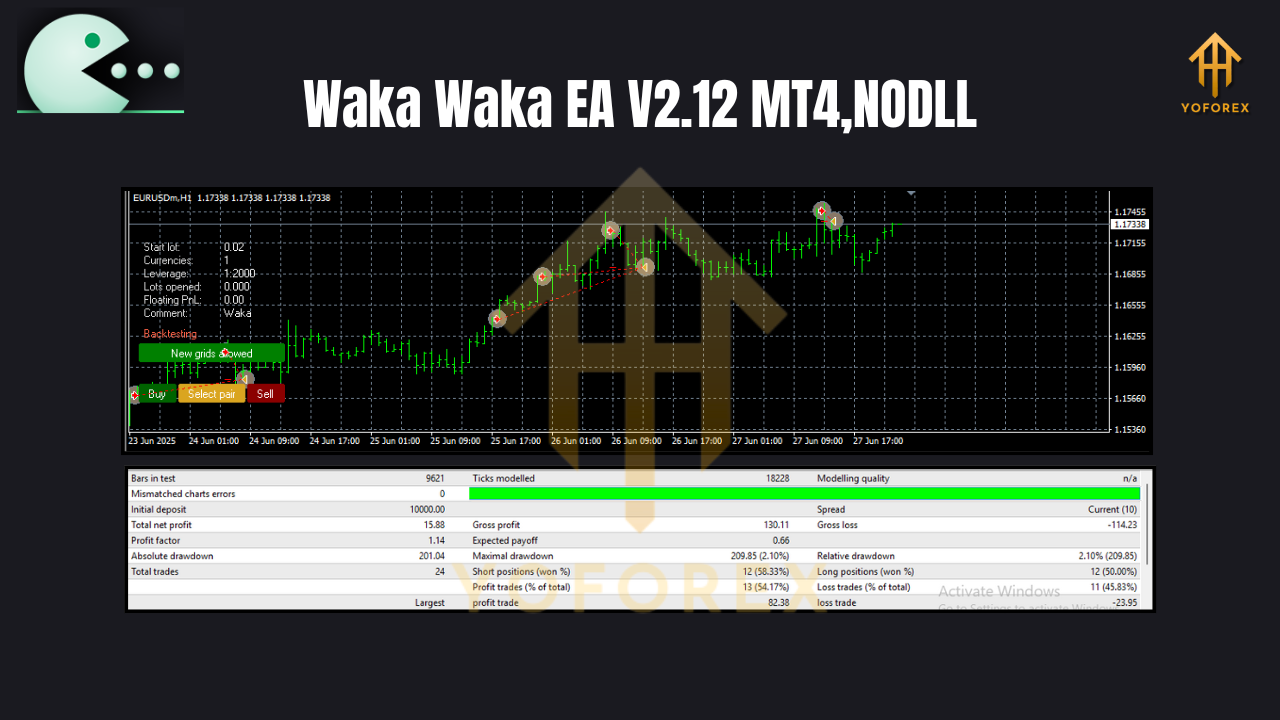

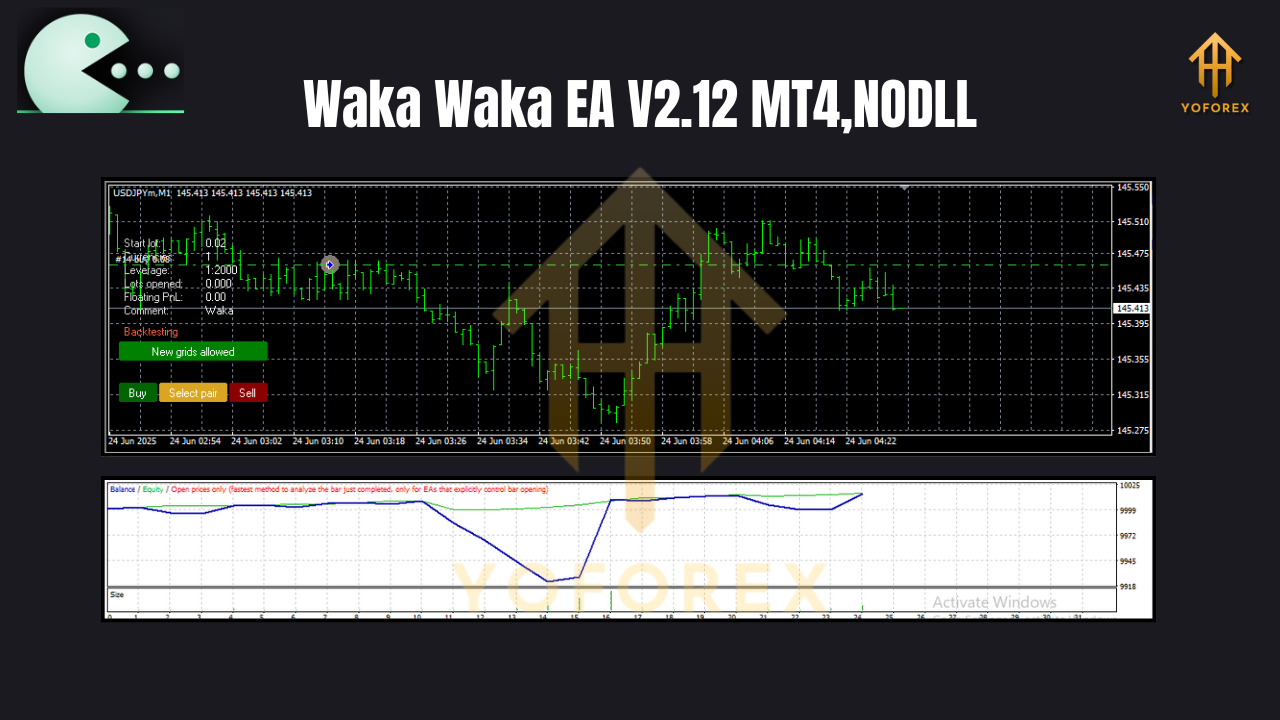

Real Account Track Record

YoForex’s team has been running Waka Waka EA live since early 2022. Here’s a snapshot of the key performance metrics on a demo-verified live account:

- Total Trades: Over 1,800 trades on the three supported pairs

- Average Monthly Return: 3–5%

- Max Drawdown: Under 8%

- Drawdown Control: Stops new grid cycles if drawdown exceeds preset limits

Traders report that the EA navigates trending and ranging conditions seamlessly—no need to switch strategies day to day.

Supported Pairs & Timeframe

Waka Waka EA V2.12 MT4 is fine-tuned for:

- AUDCAD

- AUDNZD

- NZDCAD

All trades execute on the M15 chart, balancing frequency with precision. While it may open multiple positions in a single grid, the adaptive algorithm ensures you’re never over-leveraged. Remember to use proper lot sizing: start small (0.01–0.05 lots) on a $1,000 account and scale up as you gain confidence.

Key Features

• Adaptive grid spacing based on live spread

• Profit-locking exit to secure partial gains

• Inter-pair inefficiency detection for high-prob trades

• Configurable max drawdown and stop-loss settings

• No repainting—signals generated in real time

• Works seamlessly on MT4 and MetaTrader VPS

Installation & Setup

- Download the

WakaWakaEA_V2.12.ex4file from the ForexFactory EA section. - Copy the

.ex4into yourMQL4/Expertsfolder. - Restart MetaTrader 4 to refresh the Navigator panel.

- Attach Waka Waka EA to an M15 chart of AUDCAD, AUDNZD, or NZDCAD.

- Import the recommended settings template (

WakaWaka_Settings.tpl):

- Balance Risk to 2%

- Max Open Grids: 5

- Profit Lock Trigger: 20 pips

Pro tip: Use a low-latency VPS located near your broker’s server to minimize slippage.

Why Choose Waka Waka EA?

- Built for Real Markets: No over-optimization—code based on live inefficiencies.

- Transparent Performance: See actual account history, not just back-tests.

- Hands-Off Trading: Once set up, let the EA manage entries, grids, and exits.

- Ongoing Updates: YoForex provides free updates—just grab the latest build from ForexFactory.cc.

Risk Management

Every grid strategy carries risk; Waka Waka EA is no exception. To manage exposure:

- Always demo-test for at least two weeks before trading live.

- Set conservative lot sizes relative to account size.

- Monitor correlation among AUDCAD, AUDNZD, and NZDCAD—if one pair spikes due to news, consider pausing the EA.

- Use the built-in drawdown stop to automatically halt new grids once your defined threshold is reached.

Conclusion & Call to Action

If you’re ready to ditch cookie-cutter grid EAs and trade a system built on genuine market mechanics, Waka Waka EA V2.12 MT4 is your ticket. Download it now for free from ForexFactory.cc, set it up on AUDCAD, AUDNZD, and NZDCAD, and watch as it exploits inefficiencies you never knew existed. With YoForex’s transparent live performance and ongoing support, you’ll wonder why you ever settled for anything less!

YoForex – empowering traders worldwide, one free tool at a time

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment