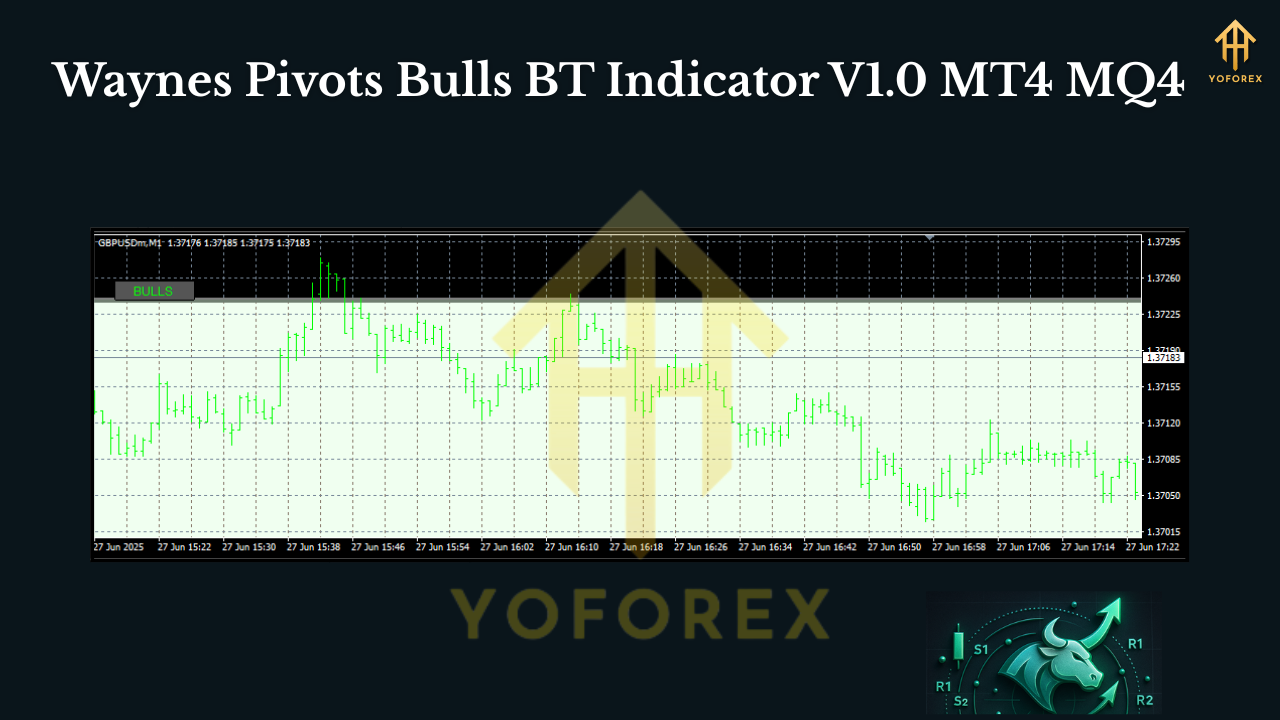

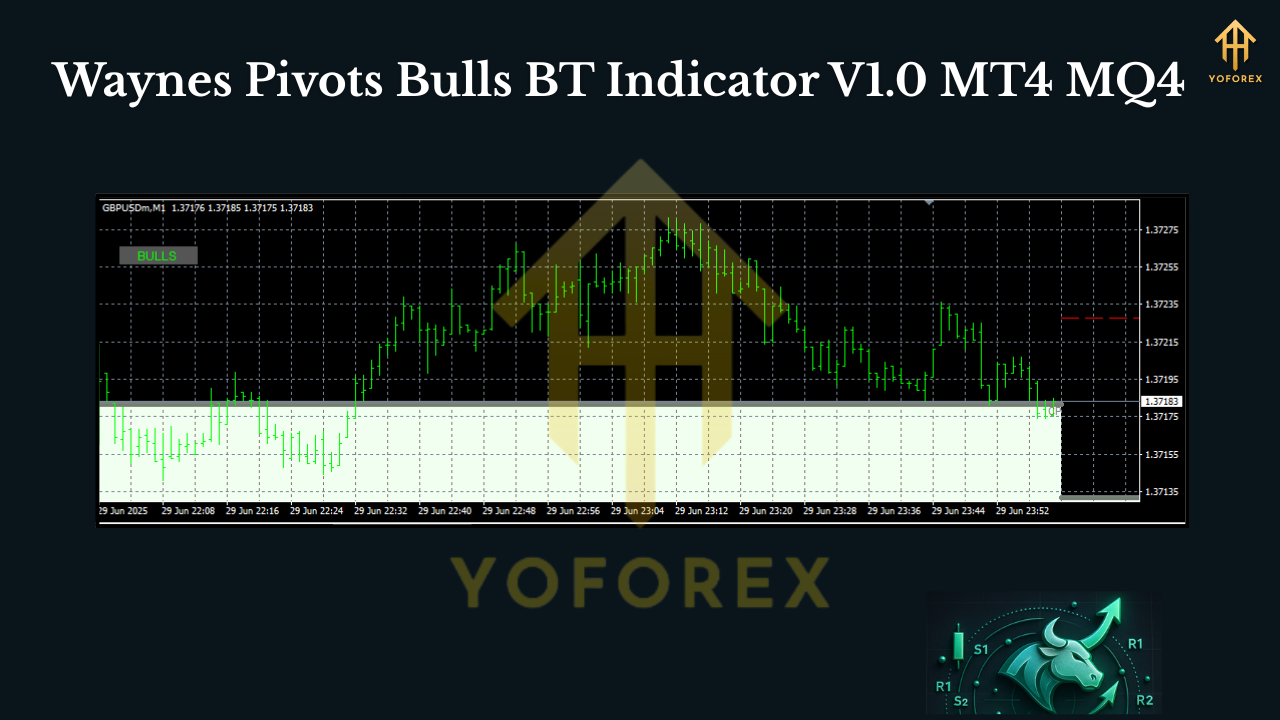

Waynes Pivots Bulls BT Indicator V1.0 MT4 (MQ4): Clean Pivot Breakouts for Everyday Traders

Time frames: M15, M30, H1, H4

Currency pairs: Major FX pairs (EURUSD, GBPUSD, USDJPY, AUDUSD), XAUUSD (Gold), and US30/GER40 indices

Minimum / Recommended deposit: $100 (for testing on a small live account after demo)

If you’ve been hunting for a straight-talking MT4 indicator that tells you where price is most likely to react—without drowning you in clutter—then Waynes Pivots Bulls BT Indicator V1.0 is exactly the kind of tool you’ll vibe with. It plots classic floor-trader pivot levels (PP, S1–S3, R1–R3) and wraps them with a bullish-bias filter and alert logic so you can focus on clean breakouts, bounces, and re-tests… not guesswork. And coz it’s a simple, robust pivot engine, there’s no repaint drama after the session starts; levels are locked, so your plan doesn’t shift under your feet.

This post walks through what the indicator does, how to use it across M15–H4, and the best practices that keep you out of trouble. You’ll also find setup tips, risk guidance for $100 accounts, and a few playbook patterns for the “bulls BT” breakout style.

Overview: What “Bulls BT” Actually Means

Waynes Pivots Bulls BT combines daily/session pivot math with a bullish trend/volatility gate—the idea is to help you focus only on high-probability long structures (you can still watch the levels for shorts, but the alert logic emphasizes bullish momentum). The result is a lean, repeatable workflow:

- Identify confluence: pivot + recent structure (previous highs/lows, VWAP, round numbers).

- Watch for a clean break above PP/R1 or a bounce off PP/S1 that aligns with the bullish filter.

- Enter with tight risk under the most recent structure or the pivot level, and let price “walk” pivots (R1 → R2 → R3) while you trail.

Because pivots are widely watched by intraday traders, they often act like signposts—liquidity tends to pool around these levels. The Bulls BT logic simply narrows the universe to the setups that show enough upside intent to be worth your risk.

Great fits:

- M15–H1 for intraday; H4 for swing context.

- EURUSD, GBPUSD, USDJPY, AUDUSD (majors), XAUUSD (gold), and US30/GER40 (index CFDs).

- Small accounts (from $100) on demo first, then micro-lot sizing live.

Key Features You’ll Actually Use

• True floor-trader pivots (PP, S1–S3, R1–R3) based on prior session’s H/L/C

• Bullish momentum filter to highlight only long-side conditions (“Bulls BT”)

• Signal arrows/markers on breakouts and re-tests around PP/R1 with trend alignment

• No repaint of pivot levels once the session is set (the levels stay constant)

• Configurable sessions (daily pivots by default; optional broker-time alignment)

• Alerting (on-screen, push, email—depending on your MT4 notifications setup)

• Risk prompts: suggested stop below structure or below PP/S1 on re-tests

• Works across M15, M30, H1, H4—consistent math, different pace

• Gold and indices compatible—just consider wider stops/targets due to volatility

• Lightweight & clean UI—you see price + pivots, not twenty indicators fighting

• Buffer-friendly plotting for EAs or dashboards that read indicator values

• Beginner-friendly defaults, with advanced options for power users

How to Trade It: Three Everyday Setups

1) PP Break & Retest (Classic)

- Wait for a decisive break above PP (bullish candle close).

- Look for the re-test of PP from above; Bulls BT stays positive.

- Enter long on a confirmation candle; stop below PP or below the re-test wick.

- First target: R1. Scale/leave runner toward R2 if momentum persists.

2) S1 Spring to PP (Mean-Revert to Trend)

Price tags S1, rejects strongly, and the bullish filter turns/holds positive.

Enter on the first strong bullish close aiming for PP first, R1 second.

Stop under S1 or under the rejection wick. Best on M15/M30.

3) R1 Walk (Momentum Day)

- Strong open; price clears PP early, tags R1, barely pulls back.

- Use small pullbacks to join above PP/R1 as the bullish filter remains on.

- Trail under minor HLs or under R1; let it walk R1 → R2 → R3 if the session is hot.

Tip: On XAUUSD or indices, widen stops a bit; aim for fewer, higher-quality entries. Let the levels do the heavy lifting.

Risk & Money Management (for $100+)

Even the best indicator can’t save reckless sizing. For small accounts:

- Risk per trade: 0.5%–1.0% max. On $100, that’s $0.50–$1.00 per trade.

- Lot sizing: On FX majors, 0.01 lots is usually the minimum; pick pairs/timeframes where stops can be tight enough to respect that risk.

- Avoid stacking multiple correlated positions (EURUSD + GBPUSD) at the same time.

- Trade the session you can monitor—London and early NY often give the cleanest pivot behavior.

Installation & Setup (MT4 / MQ4)

- Download

Waynes_Pivots_Bulls_BT.mq4or.ex4. - In MT4, go to File → Open Data Folder.

- Navigate to MQL4 → Indicators and paste the file.

- Restart MT4 (or right-click Indicators → Refresh in Navigator).

- Attach the indicator to your chart (Navigator → Indicators → Waynes Pivots Bulls BT).

- In Inputs:

- Confirm Session/Day pivots = true (default).

- Check Alerts = true if you want pop-ups/push notifications.

- Leave Bullish Filter = true to keep the long-bias focus.

7. Hit OK. You’ll see PP, S/R lines, and the Bulls BT markers when conditions strike.

Settings That Matter (and Those That Don’t)

Matters:

- Broker time alignment: Keep your pivots aligned with the session you trade most.

- Alert mode: Pop-up only vs push/email—pick what you actually use.

- Filter strictness: If your day is choppy, keep the bullish filter strict to avoid noise.

Doesn’t matter (much):

- Fancy cosmetics/colors. Clean charts = better decisions.

- Over-tweaking R2/R3 math; stick to standard floor pivots unless you really know why you’re changing them.

Backtest-Style Proof (How to Validate It Yourself)

Because pivots are rules-based and non-repainting after the session sets, you can manually validate the logic fast:

- Pick a pair (say, EURUSD) and timeframe (M15).

- Scroll back 3–6 months and mark every PP break-and-retest where Bulls BT was positive.

- Log entry, stop (below PP or structure), target (R1/R2), and RR.

- You’ll likely notice: days with stronger session ranges tend to walk pivots cleanly, while compressed days stall at or near PP/R1. That’s fine—your job is to sit out the chop, not force trades.

For gold and indices, do the same but allow wider stops/targets and fewer trades. The pattern frequency may be lower, but the RR can be bigger on trend days.

Practical Tips from Live Use

- Monday & Friday: often messier; focus on the clearest levels only.

- News & volatility: if a major release is due, wait for the print, then let price reset around PP before you commit.

- One trade per idea: if a PP re-test fails hard, don’t immediately revenge-re-enter. Give the chart time to rebuild the structure.

Why This Indicator Clicks for Many Traders

- Clarity: Pivots are universal; you’re not fighting obscure math.

- Discipline: The bullish filter removes half the second-guessing.

- Consistency: Same routine, day after day. Your notes stack, skills compound.

- Compatibility: Works with your existing price-action playbook—engulfing candles, HLs, trendlines, you name it.

And if you’re growing a small account from $100, the combination of tight, logical stops and clear level-based targets is exactly what you need to keep risk sane while learning.

Call to Action

Ready to put it to work? Install Waynes Pivots Bulls BT Indicator V1.0 on a demo, give it one or two full weeks through London/NY, and log every PP break/re-test. You’ll quickly see which pairs and sessions sing for you. Then, and only then, step into live with micro-risk. Trade clean. Keep it simple. Let price do the talking.

Comments

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555

555'"

555????%2527%2522\'\"

@@sAz3F

(select 198766*667891)

(select 198766*667891 from DUAL)

555

555F0eygZVH') OR 619=(SELECT 619 FROM PG_SLEEP(15))--

555T7Kzzlqb')) OR 436=(SELECT 436 FROM PG_SLEEP(15))--

555aIfk4YBv' OR 468=(SELECT 468 FROM PG_SLEEP(15))--

555-1 OR 155=(SELECT 155 FROM PG_SLEEP(15))--

555-1) OR 551=(SELECT 551 FROM PG_SLEEP(15))--

555-1)) OR 95=(SELECT 95 FROM PG_SLEEP(15))--

555-1 waitfor delay '0:0:15' --

555iFz1M0RK'; waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

555-1; waitfor delay '0:0:15' --

555*if(now()=sysdate(),sleep(15),0)

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

-1 OR 5*5=25

-1' OR 5*5=25 --

-1" OR 5*5=25 --

-1' OR 5*5=25 or 'UnILyvzm'='

-1" OR 5*5=25 or "hKMd0LXY"="

555

-1 OR 5*5=25 --

555

555

Leave a Comment