Master the Markets with the Average Daily Range (ADR) Indicator for MT4

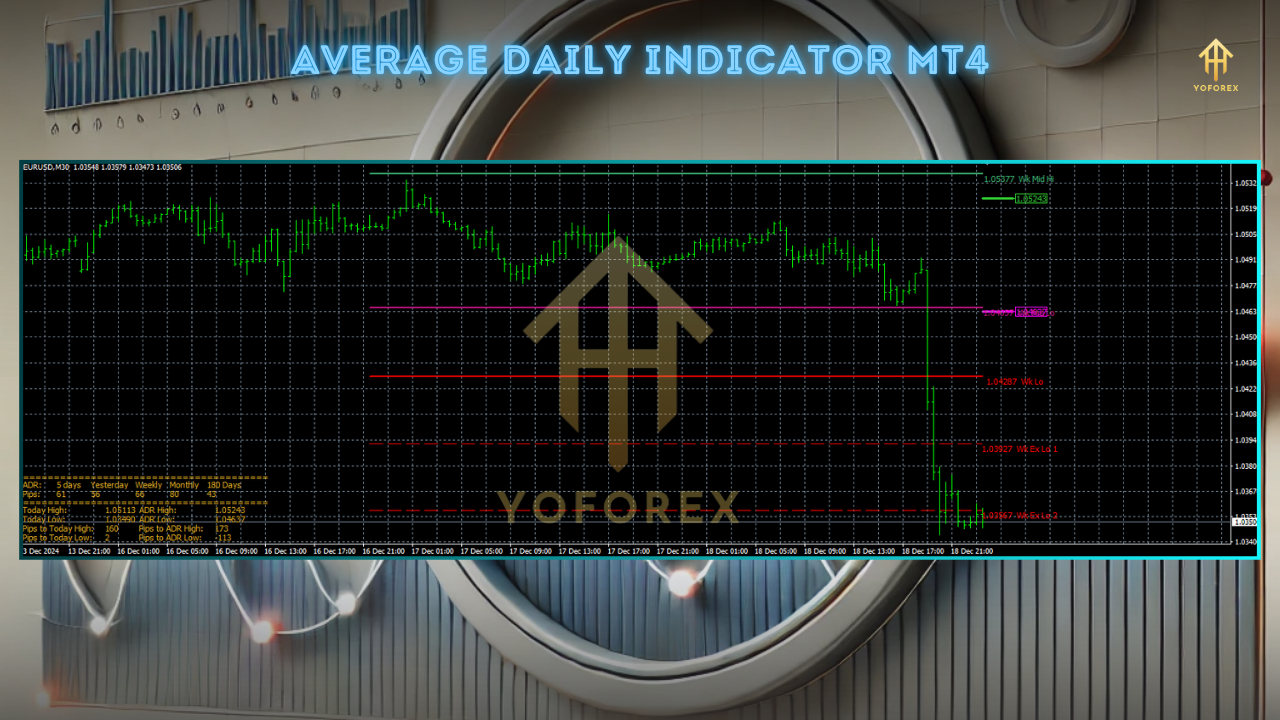

The Average Daily Range (ADR) is a popular tool among traders to measure the volatility of a currency pair or asset during a single trading day. By calculating the average price movement over a defined period (usually 14 days), this indicator helps traders assess potential price movements and plan their trading strategies accordingly. The ADR Indicator for MetaTrader 4 (MT4) is an essential tool for those who wish to gauge market volatility with precision.

What is the Average Daily Range (ADR)?

- The ADR is essentially a measure of the average movement in price over a given time frame, typically 14 days. It tells traders how much a currency pair has moved, on average, during a specific period of time (usually a day). This allows traders to estimate how much a pair could move in the current trading session, helping them to set more accurate stop-loss and take-profit levels.

- The ADR indicator calculates the difference between the high and low of each day for a selected number of days (usually 14). It then calculates the average of these daily ranges to give a clear idea of how volatile a currency pair is on a daily basis. Traders can adjust the period based on their trading style, whether they are day traders, swing traders, or long-term investors.

Key Features of the ADR Indicator for MT4

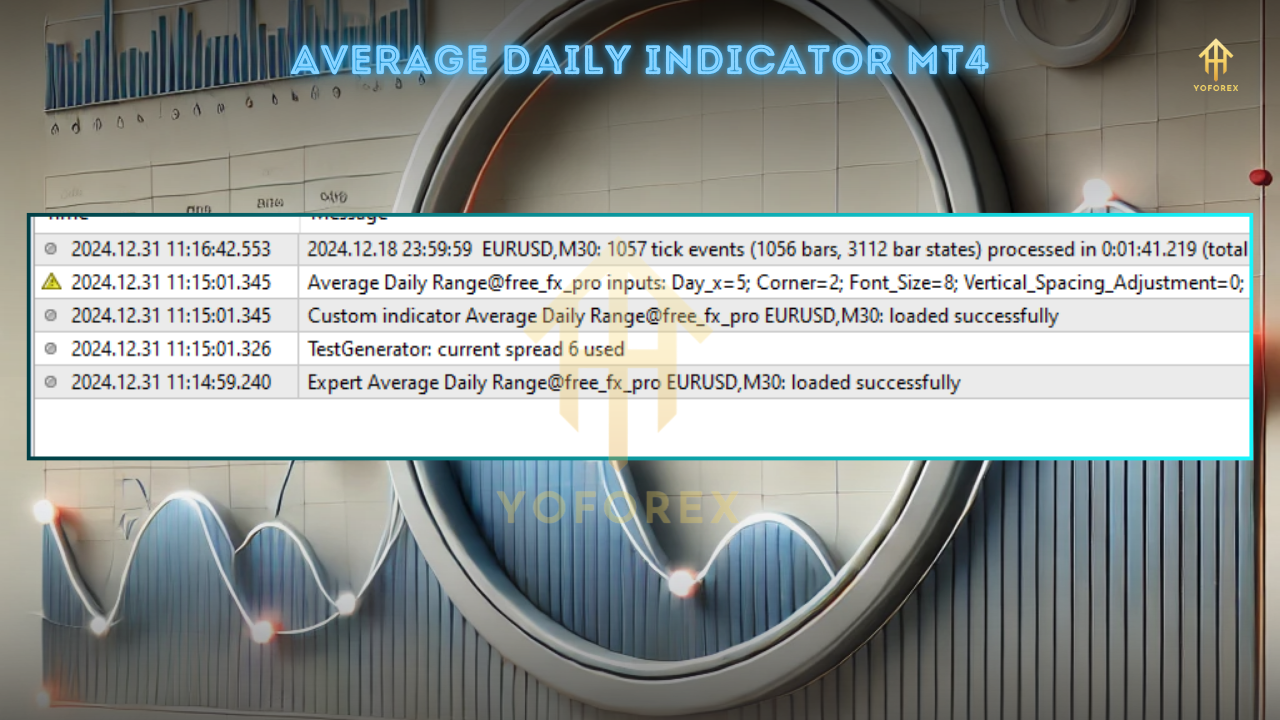

- Simple to Use: The ADR indicator is easy to set up on the MT4 platform. Once added to the chart, it automatically calculates the average range and plots it as a line or area on the chart, providing traders with real-time data on market volatility.

- Customizable Periods: The ADR can be customized to fit different timeframes, allowing traders to adjust the period to suit their trading preferences. Whether using a 14-day average or a custom range, the indicator provides flexibility.

- Helps with Risk Management: By understanding the ADR, traders can assess how much price movement to expect during the day. This helps in setting realistic targets for stop-loss orders and profit-taking levels.

- Enhanced Trade Planning: The ADR indicator allows traders to estimate potential price movements, giving them the edge in trade planning. For example, if the ADR suggests that a pair typically moves 100 pips per day, traders can set their stop-loss and take-profit orders with a better understanding of market movement.

- Indication of Volatility: The ADR indicator is particularly useful in identifying periods of high or low volatility. For instance, if the ADR reading is lower than average, traders may expect smaller price movements for the day, while a higher-than-average ADR may indicate that the market is primed for larger price swings.

Join Our Telegram

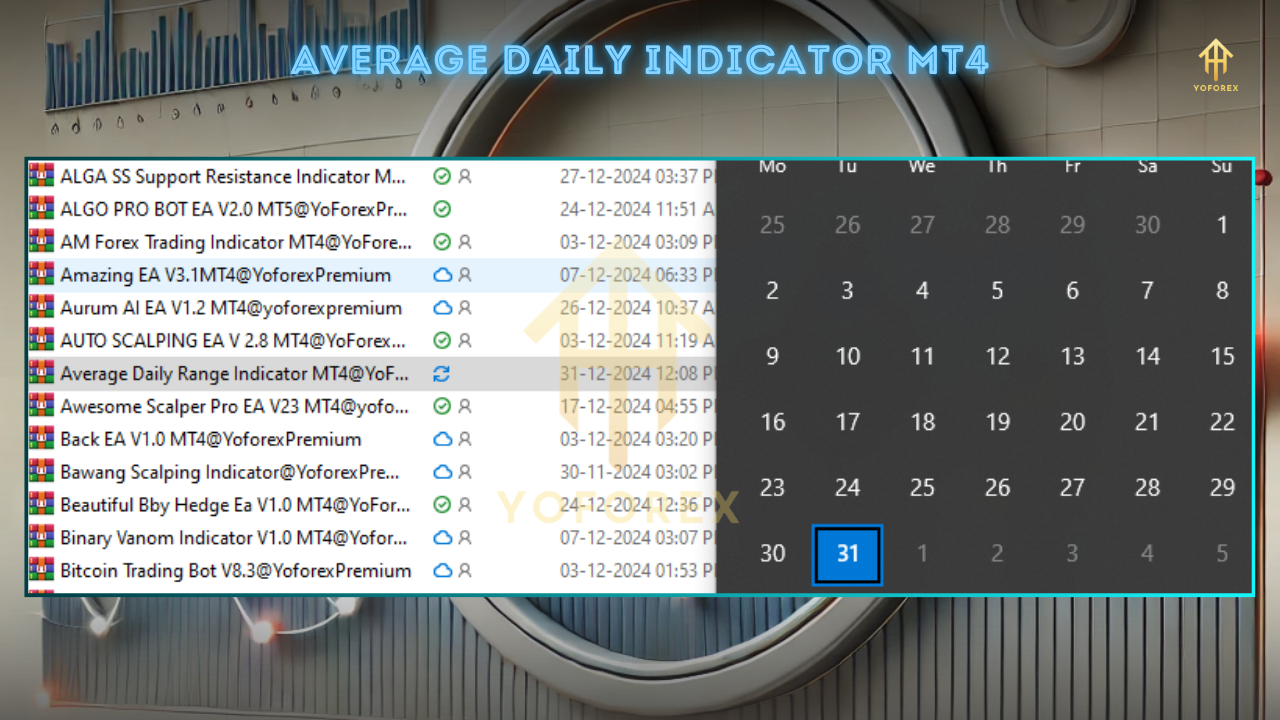

You Can visit other Websites & Download this Bot

- https://www.mql5.software/product/average-daily-range-indicator-2/

- https://www.forexfactory.cc/product/average-daily-range-indicator-2/

- https://www.yoforex.org/product/average-daily-range-indicator-2/

- https://www.fxcracked.org/product/average-daily-range-indc-2/

- https://yoforexea.com/product/average-daily-range-indicator-2/

Happy Trading

Happy Trading

There are no reviews yet.